- The final earnings season of 2023 has been considerably combined

- And, this yr is about to finish with traders already eyeing 2024

- So on this piece, we’ll focus on 5 shares that may ship robust earnings in Q1 2024

- Safe your Black Friday positive aspects with InvestingPro’s as much as 55% low cost!

As 2023 attracts to an in depth, traders are already directing their consideration to 2024, honing in on shares anticipated to ship sturdy earnings leads to the primary quarter of the upcoming yr.

The market is actively looking for corporations poised to show substantial income progress, marking them as important gamers within the present financial panorama.

With the help of InvestingPro, let’s analyze some shares positioned for stellar earnings within the first quarter of the following yr.

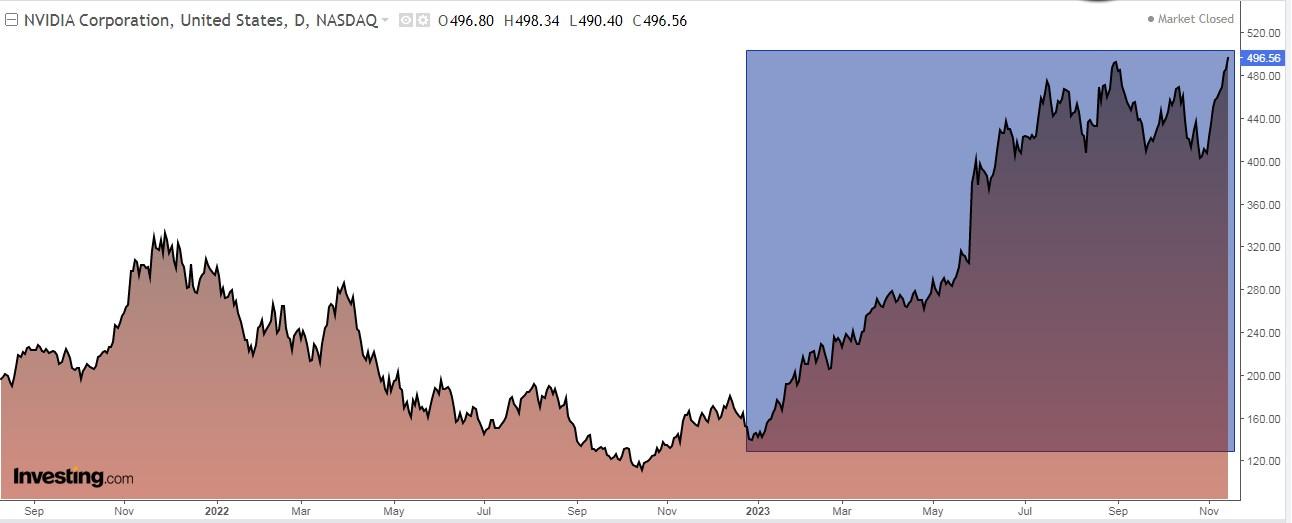

1. Nvidia

Nvidia (NASDAQ:) will current its subsequent outcomes on November 21 and is anticipated to extend precise income by +101.908% and EPS (earnings per share) by +186.72%.

For the primary quarter of 2024, income is anticipated to extend by +153.6% in comparison with the primary quarter of 2023.

The inventory is up +198.13% within the final yr and +19.02% within the final 3 months.

The market provides it a possible of $640.

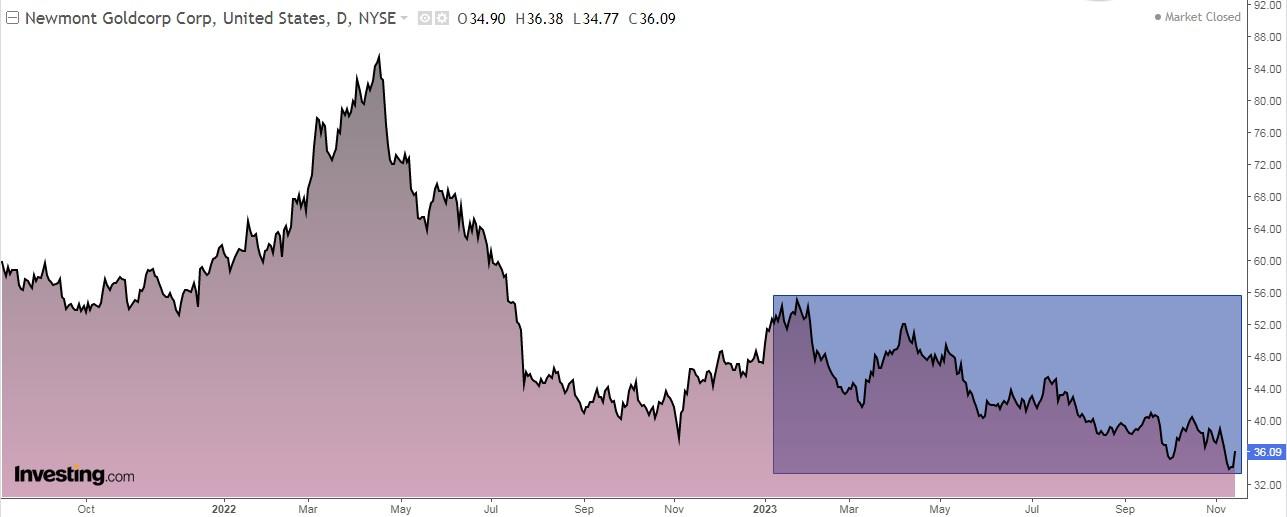

2. Newmont Goldcorp

Headquartered in Denver, Colorado, Newmont Goldcorp (NYSE:) is among the largest miners on the planet, with lively mines in Australia, the US, Indonesia, Ghana, New Zealand, and Peru.

Based in 1921, it stays the one gold mining firm within the index.

The gold mining firm pays a dividend of $0.40 per share on December 22 and shares should be held previous to November 29 to be eligible to obtain the dividend. The anal dividend yield is +4.43%.

On February 22 it’s going to current its numbers and actual income is anticipated to extend by +20.78% and earnings per share (EPS) by +28.92%. For the primary quarter of 2024, the forecast is for a income enhance of +61%.

Its shares are down -5.20% within the final 3 months, however the market sees potential at $50 and InvestingPro fashions at $41.35.

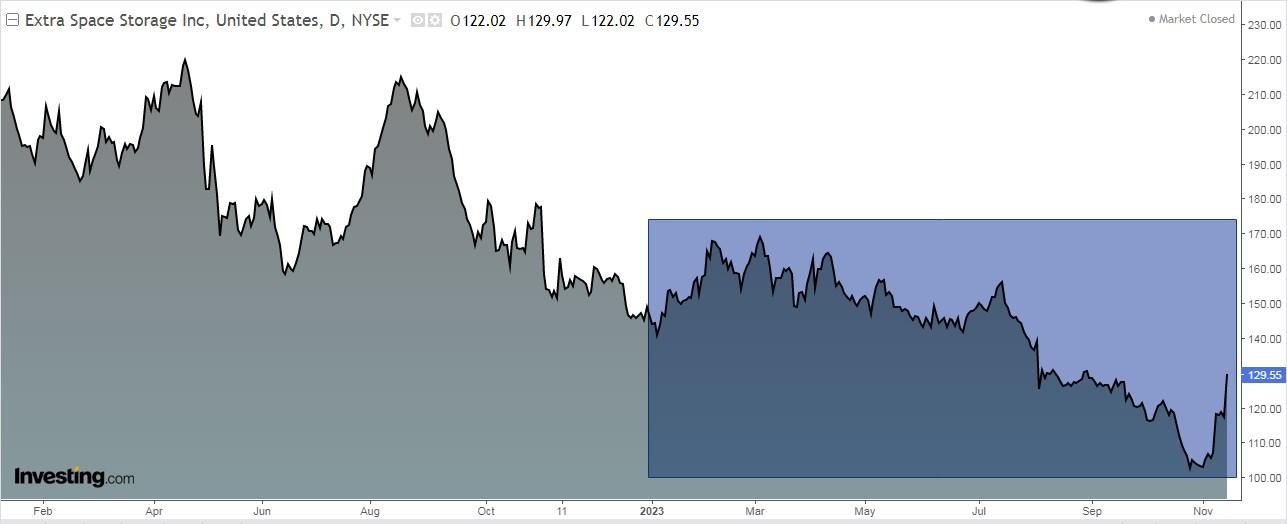

3. Further House Storage

Further House Storage (NYSE:) is a Salt Lake Metropolis-based actual property funding belief that invests in storage services. It’s the largest proprietor of storage models in the US.

On February 21 the corporate will current its accounts and is anticipated to extend precise revenues by +57.78%. Expectations for Q1 2024 are for a income enhance of +72% over the identical interval final yr.

It has 16 rankings, of which 8 are purchase, 6 are maintain and a couple of are promote. Its shares are up +1% within the final 3 months and +8.42% within the final month.

The market assigns it a possible at $142.47.

4. Oneok

Oneok (NYSE:) is an American company primarily targeted on the trade and headquartered in Tulsa, Oklahoma.

It was based in 1906 as Oklahoma Pure Gasoline Firm however modified its company identify to Oneok in December 1980.

The corporate pays a dividend of $0.95 per share and the annual yield is +5.81%. It has proven a mean annual dividend progress of +10% over the past decade.

It should current its accounts on February 26 and is anticipated to extend actual revenues by +7.54% and EPS (earnings per share) by +6.01%. For the primary quarter of 2024, revenues are anticipated to extend by +55.3% in comparison with the primary quarter of 2023.

Oneok has demonstrated strong earnings progress at an annual charge of +26% over the previous 5 years.

The inventory is up +6.70% over the previous yr.

The market sees it at $73.12, whereas InvestingPro fashions are extra bullish and go for $80.10.

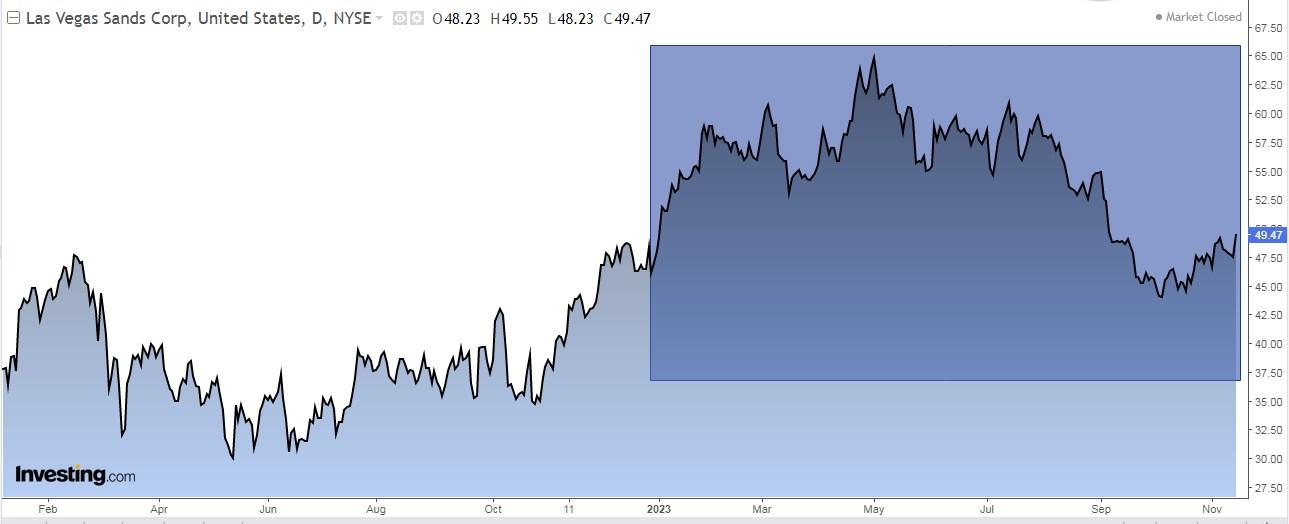

5. Las Vegas Sands

Las Vegas Sands (NYSE:) will current its outcomes on January 24 and is anticipated to extend actual revenues by +30.15% and EPS (earnings per share) by +46.5%.

For the primary quarter of 2024, revenues are anticipated to extend by +38.7% in comparison with the primary quarter of 2023.

It pays a dividend with an annual yield of +1.62%.

Its shares are up +13.47% within the final yr and +9.44% within the final month. The market provides it potential at $66.25, and InvestingPro fashions at $60.84.

***

Purchase or Promote? Get the reply with InvestingPro for Half of the Value This Black Friday!

Well timed insights and knowledgeable selections are the keys to maximizing revenue potential. This Black Friday, make the neatest funding resolution out there and save as much as 55% on InvestingPro subscription plans.

Whether or not you are a seasoned dealer or simply beginning your funding journey, this supply is designed to equip you with the knowledge wanted for extra clever and worthwhile buying and selling.

Disclosure: The creator holds no positions in any of the shares talked about on this report.

Adblock take a look at (Why?)