Yields on short-term Treasuries fell Tuesday as fears of a US authorities debt default receded following the weekend’s bipartisan debt ceiling deal that omits a well-known crypto tax loophole.

At 05:33 ET, the yield on the 10-year Treasury dropped 10 foundation factors to three.72%, whereas yields on the two-year Treasury dropped seven foundation factors to 4.514%.

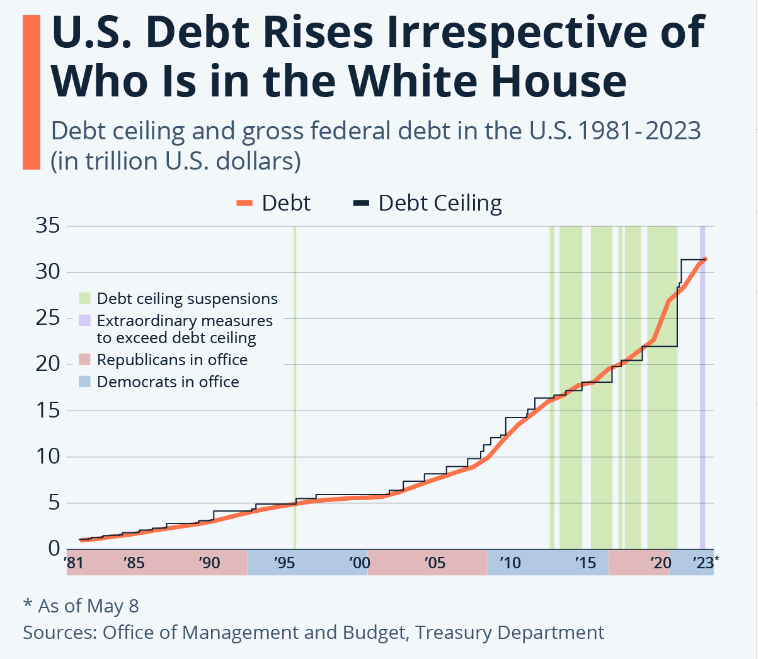

Elevating Debt Ceiling Would Have an effect on Financial institution Liquidity, Analysts Warn

This response got here after President Joe Biden and Home Speaker Kevin McCarthy agreed in precept to elevate the US debt ceiling amid fears the federal government would technically default in early June.

Congress should cross any proposed adjustments to the debt restrict. The Home Guidelines Committee will assessment the brand new settlement at the moment.

Any delays within the deal might threaten the US capability to stave off a technical default by June 5. A default would enhance the US Treasury’s value of borrowing.

Conversely, rising the debt ceiling would trigger the federal government to concern extra Treasury devices in trade for traders’ money. These loans are then added to the nationwide debt.

Analysts fear that the elevated issuance of Treasury payments would trigger short-term liquidity points at banks. Buyers purchase Treasury bonds in trade for curiosity repayments.

They would want to spend about $500 billion if the federal government raises the debt ceiling.

Crypto Retains Political Allies, However Laws Stay Elusive

Biden stated that any deal to lift borrowing limits wouldn’t permit “rich tax cheats and crypto merchants” to benefit from a tax loophole permitting wash buying and selling to scale back tax funds.

The most recent debt ceiling proposal suggests the US president didn’t make good on that promise.

As an alternative of closing the crypto loophole, the proposal suggests rescinding sure tax funds for households and small companies.

Crypto miners could as soon as once more flock to the US after revelations surfaced that the brand new debt ceiling deal additionally excludes excise tax for crypto mining corporations.

Nonetheless, Governor Ron DeSantis of Florida stated the present authorities would snuff out crypto throughout the subsequent 4 years if left unchecked.

DeSantis just lately entered the 2024 presidential race and is joined by Robert F. Kennedy and Vivek Ramaswamy in working pro-Bitcoin campaigns.

Nevertheless, as Compass Level Analysis famous on Friday, crypto payments at the moment could solely change into regulation in two to 3 years.

For BeInCrypto’s newest Bitcoin (BTC) evaluation, click on right here.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material.

Adblock check (Why?)