ShriramLife Insurance coverage launched a brand new unit-linked coverage on June 07, 2023, to mark ShriramGroup’s golden jubilee 12 months. Policyholders can decide to cowl their complete life or a specified time period, enabling them to fulfil their monetary aspirations with full flexibility. The plan has two choices – Life Objective and Legacy and presents clients choices to change coverage phrases, premium fee phrases, sum assured, and even premium.

Beneath the “Life Objective” possibility, policyholders can work in the direction of particular monetary aims and vital milestones equivalent to schooling bills, buying a dream residence, or beginning a enterprise. With the Life Objective possibility, policyholders have entry to numerous options and adaptability to assist them attain their monetary targets.

The Legacy possibility permits policyholders to assist their golden years financially or create an enduring affect on their household’s monetary future by abandoning substantial wealth after their lifetime. The plan presents three premium paying time period choices: Single pay, restricted pay, and common pay. It additionally provides clients two dying profit choices to select from. Relying on the choice chosen, the household of the deceased will both get the sum assured together with the fund worth, or a better sum assured and fund worth.

Policyholders can select the sort, stage, and quantum of canopy primarily based on their monetary targets and safety wants. Moreover, the “Golden Jubilee Plan” presents numerous rider choices to reinforce protection and supply complete safety in opposition to unexpected circumstances.

Talking on the product, Casparus Kromhout, MD & CEO, ShriramLife Insurance coverage stated, “We’re delighted to announce this plan on our Group’s momentous milestone. The plan provides numerous flexibilities and choices to select from, gives monetary safety, and encourages long-term participation available in the market. This is part of our holistic monetary options that are supplied in a custom-made style by means of our superior technological processes. We hope this product will give our clients another excuse to plan decisively and reap the advantages of accrued wealth in order that they’ll rejoice their milestones in one of the best ways potential.”

The Golden Jubilee Plan goals to empower people to realize their monetary targets and create a safe future for his or her family members. With its versatile options, funding choices, and complete protection, the plan presents a holistic resolution for people looking for life insurance coverage and wealth creation alternatives.

The Golden Jubilee Plan presents the next key options:

- Monetary management with a number of fund choices: Policyholders have the liberty to select from a number of fund choices to swimsuit their funding preferences and danger urge for food.

- Limitless free switches and premium redirection: Policyholders could make limitless free switches between funds and redirect their premiums as per their funding technique.

- Auto Switch Choice (ATO) to deal with market volatility: This selection permits policyholders to speculate their premiums in a low-risk fund (Preserver Fund) initially and step by step switch the funds to their chosen funding portfolio, lowering the chance of investing in a risky market.

- Wealth boosters assured each 5 years: The plan gives wealth boosters within the type of further items credited to the policyholder’s base premium fund worth each 5 years, ranging from the tenth coverage 12 months.

- Return of premium allocation & mortality costs: Premium allocation costs and Mortality costs are returned to the policyholder after a particular interval offering life protection to the policyholder at zero price.

- Complete life possibility (Legacy): This selection permits policyholders to avoid wasting for his or her subsequent era or withdraw funds each time wanted, offering flexibility and monetary safety.

Further options of the Golden Jubilee Plan additional improve the policyholder’s expertise. These embody:

- Custom-made life cowl: Policyholders can select from two cowl choices and choose the specified stage of protection inside every possibility.

- Unmatched flexibility: The plan presents unmatched flexibility, permitting policyholders to extend or lower the coverage time period, premium fee time period, sum assured, and premium quantity as per their altering wants.

- High-up premiums: Policyholders can top-up their scheduled premiums with further funds each time they’ve surplus cash.

- Liquidity and quick access to funds: The plan permits partial withdrawals, offering liquidity and quick access to funds throughout occasions of monetary want.

- Settlement possibility: Policyholders have the choice to decide on a settlement interval with maturity or dying advantages to deal with market volatility throughout redemption.

- Added safety with a number of riders: The plan presents further safety by means of a number of riders, permitting policyholders to reinforce their protection as per their particular necessities.

- Tax advantages: The plan gives tax advantages on investments and returns, as per the prevailing tax legal guidelines.

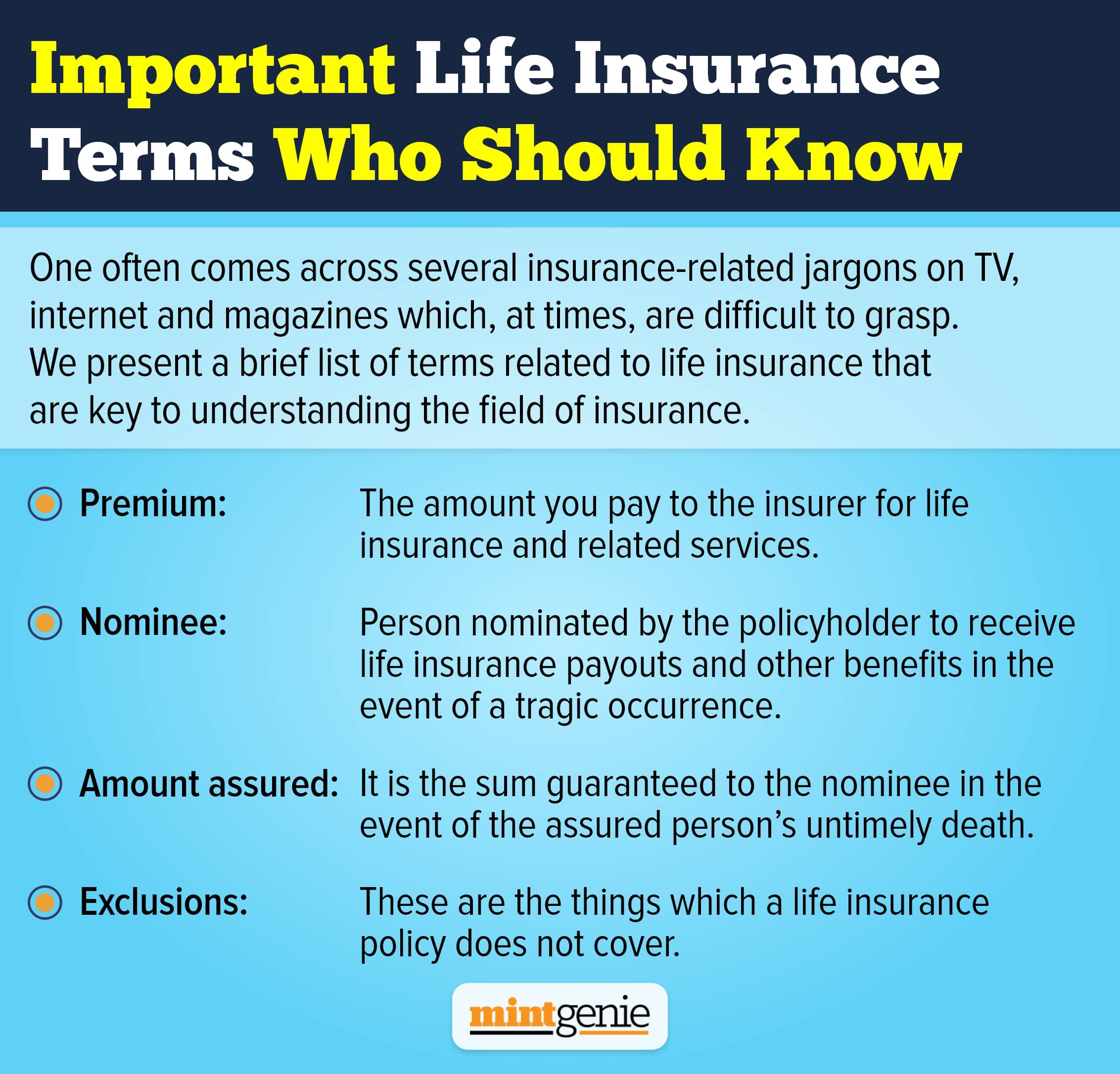

Necessary Life Insurance coverage phrases who ought to know

First Revealed: 10 Jun 2023, 11:15 AM IST

Matters to observe

Adblock take a look at (Why?)