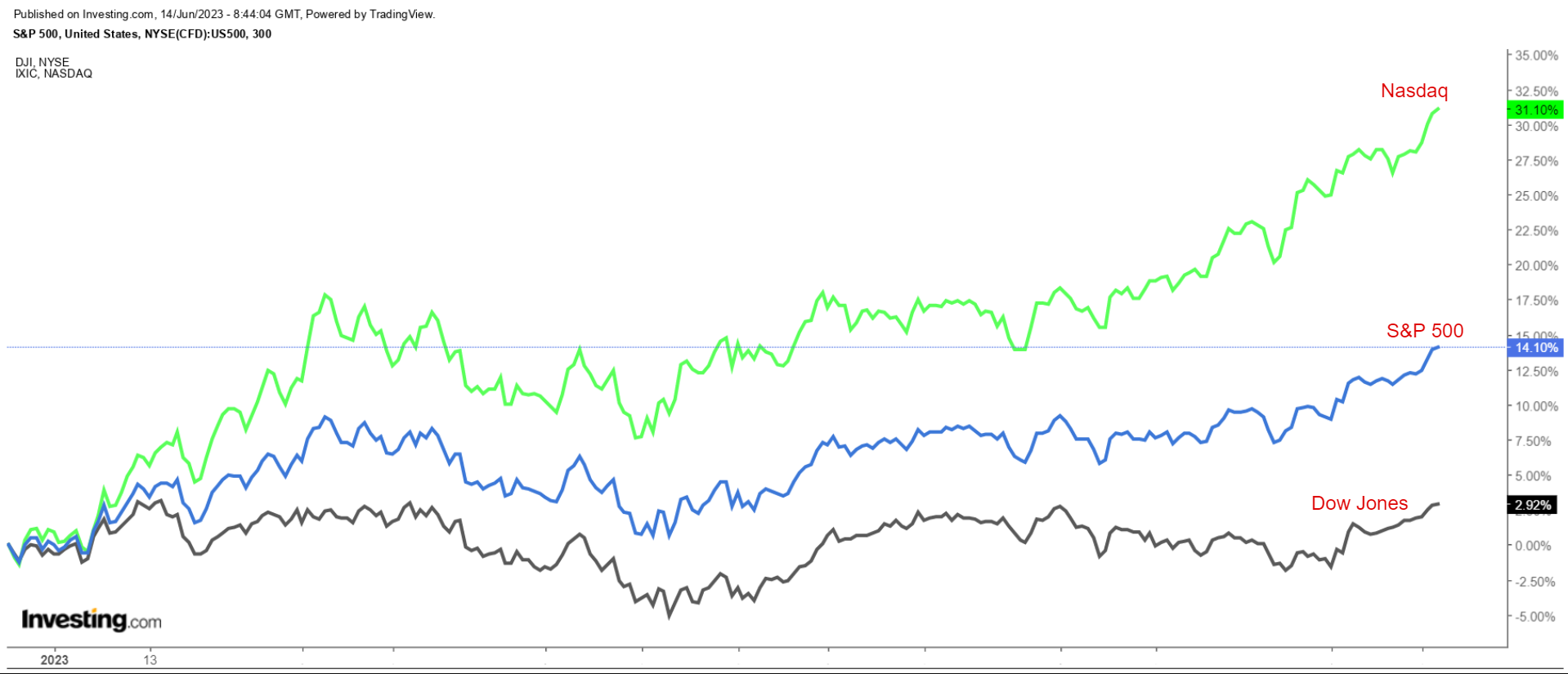

- The tech-heavy Nasdaq has outperformed the S&P 500 and the Dow Jones Industrial Common by a large margin in 2023.

- Receding inflation worries and easing fears about additional Fed price hikes will doubtless proceed to spice up corporations within the tech sector.

- As such, I used the InvestingPro inventory screener to seek out high-quality, undervalued expertise gems to purchase now with sturdy upside forward.

The technology-heavy has been the highest performer of the three main U.S. indices by a large margin so far in 2023, hovering 29.7% year-to-date.

That compares to a rise of 13.8% for the benchmark over the identical time span and a 3.2% achieve for the blue-chip .

The continued tech rally has been fueled by rising indicators that U.S. might have peaked, elevating hopes the will finish its year-long price hike cycle.

That, in flip, has boosted shares of the mega-cap tech corporations, with Nvidia (NASDAQ:), Meta Platforms (NASDAQ:), Tesla (NASDAQ:), Amazon (NASDAQ:), Apple (NASDAQ:), Alphabet (NASDAQ:), and Microsoft (NASDAQ:) all posting double-digit year-to-date share will increase so far.

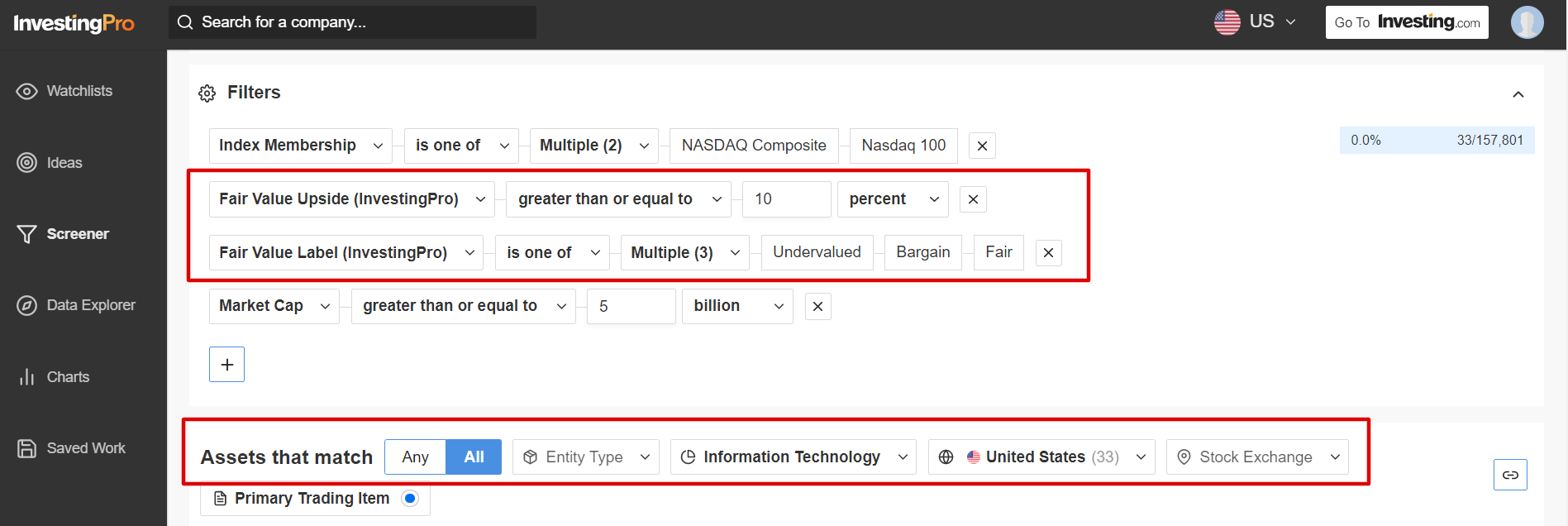

In opposition to this backdrop, I used the InvestingPro inventory screener to go looking for prime quality undervalued tech gems to purchase amid the present market setting.

I first scanned for corporations with an Investing Professional ‘Truthful Worth’ upside larger than or equal to 10%. I then filtered for names whose Investing Professional ‘Truthful Worth’ grade was both ‘Undervalued’, ‘Discount’, or ‘Truthful’.

And people corporations with a market cap of $5 billion and above made my watchlist.

Supply: InvestingPro

As soon as the standards have been utilized, I used to be left with a complete of 33 corporations.

Of these, Cognizant Expertise Options (NASDAQ:) and NetApp (NASDAQ:) have been the 2 that stood out essentially the most to me. Supply: InvestingPro

Supply: InvestingPro

For the complete record of the shares that met my standards, begin your free 7-day trial with InvestingPro right this moment!

For those who’re already an InvestingPro subscriber, you’ll be able to view my choices right here.

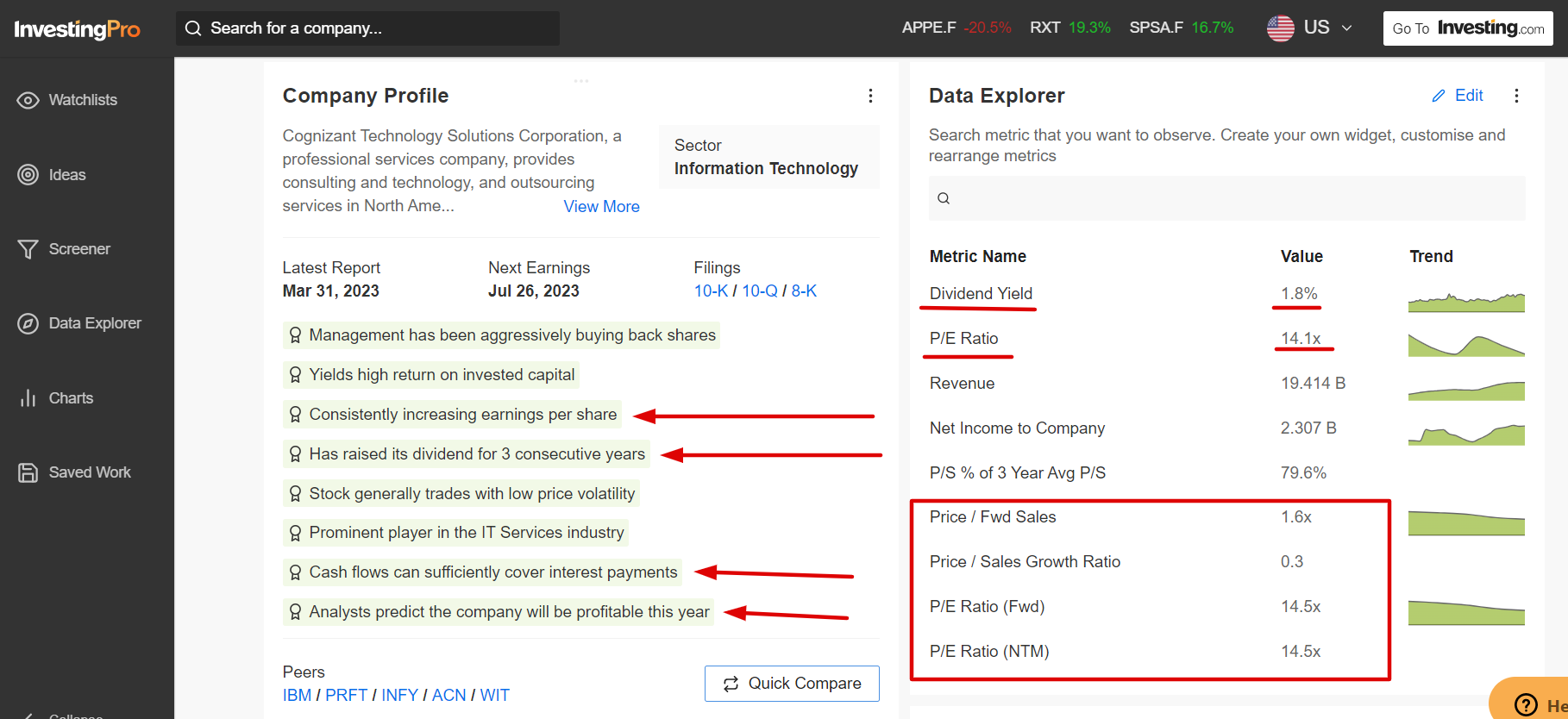

1. Cognizant Expertise Options

Cognizant Expertise Options inventory is up 12.3% year-to-date and will proceed appreciating, in keeping with the InvestingPro fashions, because it cements its standing as one of many premier go-to names within the info expertise (IT) providers trade.

Cognizant has a number of tailwinds which might be anticipated to gas additional beneficial properties in its inventory within the months forward, with highlights together with sturdy earnings prospects, and a wholesome profitability outlook, in addition to strong development in free money stream yields which ought to permit it to extend dividend funds.

Supply: InvestingPro

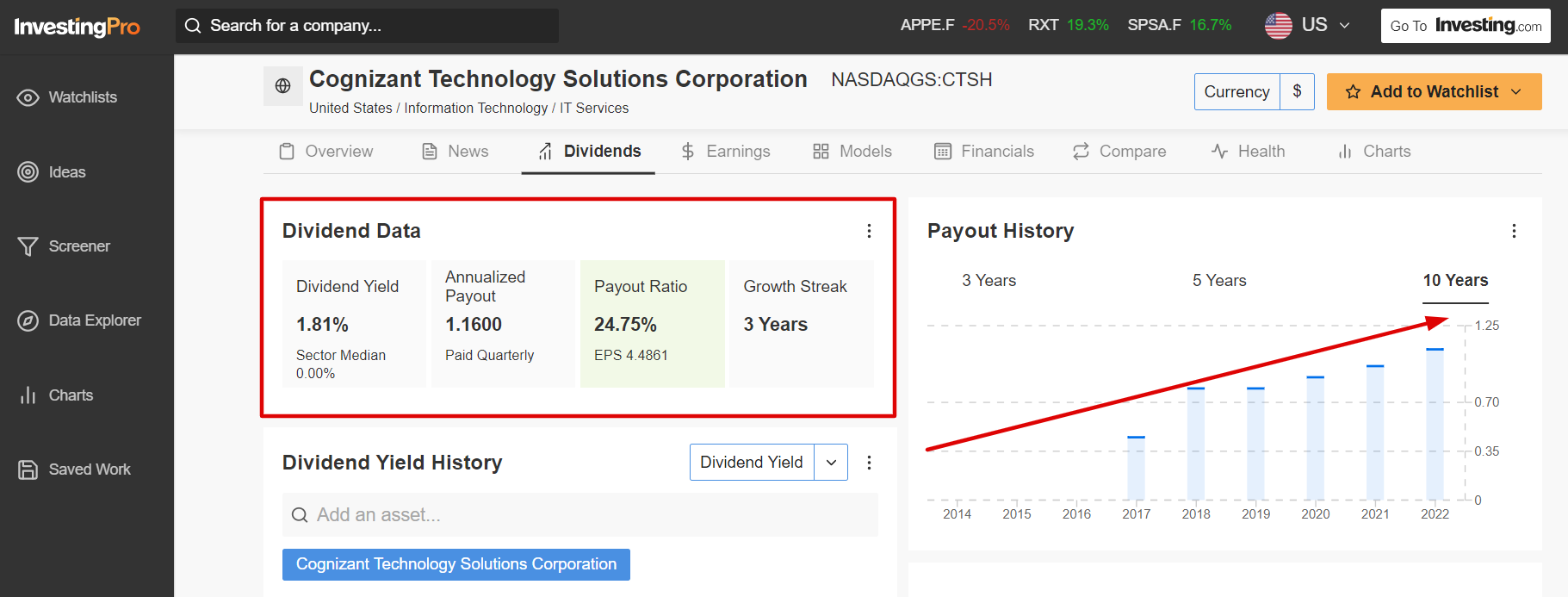

The Teaneck, New Jersey-based IT providers and consulting agency has raised its annual dividend payout for 3 consecutive years. Shares presently yield 1.81%, which is barely above the 1.48% implied yield for the S&P 500 index. Supply: InvestingPro

Supply: InvestingPro

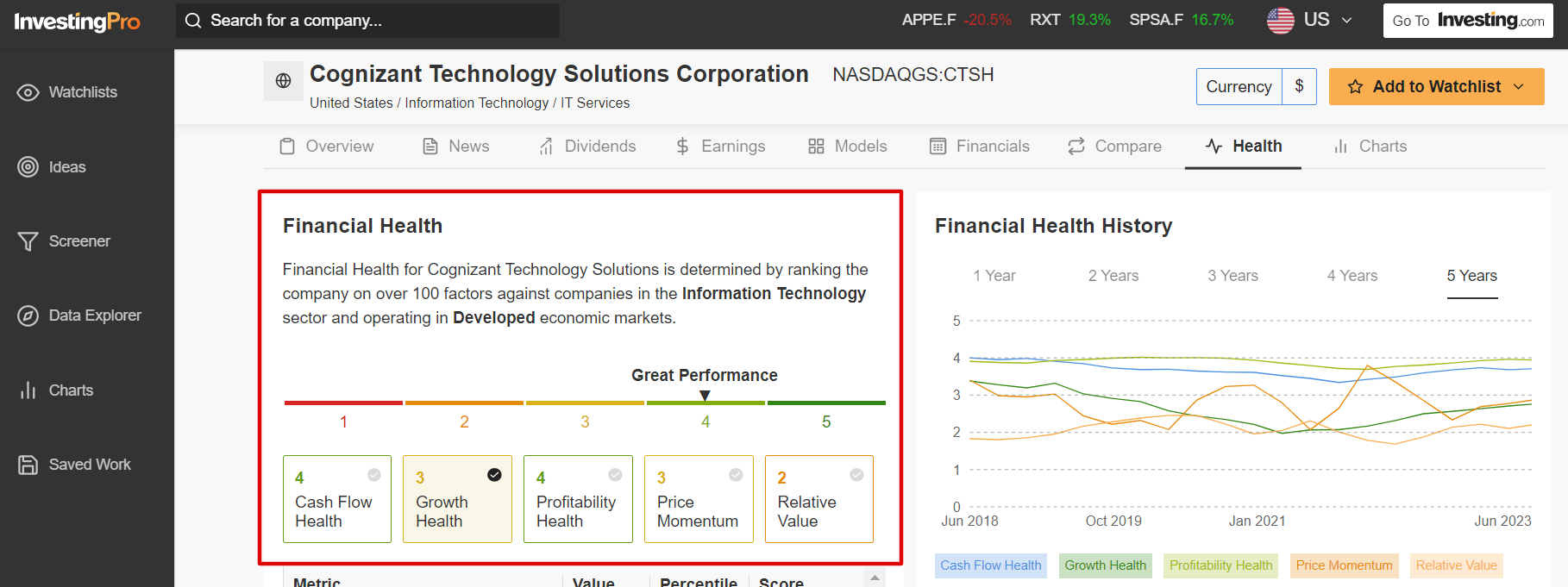

As Investing Professional factors out, Cognizant presently enjoys a ‘Monetary Well being’ rating of three.2. That’s necessary as corporations with Investing Professional well being scores larger than 2.75 have persistently outperformed the broader market by a large margin over the previous seven years, courting again to 2016.

Supply: InvestingPro

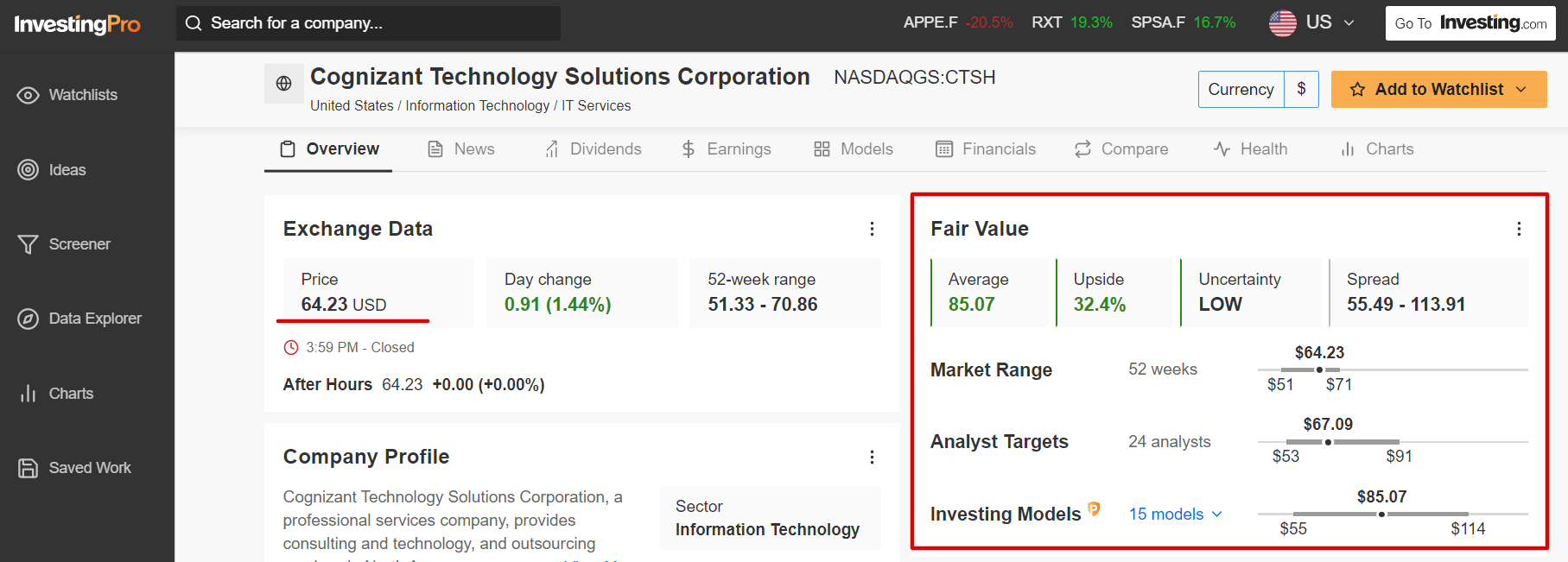

Not surprisingly, CTSH inventory is considerably undervalued in keeping with the quantitative fashions in Investing Professional: with a ‘Truthful Worth’ value goal of $85.07, Cognizant shares may see an upside of roughly 32% from present ranges. Supply: InvestingPro

Supply: InvestingPro

Cognizant’s inventory trades at a price-to-earnings (P/E) ratio of 14.1, which makes it an absolute discount in comparison with its main rivals, comparable to Accenture (NYSE:) (28.7 P/E ratio), Infosys (NYSE:) (22.0 P/E ratio), Wipro (NYSE:) (19.1 P/E ratio), and IBM (NYSE:) (60.8 P/E ratio).

As such, I imagine shares of the IT providers big are a wise purchase, particularly at present valuations.

With Investing Professional, you’ll be able to simply entry complete info and perception on any given firm multi functional place, eliminating the necessity to collect information from a number of sources, and saving you effort and time. Strive it out without cost for every week!

2. NetApp

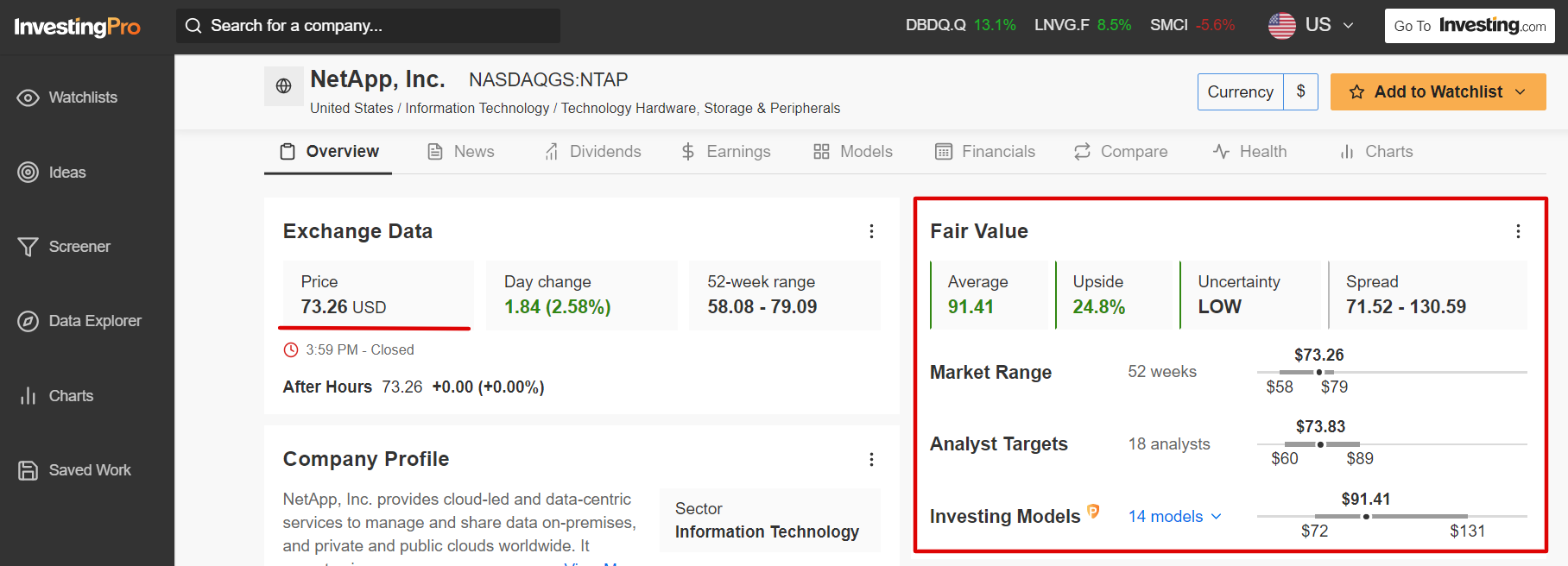

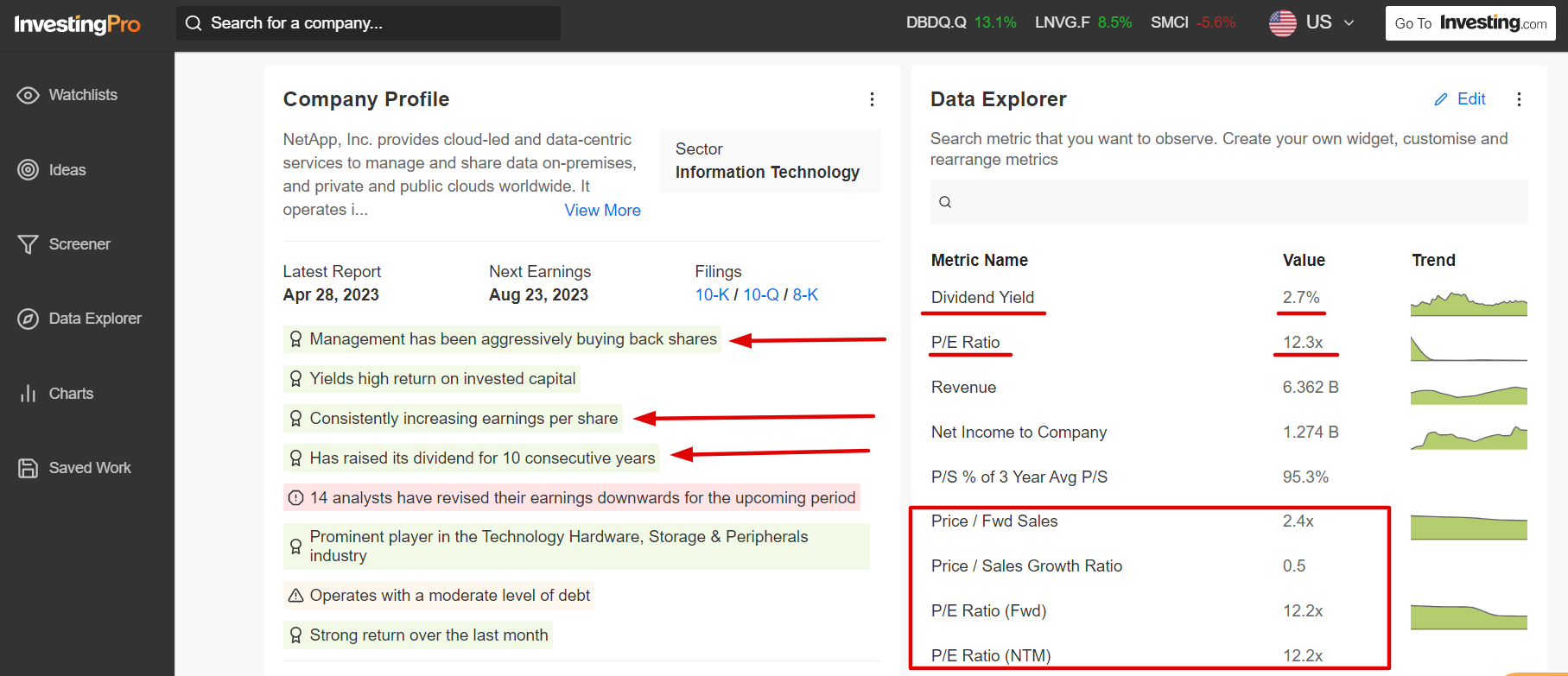

At a present value level of round $73, Investing Professional has flagged NetApp to offer important long-term worth for shareholders within the months forward.

NetApp is a knowledge storage and information administration options firm headquartered in San Jose, California. Based in 1992 with an IPO in 1995, the tech firm offers cloud information providers for administration of purposes and information each on-line and bodily.

As Investing Professional factors out, NTAP inventory may see a rise of round 25% from Tuesday’s closing value, in keeping with a variety of valuation fashions, bringing it nearer to its ‘Truthful Worth’ value goal of $91.41 per share. Supply: InvestingPro

Supply: InvestingPro

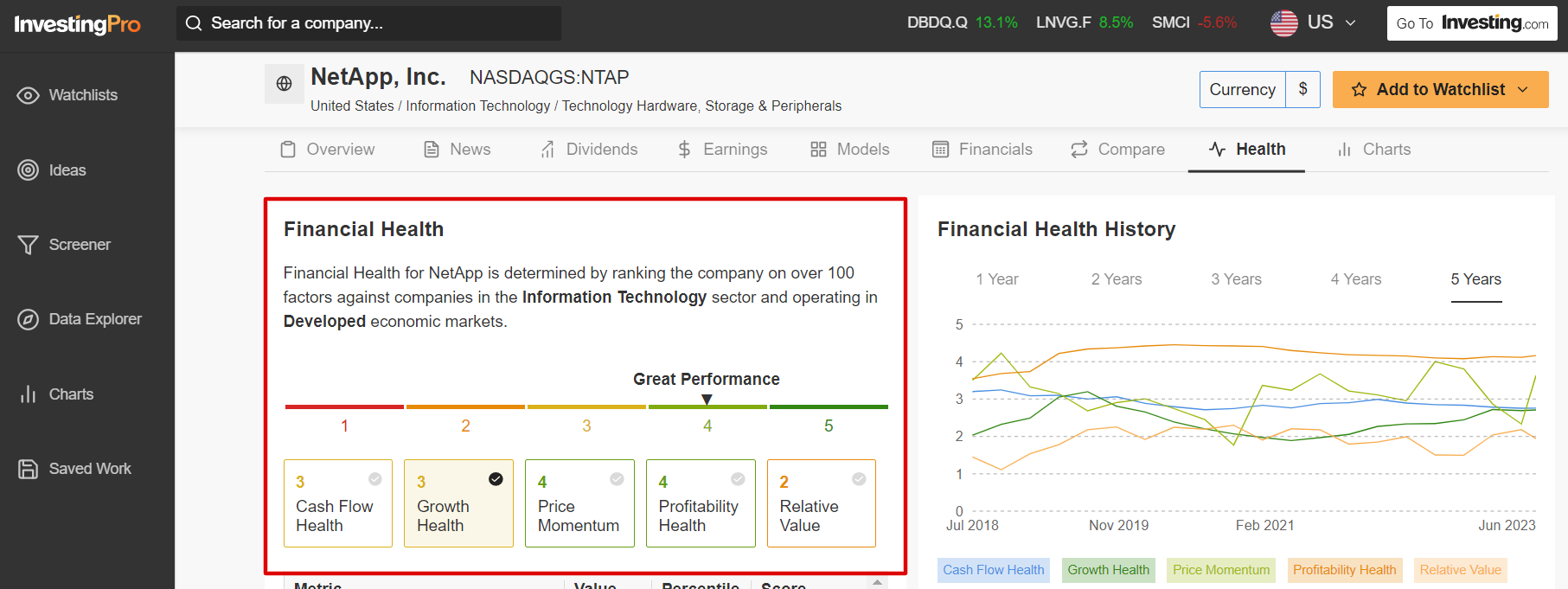

Demonstrating the power and resilience of its enterprise, NetApp sports activities a near-perfect Investing Professional ‘Monetary Well being’ rating of 4 out of 5. The Professional Well being rating is decided by rating the corporate on over 100 components in opposition to different corporations within the Data Expertise sector.

Supply: InvestingPro

Investing Professional additionally highlights a number of extra tailwinds NetApp has going for it, together with wholesome profitability, growing earnings per share, stable money stream development, and a comparatively low-cost valuation. Supply: InvestingPro

Supply: InvestingPro

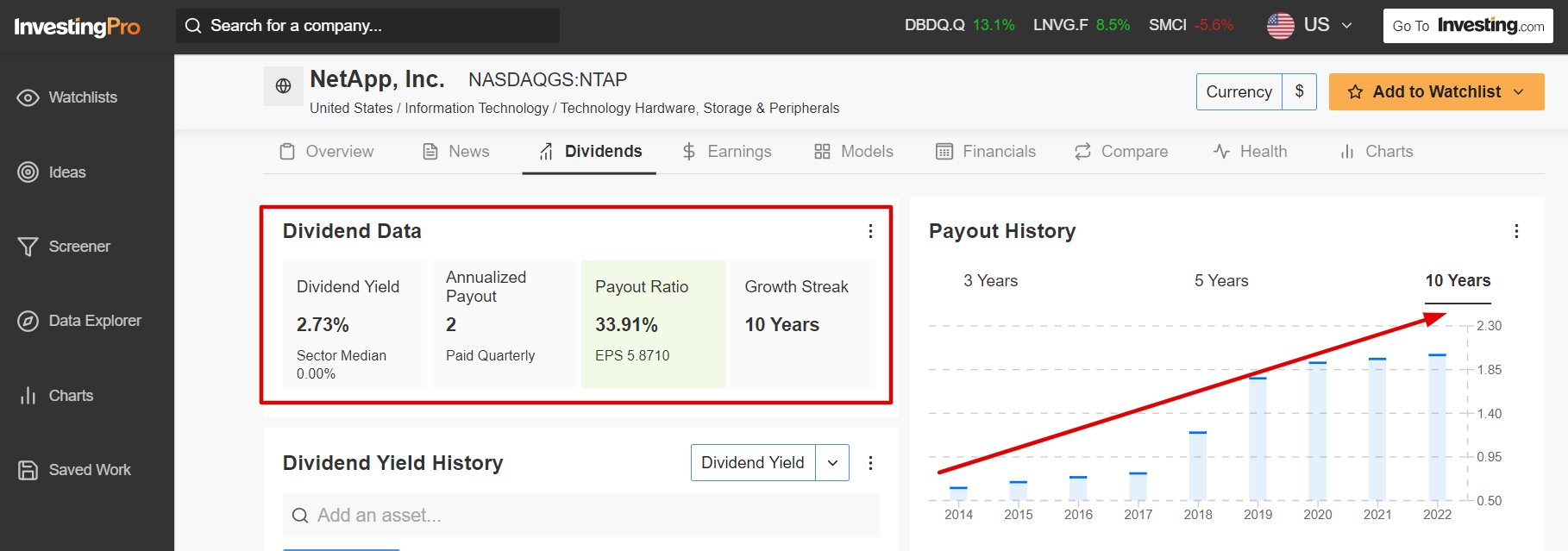

Taking that under consideration, NTAP is a powerful purchase so as to add to a portfolio, particularly when you think about its steady efforts to return extra cash to shareholders within the type of larger dividend payouts and share buybacks. Supply: InvestingPro

Supply: InvestingPro

The cloud providers and information administration firm has raised its annual dividend for 10 years operating, highlighting its distinctive monitor document in the case of returning extra money to stockholders. At Tuesday’s closing value, shares presently yield a market-beating 2.73%.

In search of extra actionable commerce concepts to navigate the present market volatility? The InvestingPro instrument helps you simply determine successful shares at any given time.

Begin your 7-day free trial to unlock must-have insights and information!

***

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the through the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Expertise Choose Sector SPDR ETF (NYSE:). I commonly rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and corporations’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Adblock take a look at (Why?)