We’re cautiously optimistic for each shares and bonds as we enter 2024, even accounting for heightened danger.

In equities, we see alternatives in dimension, fashion, sector, and nation exposures. Focused publicity is nicely positioned to beat broad market-weight publicity, in accordance with our evaluation. For bonds, we see broad attraction throughout totally different maturity profiles. Authorities bonds are our most well-liked publicity. Company bonds are priced for a slowdown, however not a recession, so they may carry heightened danger. The U.S. greenback seems costly versus different main currencies, so worldwide foreign money positioning (and probably hedging) could also be a worthwhile addition to your portfolio toolkit.

Fairness Alternatives

- Among the many basket of undervalued and unloved property, smaller-capitalization worth shares stand out.

- Cyclical sectors like financials (specifically banks), leap out as enticing. Amongst economically delicate sectors, communication companies stay interesting. Amongst defensive sectors, healthcare and utilities may supply a ballast with upside potential.

- International contrarian performs embody the UK, rising markets equities, and, particularly, Chinese language expertise. The volatility could possibly be price it, however sizing is essential.

- Second-derivative synthetic intelligence performs, primarily within the U.S. market, may supply an earnings tailwind.

The Broad Fairness Panorama Coming into 2024

Equities look pretty nicely positioned as we begin 2024, regardless of dealing with a wall of fear. Shares are moderately valued general, with all main international locations higher positioned than just a few years in the past from a valuation standpoint.

Total, we see U.S. equities as taking part in a job for buyers, though the concentrated rise within the so-called “Magnificent Seven″ has created alternatives so as to add chosen worth—which seems particularly attention-grabbing in smaller, value-oriented corporations. In different developed markets, we see enticing valuations with higher-than-usual return prospects on our evaluation, particularly in pockets of Europe (for instance, U.Ok. and European vitality shares). Whereas rising markets are undoubtedly dangerous, we will see sturdy return prospects in most eventualities, though place sizing stays essential.

Naturally, reward for danger is the important thing distinction to make, with some creating dangers that have to be accounted for in fairness allocations. One longer-term danger is the shortage of earnings progress. It is a problem as a result of buyers have been driving costs increased relative to earnings—a dynamic often known as a number of enlargement. One potential motive for the enlargement of multiples this 12 months was a perception that central banks would rapidly and aggressively pivot to chop charges. That is not the consensus base case.

Listed here are a number of the key dangers we’re watching:

Reasonable Valuations

- Valuation enlargement has largely been in AI shares. Second-derivative AI shares haven’t had the identical rally.

- The U.S. market incorporates some costly sectors and focus dangers.

- Choose alternatives exist in world equities.

Softening Economic system

- Excessive charges can weaken client demand, significantly in the event that they persist.

- A weaker client can affect company income and finally the labor market.

- Weaker European international locations might trough before the U.S. market.

Weakening Fundamentals

- In america, general company leverage is manageable, however debt prices are rising.

- Company profitability is excessive, however susceptible on the margin.

- Capital-intensive sectors stay extra uncovered to a protracted transfer increased in debt prices.

Exterior Shocks

- Geopolitical danger is excessive (Ukraine, Israel, and China).

- An oil market shock may harm the worldwide economic system.

- Industrial actual property stays a danger however seems to be a localized downside.

- Instantly increased long-term yields may have unintended results.

Whereas shares have definitely not tumbled off a cliff, buyers proceed to really feel nervy, with client sentiment scores nonetheless nicely beneath regular ranges. At a deeper degree, valuation spreads—the disparity in valuation ranges between sectors—is the place we see alternative.

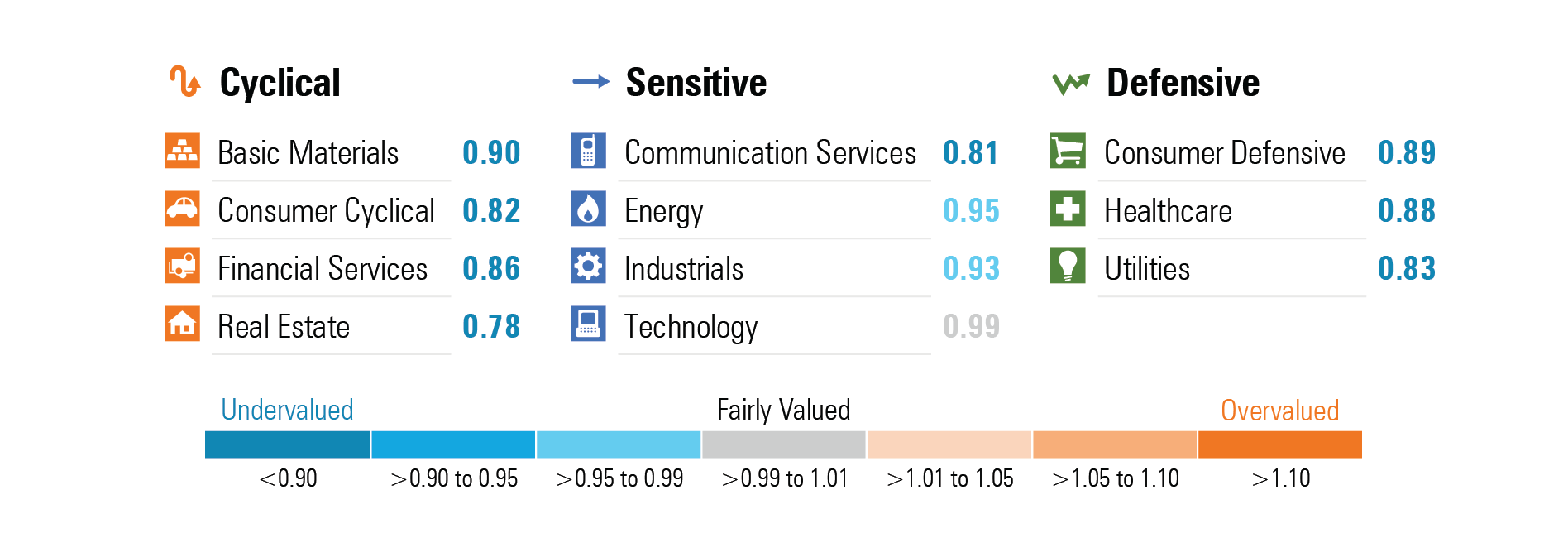

Fairness Alternative 1: Choose Sectors—Together with Financials, Utilities, and Healthcare

With U.S. index returns having been pushed predominantly by large-cap progress corporations that dominate index weightings—aka the “Magnificent Seven″—we’re discovering valuation alternatives elsewhere.

Monetary companies, squarely a cyclical value-leaning sector, leaps out as cheap with low expectations. Rising charges and the 2023 U.S. banking disaster led the sector to underperform. We imagine a lot of the chance right here has been discounted and that U.S. banks, specifically, are price a glance.

Searching for undervalued property that may assist with portfolio robustness, we see defensive sectors—together with healthcare and utilities—as areas of curiosity. They don’t seem to be essentially the most cost effective sectors however can play a powerful function in portfolio danger administration. Among the many extra economically delicate sectors, our desire stays for communication companies, regardless of sturdy returns for the 12 months to this point, because it nonetheless represents stable worth and affordable danger/reward, in our view.

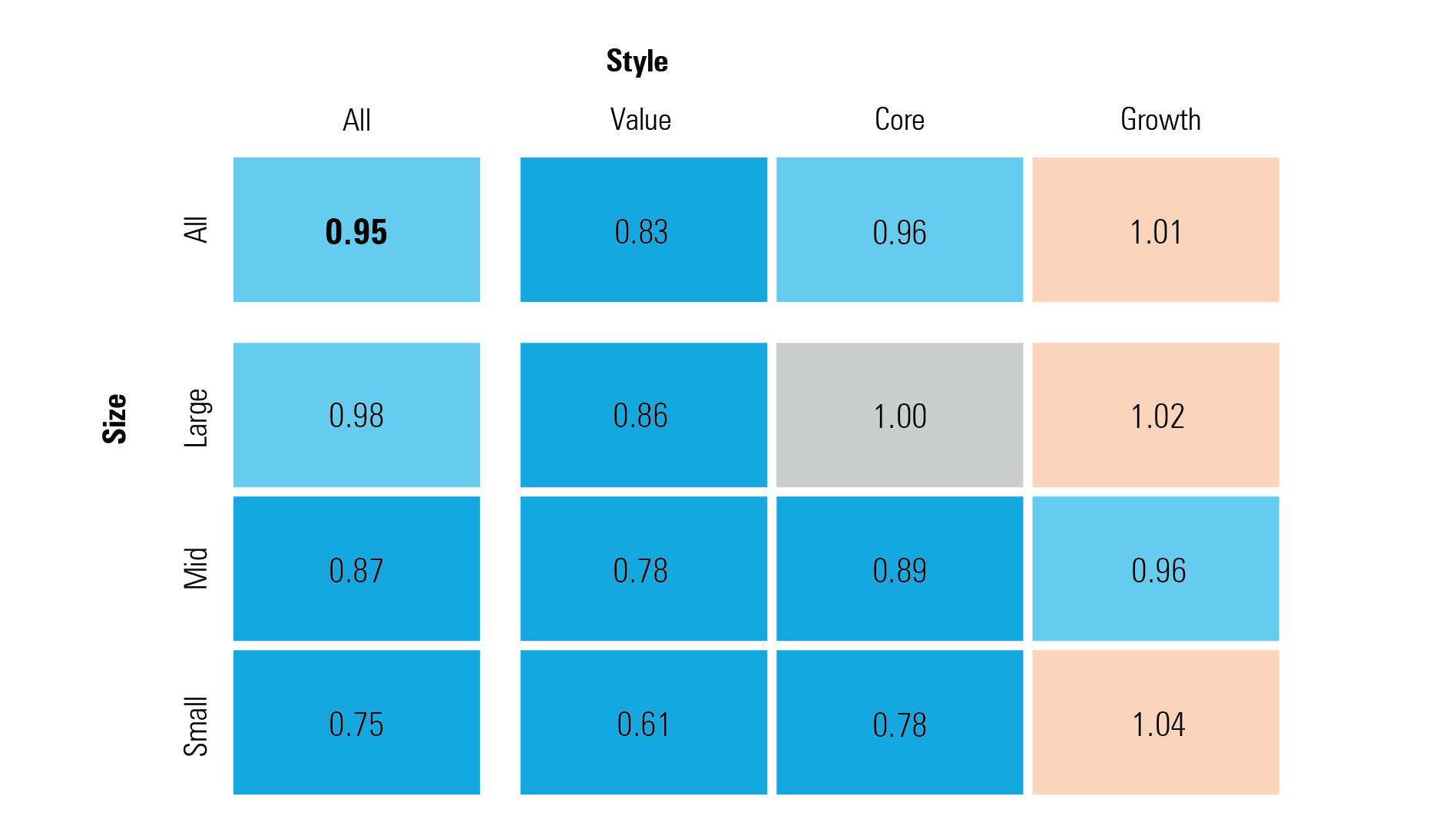

Fairness Alternative 2: Small-Cap Worth Shares

Trying on the Morningstar Type Field throughout the U.S. and Europe, we will see that the most important valuation alternative exists within the backside left nook—small-value shares.

We observe that small-cap shares are exhausting to position in a single bucket, largely as a result of so many disparate business teams—from biotech to banks—are a part of this asset class. Plus, small corporations usually show better sensitivity to the broad financial surroundings, given the preponderance of money-losing and extremely leveraged corporations within the small-cap indexes.

Due to this fact, whereas small-cap shares appear considerably cheaper than their large-cap counterparts, cautious asset choice is required, and we predict it’s essential to concentrate on high quality.

Fairness Alternative 3: Worldwide Exposures—Together with the U.Ok., European Power, Rising Markets, and China Tech

Whereas U.S. fairness returns have been dominant over current years, we predict there’s a vital alternative for buyers wanting exterior the U.S. Our work means that the U.Ok., with a big quantity of the index consisting of a well-diversified group of world corporations, together with each cyclical and defensive parts, represents good worth. Plus, cyclical industries resembling European vitality corporations, that are displaying considerably improved capital allocation amid sturdy vitality markets, look comparatively low cost. The broad alternative in rising markets has grown extra vital throughout 2023, as these shares have lagged their developed-markets friends.

A lot of the efficiency drag could be attributed to Chinese language shares as buyers weighed looming geopolitical and secular progress issues. The mixture sentiment towards rising markets stays bearish in absolute (in contrast with its personal historical past) and relative phrases (in contrast with developed markets).

Regardless of the dangers—or possibly due to them—China itself has develop into a really attention-grabbing alternative. Chinese language equities carry significantly low expectations. Nevertheless, over the long run, consumer-facing Chinese language expertise equities commerce at a considerable low cost to normalized earnings and are anticipated to generate extra returns in opposition to broad rising markets.

Fairness Alternative 4: Second-Spinoff AI Performs

AI-focused shares have topped the leaderboard in 2023, with vital valuation dangers embedded, in our evaluation. Nevertheless, second-derivative performs, together with these that may enhance margins by utilizing AI capabilities of their merchandise, supply significantly better valuations with earnings upside.

This might supply a option to entry the rising AI theme, with generative AI permitting corporations to generate advertising and marketing content material, write code, and enhance effectivity, amongst different issues. Little doubt this may create winners that may harness the advantages of AI with the power to massively scale companies and losers that can’t.

Mounted-Earnings Alternatives

- Areas with optimistic actual yields. Broad alternatives exist, particularly in developed markets. Nevertheless, area of interest alternatives additionally attraction, together with inflation-linked bonds, U.S. company mortgage-backed securities, and emerging-markets debt.

- Authorities bonds over company bonds. Particularly, U.S. Treasuries look nicely positioned, with the stability of possible outcomes for yields leaning towards falls.

- Brief-duration bonds are enticing for cautious portfolios, including wholesome revenue with appropriately decrease period danger.

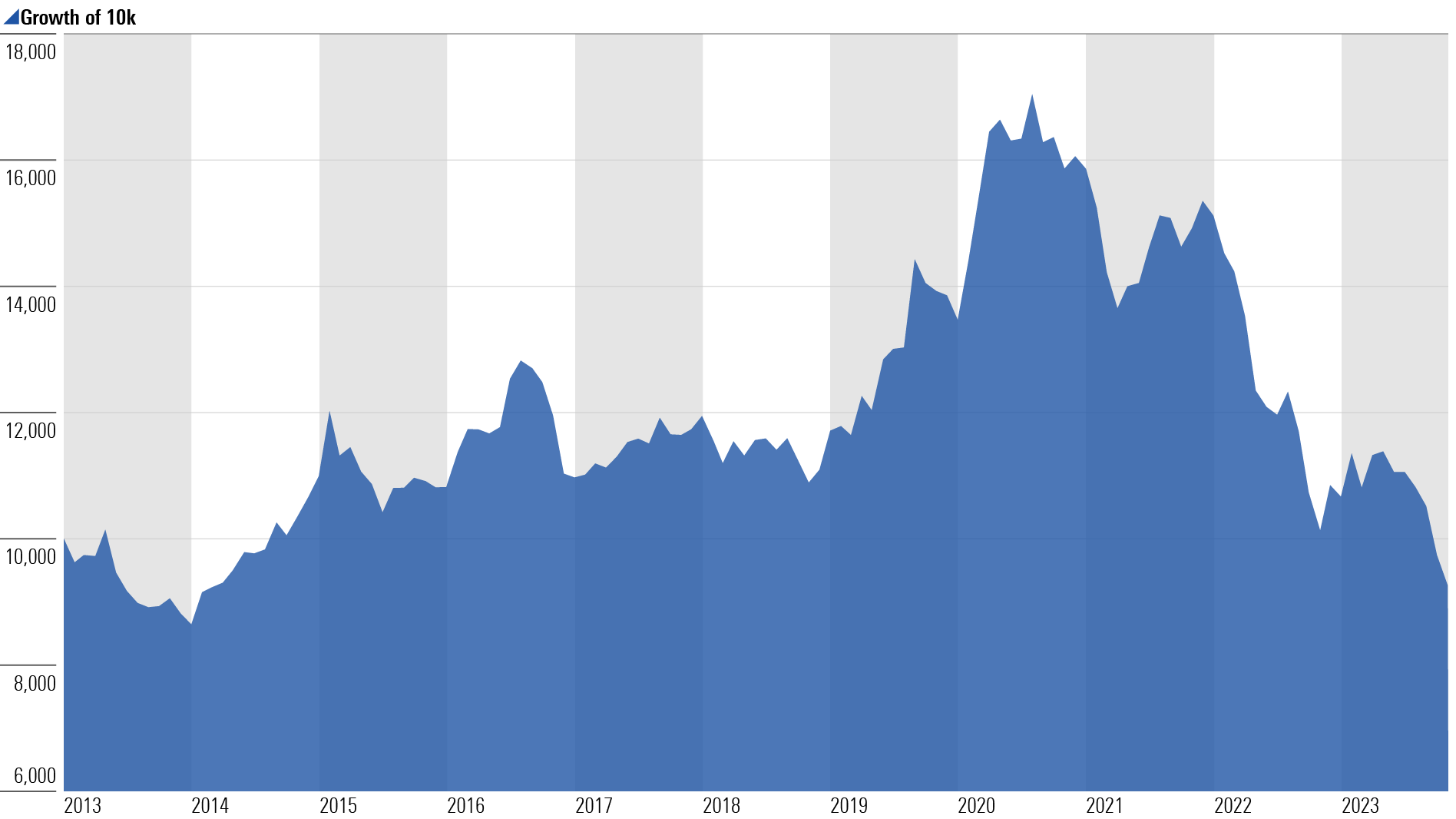

The Broad Mounted-Earnings Panorama Coming into 2024

The bond market has not supplied the defensive options over the previous two years that buyers grew to adore it for within the 4 a long time earlier than July 2021. It has been one of many worst intervals on document for developed-markets bonds in 2022 and into 2023.

That is very true for long-dated bonds.

The potential long-term regime for inflation and charges has affected these bonds with equitylike drawdowns. We now see this as a optimistic in a forward-looking context. The fabric improve in bond yields has improved their attractiveness versus different property and for portfolio danger administration extra usually.

To take benefit, it may be tempting to favor short-dated bonds. That is definitely smart in an absolute sense, though the time-frame issues. For buyers who’re cautious and/or have a short while horizon, short-dated bonds definitely attraction. We do observe this brings reinvestment danger, which is notable if rates of interest go down as anticipated. It is probably not potential to lock in at present’s long-term charges perpetually.

In follow, we predict short-dated bonds are enticing given the inverted yield curve, so we’ve a terrific place to begin—with an enormous hole between the present yield and our truthful worth yield on the quick finish of the curve. However for buyers with longer horizons, we see advantage in publicity throughout the maturity profile.

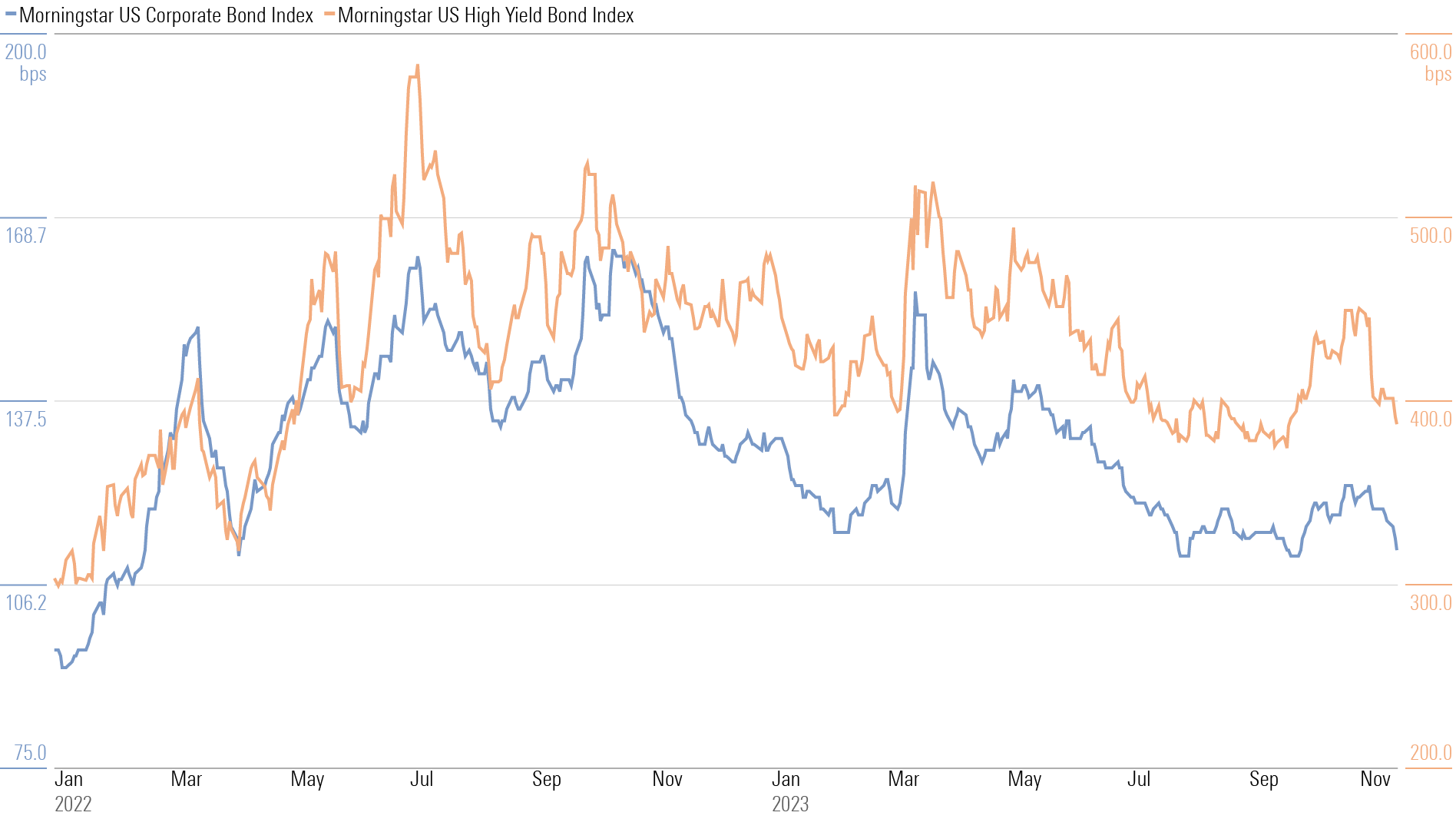

Bonds Alternative 3: Obese Authorities Bonds Versus Company Bonds

On this surroundings, we don’t must stretch for yield. Authorities bonds within the developed world presently look as enticing to us as we’ve seen in at the very least a decade. This view holds throughout all durations.

On the identical time, company bonds additionally look enticing, however the “unfold” between them is on the tight facet.

That is finest expressed by watching credit score spreads, which might often improve if financial vulnerabilities rise. But, we haven’t seen spreads budge, so company bonds (each funding grade and excessive yield) lose relative attraction given the chance of financial deterioration.