Whereas upholding the insurance coverage declare repudiated by the insurance coverage firm on the bottom of suppression of insurance policies already held by the insured, the Supreme Courtroom noticed that the insurance coverage firm didn’t discharge the burden of proof to point out that the insurer had different insurance policies present whereas taking a coverage from it.

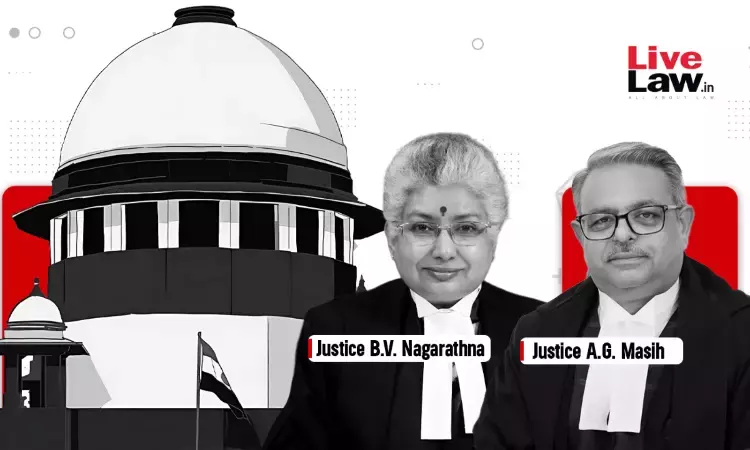

“The cardinal precept of burden of proof within the regulation of proof is that “he who asserts should show”, which implies that if the respondents herein had asserted that the insured had already taken fifteen extra insurance policies, then it was incumbent on them to show this reality by main obligatory proof…. Therefore, it may be safely concluded that the respondents (insurance coverage firm) have didn’t adequately show the truth that the insured-deceased had fraudulently suppressed the details about the prevailing insurance policies with different insurance coverage firms whereas getting into into the insurance coverage contracts with the respondents herein within the current case. Subsequently, the repudiation of the coverage was with none foundation or justification.”, the Bench comprising Justices BV Nagarathna and AG Masih stated.

The insured has taken a life insurance coverage coverage from the insurer. After the dying of the insured, her daughter (appellant) as a nominee filed an insurance coverage declare with the insurer. The declare was denied by the insurer based mostly on the assertion that the insured had suppressed the very fact of present insurance policies held by him earlier than contracting the brand new coverage.

The appellant had most well-liked to attraction earlier than the Supreme Courtroom towards the order of the Nationwide Shopper Dispute Redressal Fee (“NCDRC) denying the insurance coverage declare of the appellant.

Earlier than the Supreme Courtroom, the insurance coverage firm whereas counting on the Judgment of Reliance Life Insurance coverage Co Ltd vs. Rekhaben Nareshbhai Rathod contended that the declare of the insured was rightly repudiated by them because the repudiation of the declare attributable to suppression of the very fact of different present insurance coverage insurance policies was upheld by the Supreme Courtroom in Rekhaben case.

Per contra, the appellant identified that the insurer had didn’t discharge the burden of proof to point out if any coverage existed when the insured bought the brand new coverage from the insurer.

Discovering drive within the appellant’s competition, the Judgment authored by Justice BV Nagarathna held that the denial of the appellant’s insurance coverage declare was with none foundation as a result of the respondents/insurer had didn’t discharge the burden of proof to point out if the insured had suppressed the details about the prevailing insurance policies with different insurance coverage firms whereas getting into into the insurance coverage contracts with the respondents/insurer herein within the current case.

“The respondents have merely supplied a tabulation of details about the opposite insurance policies held by the insured-deceased. The stated tabulation additionally has lacking data with respect to coverage numbers and issuing dates and bears completely different dates of births. Additional, this data hasn’t been supported with every other paperwork to show the averment in accordance with regulation. No officer of every other insurance coverage firm was examined to corroborate the desk of insurance policies stated to have been taken by the deceased coverage holder, father of the appellant herein. Furthermore, the desk produced is incomplete and contradictory so far as the date of delivery of the insured is worried.”, the court docket noticed.

Judgment of Rekhaben Nareshbhai Rathod’s Distinguished

In assist of the repudiation of the insurance coverage declare, the insurer contended that the Supreme Courtroom within the Rekhaben case, upheld the repudiation of the insurance coverage declare attributable to suppression of the very fact of different present insurance coverage insurance policies.

Nevertheless, unable to agree with the respondent/insurer’s competition, the court docket distinguished the case of Rekhaben from that of the current case.

Within the Rekhaben case, there was an admission of the very fact of suppression of earlier insurance policies bought by the insured, nevertheless, within the current case there was no admission of the suppression of earlier insurance policies taken by the insured.

“Nevertheless, the aforesaid judgment (Rekhaben case) is distinguishable from the current case, insofar as there is no such thing as a admission by the appellant herein of any earlier insurance policies taken by the insured. In that case (Rekhaben case), after the admission by the coverage holder, the Courtroom was tasked solely with the query of whether or not the very fact about earlier polices certified to be a “materials reality” that was suppressed. Nevertheless, within the current case, in mild of Part 45 of the Insurance coverage Act, 1938, the burden rests on the insurer to show earlier than the Courtroom that the insured had suppressed the details about the earlier insurance policies. This burden of proof needs to be duly discharged by the insurer in accordance with the regulation of proof.”, the court docket noticed.

Conclusion

Primarily based on the above premise, the insurer/respondent was directed to make the fee of the insurance coverage declare below each insurance policies to the appellant, amounting to Rs. 7,50,000/- and Rs. 9,60,000/-, with curiosity on the fee of seven% every year from the date of submitting the criticism, until the precise realization.

Counsel For Petitioner(s) Mr. Venkateswara Rao Anumolu, AOR Mr. Sunny Kumar, Adv.

Counsel For Respondent(s) Mr. Praveen Mahajan, Adv. Ms. Adviteeya, Adv. Mr. Nishant Sharma, Adv. Mr. Rakesh Okay. Sharma, AOR

Case Title: MAHAKALI SUJATHA versus THE BRANCH MANAGER, FUTURE GENERALI INDIA LIFE INSURANCE COMPANY LIMITED & ANOTHER

Quotation : 2024 LiveLaw (SC) 300

Click on right here to learn/obtain the judgment

Adblock check (Why?)