Abrdn Plc is including publicity to Indian sovereign bonds on enticing yields and amid expectations that their inclusion into world indexes will drive giant inflows.

“We’re very optimistic about India,” stated Stephen Hen, chief government officer of the agency that manages and administers £495 billion ($626 billion) in property. Nonetheless, he sees the market going through some uncertainty forward of the nationwide elections beginning subsequent month.

India’s debt market is projected to draw as much as $40 billion of latest cash with JPMorgan Chase & Co set so as to add the nation’s bonds into its indexes from June. Foreigners at present maintain only a fraction of Indian debt.

Companies

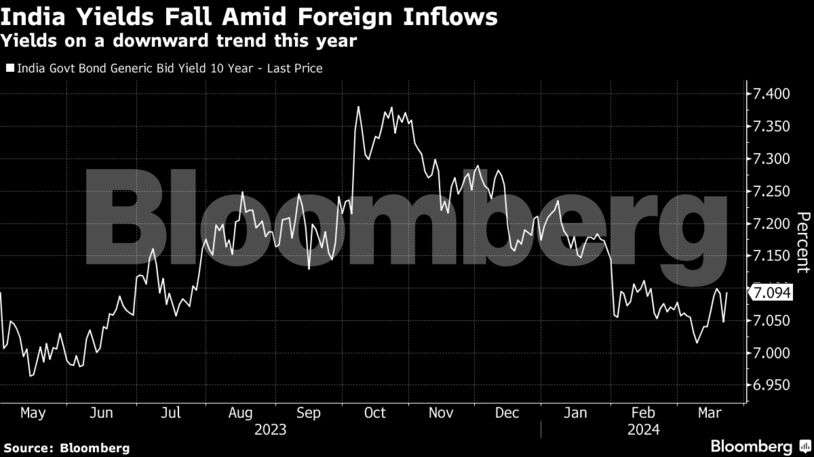

CompaniesBloomberg Index Companies Ltd. can even embrace some India bonds in its rising market native forex index beginning subsequent 12 months. Bloomberg LP is the father or mother firm of Bloomberg Index Companies Ltd., which administers indexes that compete with these from different service suppliers.The benchmark 10-year yield closed at 7.09% on Friday, after falling to a nine-month low of round 7% earlier in March. The yield can drop to six.78% by year-end, in accordance with a Bloomberg ballot of strategists.

Standard in Markets

Total, Hen expects rising markets to carry out higher when the Federal Reserve begins its easing cycle. “When charges come off, which they are going to, that traditionally EM begins to do higher and we predict that buyers want to organize for that,” he added.

Listed below are some extra views from Hen:

-Favors local-currency authorities bonds in Asia as a result of their “superb return,” along with investment-grade credit score

-Much less assured about high-yield as a result of it’s “priced to perfection”

-Constructive about tech shares in Taiwan and Korea, which lead digitization and electrification; optimistic about Japan equities

-Financial coverage easing in South America provides good prospects in local-currency bonds in that area

Adblock take a look at (Why?)