Aditya Birla Solar Life Insurance coverage (ABSLI), the life insurance coverage subsidiary of Aditya Birla Capital Restricted (ABCL), just lately introduced the launch of an industry-first, new-age financial savings answer ABSLI Nishchit Laabh Plan, a non-linked non-participating particular person life insurance coverage financial savings plan that gives assured returns with most flexibility.

The ABSLI Nishchit Laabh Plan offers an optimum mix of monetary safety, assured returns & utmost agility by enabling the policyholders to decide on between endowment, earnings with lump sum and moneyback choices. Policyholders could have the ability to evaluate and align their coverage with their life targets by selecting the advantages possibility on the inception of the coverage.

Commenting on the launch of ABSLI Nishchit Laabh Plan, Kamlesh Rao, MD & CEO, Aditya Birla Solar Life Insurance coverage stated, “At Aditya Birla Solar Life Insurance coverage, it’s our objective to offer progressive and reasonably priced life insurance coverage options to our prospects. Our latest providing, ABSLI Nishchit Laabh Plan will empower our policyholders to customise their plan in keeping with their wants. Together with assured advantages, policyholders will obtain elevated returns within the type of loyalty addition as nicely.”

The plan goals to offer a long-term corpus creation possibility with a coverage time period spanning between 20 and 42 years. Additional, policyholders will be capable to increase their maturity corpus by means of loyalty additions. Together with desired agility, policyholders will get to be benefactors of assured safety cowl throughout coverage phrases, additional lowering danger of their portfolio.

The utmost entry age to avail ABSLI Nishchit Laabh Plan is 60 years, whereas the minimal age is 30 days. To avail of the plan, the policyholders can select to pay a minimal yearly premium of ₹15,000.

The plan comes with versatile Premium Cost Phrases (PPT) and permits the policyholders to select from a variety of coverage phrases to suit particular person wants. Beneath the “Earnings with Lumpsum” possibility, the policyholder can select between 8, 10 & 12 years as PPTs together with an earnings time period of 20 and 30 years. If the policyholder needs to decide on both an endowment or money-back possibility, the PPTs will stay the identical, nonetheless, the coverage time period can be 20 and 25 years solely.

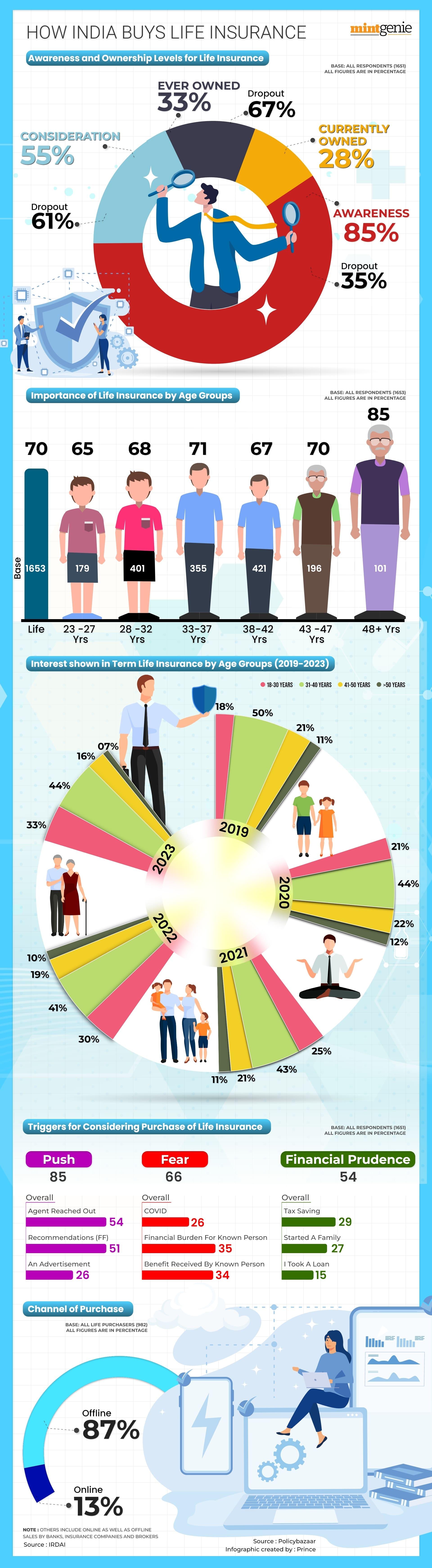

HOW INDIA PURCHASES LIFE INSURANCE

First Printed: 17 Aug 2023, 03:45 PM IST

Subjects to observe

Adblock take a look at (Why?)