A have a look at the non-public finance part of market information this month, and you’ll find various mutual fund homes launching new tech fund provides within the info know-how (IT) sector. This isn’t stunning as fund managers are bent upon benefiting from backside fishing of high quality shares out there. Nonetheless, this brings us again to the query, “Is it value investing in tech funds or funds which have their core deal with the know-how theme?”

A have a look at some know-how funds reveals that these funds have earned good returns to buyers when held for a chronic interval. The “Cumulative” impact of “Compounding” is clear from common and continued investments in them although the sector has been bled by sudden market fluctuations, steep market falls, and common corrections in inventory costs.

In recent times, the Indian know-how sector has demonstrated exceptional efficiency, surpassing each the broader market and the technology-focused US markets. A number of elements contribute to this phenomenon:

- The escalating adoption of digital applied sciences by companies and customers in India is propelling the demand for IT companies.

- Famend international IT giants like TCS, Infosys, and Wipro are headquartered in India, boasting a stable historical past of constant progress and profitability.

- The Indian authorities’s substantial investments within the IT sector are offering a further impetus to this progress trajectory.

Collectively, these components mission a steady enlargement of the Indian know-how sector within the forthcoming years. Because of this, it presents an interesting funding prospect for these in search of long-term progress alternatives.

The next desk illustrates the efficiency of some tech funds over 5 years and 10 years.

|

Title of the Fund |

5-year-returns (in %) |

10-year-returns (in %) |

|

ICICI Prudential Know-how Fund |

20.70 |

20.97 |

|

SBI Know-how Alternatives Fund |

20.41 |

19.03 |

|

Franklin India Know-how Fund |

18.09 |

16.83 |

| Supply: MoneyControl | ||

Most of those actively managed funds have very excessive publicity to tech shares. With this sector bleeding pink all alongside in 2022 and never performing as much as buyers’ expectations in 2023 up to now, numerous mutual fund homes at the moment are launching unique know-how mutual funds that may purchase shares at cheaper valuations. Not that each one info know-how shares are low cost and obtainable at their right worth, nevertheless, fund managers are prepared to attend for additional 10-15 per cent corrections on this sector to take a position on the right costs, thus, benefiting from purchases at low costs after which redeeming the shares at increased costs.

There’s certainly restricted diversification in these funds, thus, explaining the danger consider these funds. However, it is essential to acknowledge the existence of sure dangers linked with investing within the Indian know-how sector. These potential dangers embody:

- The sector’s cyclicality, which could result in short-term volatility.

- Publicity to worldwide financial uncertainties, together with a possible deceleration within the US financial system.

Potential buyers ought to diligently consider these dangers earlier than making any funding choices in regards to the Indian know-how sector.

Nonetheless, the unbridled focus coupled with the ready interval throughout which buyers proceed to build up fund items at comparatively low costs helps them to realize from placing cash in these funds in the long term.

Other than common systematic funding plans (SIPs) in these funds which contain investing by small and common installments over a chronic interval, buyers additionally purchase chunks of fund items in a lump sum when the markets are terribly down and out. This helps them to realize probably the most when the tech cycle heats up in an upbeat market. Nonetheless, to realize from these funds, buyers should wait and watch. These funds carry out in cycles, which implies that there isn’t a manner buyers can afford to worry and really feel afraid of utmost market pitfalls on account of unexpected macro elements.

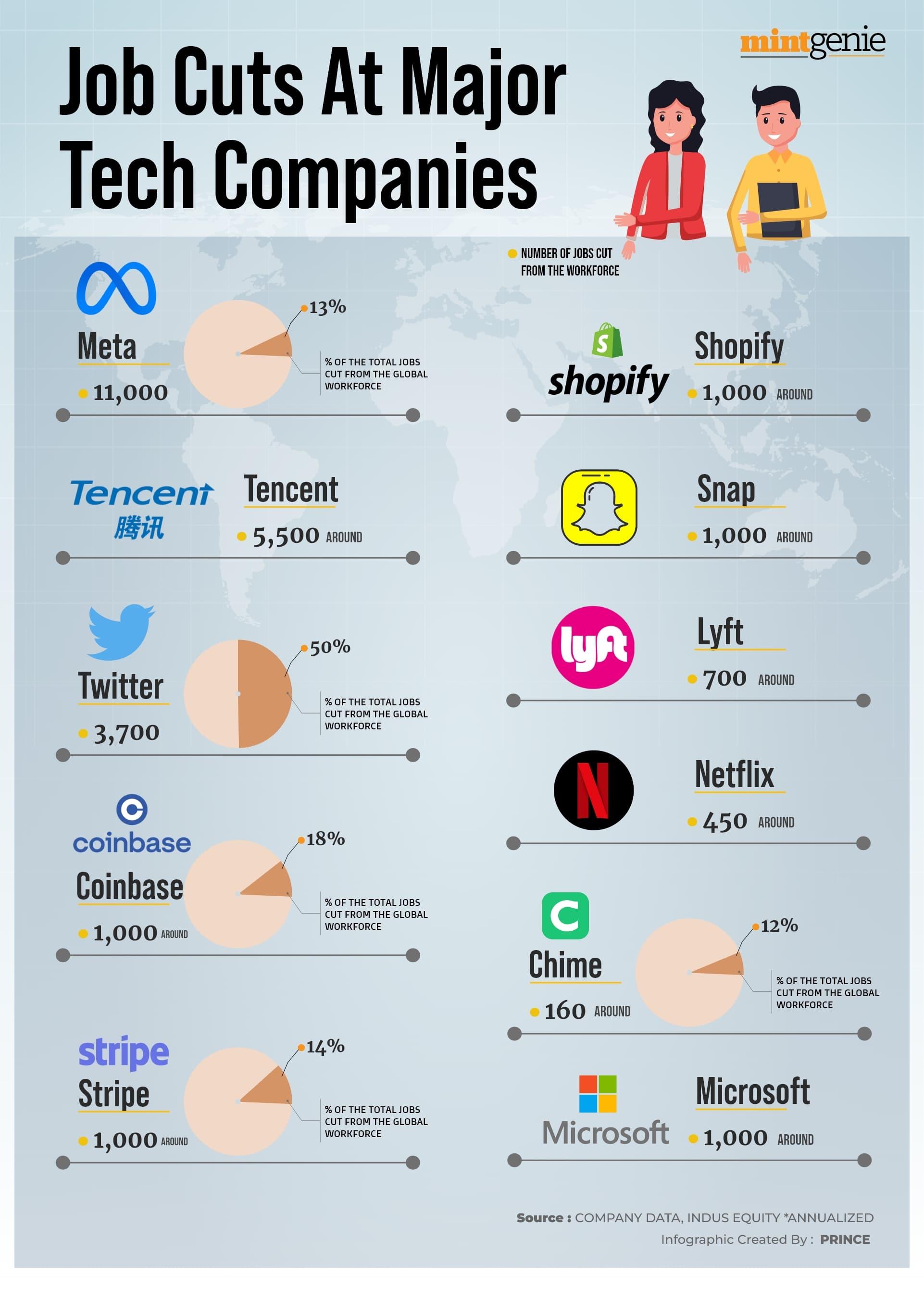

Job cuts at main tech corporations

First Printed: 29 Aug 2023, 03:51 PM IST

Subjects to comply with

Adblock take a look at (Why?)