Nonetheless not completed along with your tax planning for the 12 months? You could submit the proof of tax-saving investments quickly or face the next TDS. Don’t really feel complacent in case your employer hasn’t requested for proof of investments but. You might need been put below the brand new tax regime that gives no deductions or exemptions. No exemption for HRA and LTA, or deduction for tax-saving investments, medical insurance coverage and curiosity paid on house and schooling loans. Except a person explicitly makes a selection, he might be put below the brand new tax regime by default

A taxpayer who finds himself within the new regime can swap to the previous tax regime on the time of submitting tax returns. “Nonetheless, taxpayers can declare deduction provided that they make their tax-saving investments earlier than 31 March,” says Sudhir Kaushik, CEO of tax submitting portal TaxSpanner. com. The taxpayers who modified jobs in the course of the 12 months could not have been requested to submit proof of investments both. The brand new employer may not have taken into consideration the revenue from the earlier job and would have calculated a decrease tax. “They need to additionally full their tax-saving investments now,” says Kaushik

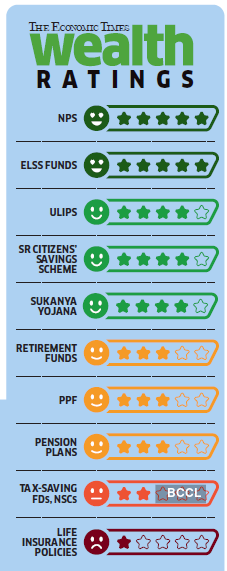

Our annual rating of tax-saving devices helps such people make the best decisions. We assessed 10 tax-saving choices on eight key parameters—returns, security, flexibility, liquidity, prices, transparency, ease of funding and taxability of revenue. Every parameter has equal weightage and the composite scores decide the place within the rating.

RETURNS 8.16% in previous 5 years

Lock-in: Until retirement

In style in Wealth

The extra deduction provided by the scheme may be very helpful for these with surplus funds.

The NPS continues to be the highest tax-saver for the second 12 months operating. The NPS saves tax below three sections: contributions as much as Rs.1.5 lakh will be claimed as deduction below Part 80C; there’s a further deduction of as much as Rs.50,000 below Part 80CCD(1b); and if the employer places as much as 10% of the fundamental wage of the person within the NPS, that quantity is deductible below Part 80CCD(2).

Other than tax deductions, the NPS has develop into extra versatile and investor-friendly. The restrict for fairness allocation has been raised to 75%. People can now change their asset combine as much as 4 occasions in a 12 months, and might put money into funds of a number of pension fund managers. The PFRDA has additionally launched the systematic withdrawal possibility, which can let buyers stagger withdrawals on maturity.

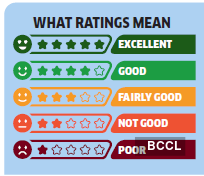

Fairness funds of the NPS have completed very nicely up to now 12 months, and are anticipated to proceed on the upward trajectory. It’s because analysts anticipate large-cap shares to do nicely within the coming months. Fairness funds of the NPS are large-cap oriented, which bodes nicely for buyers.

Even gilt and company bond funds have delivered respectable returns up to now 12 months. Their efficiency might enhance in 2024 if the RBI cuts charges within the coming months. The ten-year bond yield is at the moment at 7.23% and analysts anticipate it to say no by a minimum of 25-30 foundation factors.

On the similar time, different funding funds haven’t completed too nicely. It’s a great factor that there’s a 5% funding restrict for these funds. We recommend avoiding these funds altogether.

How NPS funds carried out

ELSS funds

RETURNS: 18.24% Previous 5 years

Lock-in: 3 years

With fairness markets on a roll, ELSS funds, particularly large-cap oriented schemes, are anticipated to do nicely within the close to time period.

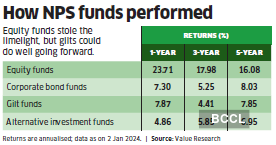

ELSS funds have moved as much as second place within the rating this 12 months, buoyed by the advance within the prospects of the inventory markets. With large-cap shares anticipated to outperform, ELSS funds with a bigger allocation to this phase will clearly do higher. Our prime picks have greater than 75% of their corpus in large-cap shares.

Most promising ELSS funds

ELSS funds rating excessive in our rating as a result of they’re clear, have very low prices and the three-year lock-in interval is the shortest amongst all tax-saving choices. Nonetheless, they’re fairness funds and are uncovered to market dangers. Ideally, one ought to put money into these via month-to-month SIPs, however this isn’t attainable if you need to present proof of Part 80C investments in a number of days.

Nonetheless, consultants say that buyers shouldn’t be overly apprehensive about short-term vital underperformance. “For superior risk-adjusted efficiency and long-term returns, you need to stand up to substantial poor efficiency for a short interval,” says Dhirendra Kumar, CEO of mutual fund tracker Worth Analysis.

Taxpayers who aren’t capable of abdomen volatility within the markets can take the SIP route by staggering their investments over the following two months.

Ulips

RETURNS:8.15% in previous 5 years

Lock-in: 5 years

Because the tax web spreads, these insurance-cum-investment plans are a tax-free haven. Nonetheless, these aren’t as versatile as ELSS.

Ulips proceed to be a tax-efficient possibility. Good points from ELSS funds past Rs.1 lakh in a 12 months are taxed at 10%, however in case of Ulips, the maturity proceeds are tax-free below Part 10(10d), supplied the life cowl is a minimum of 10 occasions the annual premium. The policyholder can even swap from a debt fund to an fairness fund, and vice versa, with none tax implication. Nonetheless, ELSS funds don’t require a multi-year dedication and have shorter lock-in intervals.

Relating to flexibility, Ulips have an edge over the NPS. The cash just isn’t locked until retirement and a policyholder could make periodic withdrawals. Nonetheless, in contrast to NPS, the place the investor can change the pension fund supervisor and put money into a couple of pension fund, right here the customer is caught with the insurance coverage firm for the remainder of the time period. A Ulip, nevertheless, won’t provide the life insurance coverage you really need. One wants a life cowl of a minimum of 7-8 occasions one’s annual revenue. Somebody with an annual revenue of Rs.12 lakh should take a canopy of a minimum of Rs.85-90 lakh. Provided that the life cowl provided by a Ulip is just 10-12 occasions the annual premium, he must shell out nearly Rs.8-9 lakh a 12 months to get the required cowl. If you purchase a Ulip, needless to say it’s a long-term funding. Purchase provided that you’ll be able to proceed with the plan for the total time period.

Senior Residents’ Financial savings Scheme

RETURNS: 8.2% in Jan-Mar 2024

Lock-in: 5 years

It’s one of the simplest ways to avoid wasting tax for senior residents. A brand new rule that permits limitless extensions makes it extra enticing.

The Senior Residents’ Financial savings Scheme (SCSS) is the most effective funding possibility for these above 60. The rate of interest of 8.2% is best than that provided by most banks. Final 12 months’s price range gave a bonanza to senior residents by climbing the funding restrict per particular person to Rs.30 lakh. In November, the extension guidelines have been additionally relaxed. Traders can even prolong the SCSS account a number of occasions, in blocks of three years every. Earlier, one might prolong it solely as soon as, and for 3 years, on the finish of the unique fiveyear time period. Nonetheless, an accountholder extending the scheme won’t get tax deduction below Part 80C.

Although the curiosity earned is totally taxable as revenue, senior residents get pleasure from tax exemption for curiosity as much as Rs.50,000. This implies as much as Rs.6.25 lakh invested within the scheme will earn taxfree curiosity. The most effective half is that the scheme pays out pension at first of every quarter.

Nonetheless, the eligibility is restricted to these above 60 years. In some instances, the place the investor has opted for voluntary retirement and has not taken up one other job, the minimal age is relaxed to 58 years. There may be additionally no age bar for defence personnel. They’ll put money into the scheme even earlier than 60 so long as they fulfill the opposite necessities. These restrictions have introduced down its rating. An account will be opened in a Submit Workplace or at designated branches of banks. It’s higher to open an account with a financial institution as a result of working will probably be much less cumbersome.

Sukanya Samriddhi Yojana

RETURNS: 8.2% in Jan-Mar 2024

Lock-in: Until little one is eighteen

The latest hike in rate of interest has made it a beautiful possibility for fogeys with lady youngsters. However it has a restricted scope.

The rate of interest of the Sukanya Samriddhi Yojana was raised to eight.2% final week, making it essentially the most profitable scheme within the small financial savings basket. The Senior Residents’ Financial savings Scheme additionally offers 8.2%, however the revenue is totally taxable. The curiosity earned by the Sukanya scheme is tax-free. The one downside is that the scheme has a really restrictive entry. It’s open solely to taxpayers with daughters beneath 10 years. There may be additionally an annual cap of Rs.1.5 lakh on the funding. These restrictions deliver down the rating of the scheme.

Accounts will be opened in any publish workplace or designated banks with a minimal funding of Rs.250. A mum or dad can open an account for a most of two daughters, however the mixed funding within the two accounts can’t exceed Rs.1.5 lakh in a 12 months. Do word that it’s obligatory to make a minimal deposit yearly for 15 years from the date of account opening, in any other case the account is deactivated. You possibly can reactivate the account with a fantastic of Rs.50 per 12 months of default.

Take into account that the rate of interest is linked to the federal government bond yield and is topic to vary each quarter. Bond yields are excessive proper now, however are anticipated to say no when the RBI cuts charges. So, don’t anticipate the Sukanya rate of interest to stay at this degree for very lengthy.

Even so, the scheme is an excellent addition to the fastened revenue portfolio. It presents the next fee than the PPF and offers assured returns.

Retirement mutual funds

RETURNS: 7-9% in previous 5 years

Lock-in: 5 years

These hybrid funds put money into a mixture of fairness and debt. The debt portion offers stability to the portfolio, whereas the fairness portion helps them generate good returns.

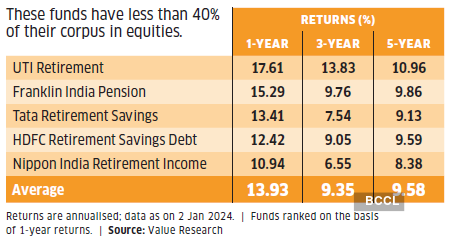

How retirement funds fared

Fairness markets have been on a roll, however not everybody can abdomen the chance. On the similar time, the excessive inflation implies that the actual returns of fastened revenue portfolios might be very low. Some hybrid schemes give buyers the most effective of each worlds by investing in a mixture of debt and fairness. In contrast to ELSS funds, which make investments their whole corpus in equities, retirement mutual funds put money into a mixture of fairness and debt devices. The debt portion offers stability to the portfolio, whereas the fairness portion helps them generate good returns (see desk). They’re additionally eligible for tax deduction below Part 80C.

We notably like UTI Retirement Fund, which has given good returns at a considerably decrease danger. The fund has lower than 40% of its corpus in equities. Traders with a low danger urge for food who need to save for the long run can go for these retirement funds. Nonetheless, these funds have a lock-in interval of 5 years. Additionally, some retirement funds, similar to Franklin Pension Fund, levy an exit load if redeemed earlier than you flip 58.

NSCs, tax-saving FDs

RETURNS:7-8%

Lock-in: 5 years

Good possibility just for late risers and senior residents who could have exhausted the funding restrict in SCSS.

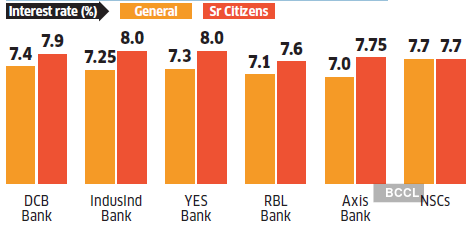

The 7-8% curiosity provided by tax-saving fastened deposits would possibly look enticing, however tax eats into the returns. Curiosity is totally taxable on the slab fee relevant to the person, so the post-tax return for buyers within the 30% tax bracket is lower than 5%. Nonetheless, there are some plus factors too. One large benefit is that the funding will be completed in a short time with minimal effort. The taxpayer has to only go online to his Netbanking account, and full the method.

High tax-saving fastened deposits

In comparison with financial institution deposits, NSCs are extra enticing. They’re providing 7.7%, and the curiosity earned on the NSC is eligible for deduction within the following years. Right here’s how this works. If an investor buys Rs.50,000 value of NSCs in January 2024, the funding would earn Rs.3,840 in a 12 months. The investor can declare deduction for this Rs.3,840 in 2024-25. The subsequent 12 months, the Rs.4,000 curiosity will be claimed as a deduction in 2025-26.

Pension plans

RETURNS: 7-14% in previous 5 years

Lock-in: Until retirement

Pension plans from insurance coverage corporations can’t match the NPS on prices, flexibility and tax advantages.

Pension plans from life insurance coverage corporations principally work like Ulips, however they’ll’t match the quite a few tax benefits that the NPS and Ulips get pleasure from. Making pension plans eligible for deduction below Part 80CCD is among the long-standing calls for of the life insurance coverage trade. Nonetheless, it’s unlikely that the approaching price range will curtail the unique profit loved by the government-sponsored NPS.

The NPS additionally permits the investor to shift from one pension fund supervisor to a different if he isn’t glad with the service or efficiency. Nonetheless, in case of a pension plan, the investor is tied to the identical insurance coverage firm until the plan matures. The issue of taxability of the pension revenue from annuity is one thing that each pension plans and the NPS must take care of.

In keeping with the consultants, if annuities are made tax-free, will probably be a sport changer for the trade and can go a great distance in making India a pensioned society.

Life insurance coverage insurance policies

RETURNS: 5-6%

Lock-in: Minimal 5 years

Insurance coverage insurance policies proceed to be the worst method to save tax. Corpus is tax-free however flexibility and returns are very low.

Life insurance coverage is the bulwark of a monetary plan as a result of it safeguards all different monetary targets. Nonetheless, these are the worst method to save tax in our rating. The target of life insurance coverage is to offer monetary assist to a household if the breadwinner dies.

This function is finest completed via a pure safety time period plan with no funding element. These plans price a fraction of what you pay for a conventional endowment coverage or a a refund plan. A 30-year-old man should buy a canopy of Rs.1 crore for 30 years by paying an annual premium of Rs.12,000-14,000 per 12 months.

Compared, an endowment plan providing a canopy of Rs.40-50 lakh will price the customer nearly Rs.4-5 lakh per 12 months. The one benefit of life insurance coverage insurance policies is the assured returns and tax-free maturity corpus. However these advantages are far outweighed by the low returns and inflexibility of the instrument.

Final 12 months’s price range made a basic change by bringing life insurance coverage into the tax web. Now, if the annual premium of all new insurance policies exceeds Rs.2.5 lakh, the maturity won’t be tax-free.

( Initially revealed on Jan 08, 2024 )

Adblock take a look at (Why?)