Introduction

In September 2023, the Worldwide Capital Markets Affiliation (ICMA) revealed the primary steering on blue bonds, outlined by the World Financial institution as debt devices issued by governments, growth banks or others to boost capital to finance marine and ocean-based tasks which have optimistic environmental, financial and local weather advantages. This marked an vital milestone for blue bonds, however the debt instrument stays nascent. On this article, we study why blue bonds are needed, the progress the debt instrument has made so far and what’s required if blue bonds are to emulate the success of inexperienced bonds.

The blue financial system is valued at roughly $3 trillion, which might be the equal of the world’s seventh largest financial system in GDP phrases.

The ‘Blue Planet’

Protecting greater than three-quarters of the floor of the planet and representing roughly 97% of the water when it comes to quantity, the oceans are the principle purpose behind the Earth’s appellation of ‘Blue Planet’.

Past the massive scale of area they occupy, oceans are additionally important for billions of individuals, not solely when it comes to habitat (40% of the world’s inhabitants reside in coastal areas), but in addition when it comes to livelihood (greater than 3 billion folks depend on the ocean for his or her livelihoods, the overwhelming majority of whom reside in creating nations1). The blue financial system is valued at roughly $3 trillion, which might be the equal of the world’s seventh largest financial system in GDP phrases.2

,

As well as, the oceans function the ‘the lungs of the earth’: not solely do they produce half of the oxygen within the ambiance, however the phytoplankton in oceans launch 4 occasions extra oxygen than the Amazon rainforest. The oceans additionally act as a carbon sink by absorbing roughly 30% of CO2 emissions, in addition to having absorbed round 90% of extra warmth brought on by human actions.

SDG 14, the United Nations’ Sustainable Growth Aim masking life under water, is essentially the most under-funded of the 17 SDGs.

Lagging funding flows into the blue financial system

In discussions concerning the path to web zero, emphasis is commonly positioned on decreasing greenhouse gasoline (GHG) emissions and creating new carbon seize applied sciences, however our oceans additionally type a key a part of the answer. Certainly, there’s a case for elevating consciousness of the significance of oceans to folks’s livelihoods, in addition to their position as a buffer towards local weather change. This lack of know-how is mirrored by lagging funding flows into the blue financial system. SDG 14, the United Nations’ Sustainable Growth Aim masking life under water, is essentially the most under-funded of the 17 SDGs. The financing hole for contributions to the blue financial system total is estimated to be round $750 billion from the European Fee by 2030, and as much as $5 trillion for the Asia-Pacific area. It’s estimated that investing $1 throughout 4 key ocean-related actions (mangrove safety and restoration, decarbonising the transport sector, scaling up offshore wind vitality manufacturing, sustainable fishing and aquaculture) may yield at the very least 5% in world advantages.3 So how can buyers assist to bridge this hole and channel the mandatory funds in direction of the blue financial system?

Blue bonds appear a really perfect device to finance the mandatory investments to realize this objective. The World Financial institution defines blue bonds as a debt instrument issued by governments, growth banks or others to boost capital to finance marine and ocean-based tasks which have optimistic environmental, financial and local weather advantages.

As per the most recent ICMA pointers, blue bonds can finance, however are usually not restricted to, the next areas:

From 2018 to 2022, there have been solely 26 blue bonds, with a cumulative worth of roughly $5 billion, which represents lower than 0.5% of the sustainable debt market.

As per the most recent ICMA pointers, blue bonds can finance, however are usually not restricted to, the next areas:

- Water provide

- Water sanitation

- Ocean-friendly and water-friendly merchandise

- Ocean-friendly chemical compounds and plastic associated sectors

- Sustainable transport and port logistics sectors

- Fisheries, aquaculture and seafood worth chain

- Marine ecosystem restoration

- Sustainable tourism companies

- Offshore renewable vitality manufacturing

Because the debut of blue bonds as an investable instrument in 2018 (the primary blue bond was issued by the Republic of Seychelles, 11 years after the primary inexperienced bond), the take-up has been very gradual. From 2018 to 2022, there have been solely 26 blue bonds, with a cumulative worth of roughly $5 billion, which represents lower than 0.5% of the sustainable debt market.4

A nonetheless nascent debt instrument

Blue bond issuance so far has predominantly been restricted to sovereigns and growth banks, with a heavy rising markets tilt, given the robust reliance of those markets on revenues associated to the blue financial system. Sovereign blue bonds issuance, though very promising and with a definite environmental influence, nonetheless faces many challenges, reminiscent of excessive nation credit score threat for rising markets issuers and weak secondary market liquidity.

Issuance within the company area remains to be nascent, with Danish vitality firm Ørsted the primary company to problem a blue bond for its offshore renewable vitality venture. But, at $100 million, the bond is just too small to permit flows from massive institutional buyers.

There’s potential for blue bonds to leap among the hurdles that inexperienced bonds initially confronted.

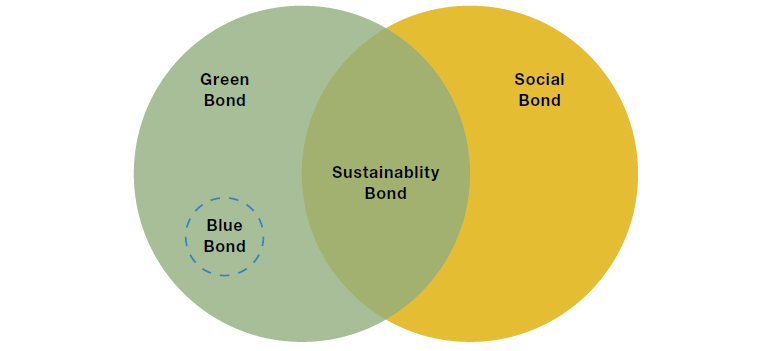

With ICMA steering now in place, creating a spot for blue bonds that’s distinct however firmly inside the wider inexperienced bond market (as illustrated in Determine 1), there’s potential for blue bonds to leap among the hurdles that inexperienced bonds initially confronted. Arguably blue bonds can profit from the confirmed and established demand for sustainable investments we see in markets at this time. This was one of many huge challenges that inexperienced bonds confronted. It took near 12 years for inexperienced bonds to achieve $1 trillion in cumulative issuance, with the Paris Settlement in 2015 a key second for the asset class.5 It stays to be seen whether or not the Treaty of the Excessive Seas (Excessive Seas Treaty), adopted by the United Nations in June 2023, or the brand new ICMA pointers for blue finance, will mark an analogous watershed second for blue bonds and whether or not they may permit for different bond issuers to enter the area

Determine 1. Kinds of Use-of-Proceeds Bonds

Supply: Primarily based on ICMA Rules.

Impression reporting will even play a significant position in establishing and sustaining the credibility of the asset class.

Establishing metrics to measure influence is vital

Impression reporting will even play a significant position in establishing and sustaining the credibility of the asset class. Whereas the inexperienced bond market predominantly concentrates on GHG emission reductions, there’s not, at current, a common metric for measuring influence within the blue bond universe. Quantifying carbon sequestration or the influence of biodiversity safety on ocean life pose a plethora of challenges. Nevertheless, efforts should be made to search out options given this will likely be key in establishing investor confidence within the asset class and finally encouraging elevated issuance and wider adoption.

Conclusion

In abstract, we imagine the success of the blue bonds will likely be depending on the next non-exhaustive components:

- A powerful framework: blue bonds are presently bundled below the ‘inexperienced bonds’ umbrella. Clear frameworks, methodologies and ringfencing on using proceeds should be developed. Organisations such because the ICMA, the Taskforce on Nature-related Monetary Disclosures (TNFD) and the European Fee, by way of their taxonomy, can be pure candidates to create and/or strengthen these frameworks and to standardise their use. Now we have seen the primary indicators of this with the ICMA steering issued in September 2023.

- A stronger pipeline of tasks to spend money on to deal with the blue financial system’s financing hole.

- A wider vary of debt devices past these issued by sovereigns and growth banks.

- Impression reporting: the blue financial system not solely performs a task within the livelihood of billions of individuals around the globe, but in addition has a significant half to play within the local weather change debate from a carbon-capture perspective, nature-based options in addition to the decarbonisation of key sectors reminiscent of transport. It is very important create a set of metrics to measure all these impacts, which can assist guard towards potential bluewashing and assist to determine investor confidence within the asset class.

The world’s oceans are important to the livelihoods of billions of individuals, in addition to an vital buffer towards local weather change. Whereas blue bonds are presently of their nascence – and have numerous hurdles to beat earlier than they’re adopted extra broadly – we imagine they’ve the potential to play a key position in preserving our oceans, marine life and finally our planet.

1. Sources: OECD – Ocean Financial system and creating nations.

2. Supply: Oceans – United Nations Sustainable Growth.

3. Supply: Konar, M., & Ding, H. 2020. A Sustainable Ocean Financial system for 2050 Approximating Its Advantages and Prices. Secretariat of the Excessive Degree Panel for a Sustainable Ocean Financial system, World Sources Institute. Washington, DC.

4. Supply: Bloomberg Knowledge.

5. Supply: $1Trillion Mark Reached in International Cumulative Inexperienced Issuance: Local weather Bonds Knowledge Intelligence Experiences: Newest Figures | Local weather Bonds Initiative.

Adblock check (Why?)