Shares to observe: Try the businesses making headlines earlier than the opening bell at present, on April 8, 2024.

Adani Wilmar: The Adani Group witnessed double-digit progress in each edible oils and meals companies in the course of the quarter ended March FY24, pushed by elevated retail penetration, notably specializing in under-indexed markets. The corporate additionally achieved its highest ever quantity in the course of the quarter, and it continued to achieve market share.

Wipro: Chief Government Officer and Managing Director Thierry Delaporte of the IT providers firm resigned from his place on April 6. The software program main has appointed Srinivas Pallia because the CEO and MD of the corporate. Thierry Delaporte stepped down as MD and CEO to pursue passions exterior the office.

Vodafone Concept: The telecom operator has obtained approval from its board of administrators for fund-raising as much as Rs 2,075 crore from Oriana Investments, an Aditya Birla Group entity. The corporate will concern as much as 1,39.5 crore fairness shares to Oriana Investments at a problem worth of Rs 14.87 per share, topic to shareholder approval in a common assembly.

Tata Metal: The Tata Group firm mentioned India’s crude metal manufacturing grew by 4.5 % year-on-year to five.38 million metric tons (MT), whereas deliveries elevated by 5 % YoY to five.41 MT and have been the best ever quarterly deliveries. Additional, in FY24, Tata Metal India achieved the best ever annual crude metal manufacturing of 20.8 MT, with a progress of 4 % YoY by debottlenecking throughout websites and reaching larger metal manufacturing at Neelachal Ispat Nigam, and deliveries elevated by 5.6 % YoY to 19.9 MT.

Commercial

Commercial

Cochin Shipyard: The corporate has signed the Grasp Shipyard Restore Settlement (MSRA) with america Navy. The MSRA is a non-financial settlement and is efficient April 5. It will facilitate the restore of US Naval vessels beneath Army Sealift Command within the Cochin Shipyard.

BSE: The Bombay Inventory Trade (BSE) mentioned it could be implementing a restrict worth safety (LPP) mechanism in its fairness derivatives section, efficient April 16, 2024, to strengthen pre-trade danger management measures.

Titan Firm: The corporate registered a income progress of 17 % YoY for the quarter ended March FY24 and added 86 shops (web) in the course of the quarter, whereas the group’s retail community presence stands at 3,035 shops. Jewellery enterprise operations grew 18 % YoY, led by each patrons and same-store gross sales, clocking wholesome double-digit progress, whereas watches and wearables enterprise elevated 6 % in comparison with the year-ago interval. Rising companies grew 24 % YoY, and CaratLane’s enterprise elevated 30 % YoY, however the EyeCare section recorded a 1 % YoY decline for the quarter.

JSW Power: The corporate has closed its certified establishment placement (QIP) concern and raised Rs 5,000 crore by way of the allotment of 10.3 crore fairness shares to 97 certified institutional patrons at a problem worth of Rs 485 per share. Goldman Sachs picked up Rs 1,356.1 crore value of fairness shares, and Nomura India purchased Rs 500.15 crore value of shares.

Commercial

Commercial

United Breweries: The corporate has obtained an order for tax demand (together with curiosity and penalty) of Rs 263.72 crore for FY20 from the Maharashtra State Items & Service Tax Division.

Punjab Nationwide Financial institution: The general public sector lender has recorded whole enterprise of Rs 23.56 lakh crore for the quarter ended March FY24, rising 8.8 % YoY, with whole deposits rising 7 % to Rs 13.7 lakh crore and advances rising 11.5 % YoY to Rs 9.85 lakh crore. Home deposits elevated 6.6 % YoY, and CASA deposits grew 2.6 % YoY, whereas home advances rose 11.2 % YoY.

Nestle India: The FMCG firm has obtained approval from the board of administrators for the appointment of Suneeta Reddy as an Further Director and Impartial Non-Government Director. The board additionally accredited fee of common license charges (royalty) by the corporate to Société des Produits Nestlé S.A. (licensor), the guardian firm.

Gland Pharma: The generic injectable-focused pharmaceutical firm has obtained approval from america Meals and Drug Administration (USFDA) for Eribulin Mesylate injection. It expects to launch this product within the close to time period via its advertising companion. Eribulin injections are used within the remedy of breast most cancers that spreads to different components of the physique.

Strides Pharma Science: The USA Meals and Drug Administration (USFDA) had carried out a routine present good manufacturing practices (cGMP) inspection on the formulations facility of Strides Alathur, an entirely owned subsidiary of the corporate, in Chennai from April 1 to April 5, 2024. The US FDA closed the inspection with two observations.

Cholamandalam Funding and Finance Firm: The corporate recorded total disbursements for Q4FY24 at round Rs 24,600 crore, a progress of 17 % over a year-ago interval. For FY24, disbursements elevated 33 % YoY to Rs 88,300 crore. Property beneath administration grew round 35 % to roughly Rs 1.53 lakh crore.

Zee Leisure Enterprises: The media and leisure firm’s MD and CEO, Punit Goenka, have proposed the implementation of a lean and streamlined administration construction to the board to attain the focused targets of the corporate. The MD and CEO have initiated the method of rationalizing the workforce by 15 % throughout the corporate. The proposed construction is aimed toward arriving at an economical operational mannequin and can additional allow the corporate to chart larger progress by sustaining efficiency and profitability.

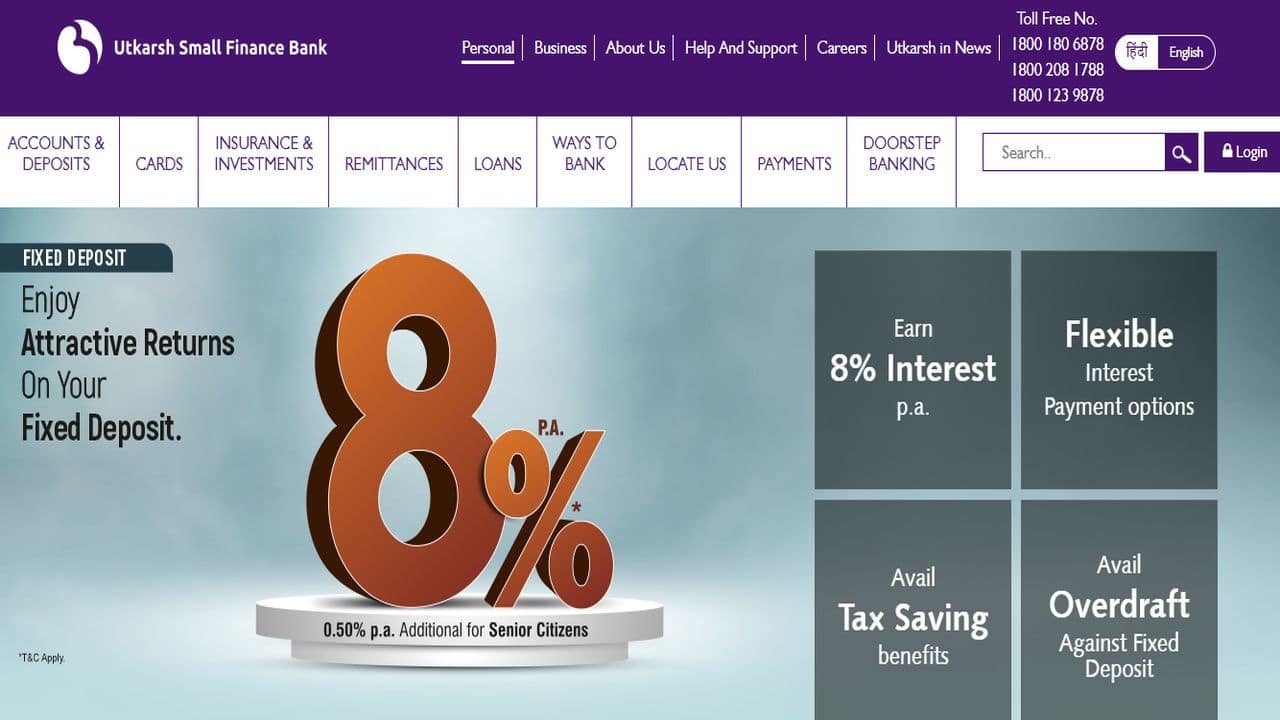

Utkarsh Small Finance Financial institution: The gross mortgage portfolio for the quarter ended March FY24 grew by 31.1 % YoY to Rs 18,299 crore, whereas whole deposits elevated by 27.4 % to Rs 17,473 crore, and CASA deposits rose 25.1 % to Rs 3,582 crore throughout the identical interval. The financial institution recorded retail time period deposits at Rs 7,968 crore, rising 42.9 % over a year-ago interval, and bulk time period deposits at Rs 5,922 crore for the quarter, rising 12.3 % YoY.

Financial institution of Baroda: The general public sector lender has recorded international enterprise at Rs 24.16 lakh crore for the quarter ended March FY24, rising 11.20 % YoY, with international advances rising 12.41 % YoY to Rs 10.89 lakh crore and international deposits rising 10.24 % YoY to Rs 13.26 lakh crore. Home deposits jumped 7.75 % to Rs 11.28 lakh crore, and home advances elevated 12.8 % to Rs 8.97 lakh crore throughout the identical interval.

Union Financial institution of India: The general public sector lender has reported whole enterprise at Rs 21.26 lakh crore for the quarter ended March FY24, rising 10.31 % over a year-ago interval, with advances rising 11.72 % YoY to Rs 9.04 lakh crore and deposits rising by 9.29 % YoY to Rs 12.21 lakh crore. Complete home RAM (retail, agriculture, and MSME) advances on the financial institution grew by 13.82 % YoY to Rs 4.97 lakh crore in This autumn FY24.

UCO Financial institution: The financial institution has appointed Sourav Kumar Dutta as Chief Expertise Officer for 3 years on a contractual foundation, with impact from April 5.

Bandhan Financial institution: Chandra Shekhar Ghosh will retire as Managing Director and Chief Government Officer of the financial institution after the completion of his present tenure on July 9, 2024.

Dr. Reddy’s Laboratories: The pharma main has entered right into a partnership with Bayer to market and distribute a second model of Vericiguat in India. Below the phrases of this settlement, Bayer has granted non-exclusive rights to Dr. Reddy’s beneath the model identify Gantra. Vericiguat is used within the remedy of power coronary heart failure with a lowered ejection fraction.

Aurobindo Pharma: The USA Meals and Drug Administration (US FDA) has inspected the brand new injectable facility of Eugia Steriles, the step-down subsidiary of Aurobindo, in Andhra Pradesh, from March 28 to April 5, 2024. It closed the inspection with the observations, that are procedural in nature. In the meantime, Aurobindo has appointed T Vijaya Kumar as President, R & D (specialty drug supply), with impact from April 5.

Godrej Shopper Merchandise: Working situations in India continued to stay subdued within the quarter ended March FY24. India natural enterprise continued to ship sturdy underlying quantity progress at a excessive single digit, with progress being broad-based throughout each dwelling care and private care. Whereas demand for family pesticides has been subdued resulting from an prolonged winter within the North and East, Park Avenue and KamaSutra manufacturers delivered according to class seasonality. Underlying quantity progress continued to be in double- digits. At a consolidated stage (natural), the corporate expects to ship underlying quantity progress of excessive single digits and gross sales progress of mid-single digits, pushed largely by forex volatility.

Greaves Cotton: Greaves Retail, the retail unit of the corporate, has entered right into a strategic expertise switch and provide settlement with Tsuyo Manufacturing, the Indian firm specializing in electrical car elements. The partnership will strengthen Greaves Cotton’s innovation capabilities and improve manufacturing effectivity within the electrical L3 car section.

South Indian Financial institution: The financial institution mentioned the board has appointed Vinod Francis as Chief Monetary Officer (CFO) and key managerial personnel of the financial institution, with impact from April 8. Vinod Francis is presently working as the overall supervisor on the financial institution. The current CFO, Chithra H, will take cost because the Chief Compliance Officer (CCO) of the financial institution.

Karur Vysya Financial institution: The financial institution has determined to extend the marginal price of funds-based lending charges (MCLR) by 10 bps throughout tenures, with impact from April 7.

Indiabulls Actual Property: Embassy Group, Baillie Gifford & Co., Blackstone Actual Property Fund, Quant Lively Fund, Poonawalla Finance, Micro Labs, Maybank, Utpal Sheth, Capri International, Yash Shares & Inventory, Aalidhra, and others will make investments Rs 3,911 crore in the actual property firm by way of preferential allotment.

Financial institution of India: The general public sector lender has reported international enterprise at Rs 13.23 lakh crore for the quarter ended March FY24, rising 11.66 % over the corresponding interval of final fiscal. International deposits elevated by 10.2 % YoY to Rs 7.38 lakh crore, and international gross advances jumped 13.56 % YoY to Rs 5.86 lakh crore in the course of the quarter.

Jammu & Kashmir Financial institution: Pratik D. Punjabi has resigned as Chief Monetary Officer of the financial institution, with impact from April 5, to discover skilled alternatives exterior the financial institution.

RITES: The transport infrastructure consultancy has signed an MoU with the Indian Institute of Expertise, Madras (IIT-Madras) to collaborate on inexperienced power initiatives within the area of transport and mobility. The partnership goals to seek out novel infrastructure options for the transportation and storage of inexperienced hydrogen and inexperienced ammonia.

Drive Motors: The auto firm has recorded manufacturing of business automobiles, utility automobiles, and tractors at 3,152 items, whereas home gross sales stood at 3,248 items and exports at 420 for the month of March 2024.

Data Edge India: The standalone billings in the course of the quarter ended March FY24 stood at Rs 826.9 crore, rising 10.5 % over Rs 748.6 crore recorded within the year-ago interval, with recruitment enterprise rising 7.2 % YoY to Rs 625.4 crore and 99 acres for the actual property section rising 26.4 % YoY to Rs 131.1 crore in This autumn.

Zee Media Company: The corporate has included its wholly owned subsidiary, Zee Media Inc., within the State of Delaware, United States of America.

Jay Kailash Namkeen: The corporate will listing its fairness shares on the BSE SME on April 8. The difficulty worth is Rs. 73 per share. The inventory will probably be within the trade-for-trade section for 10 buying and selling days.

Yash Optics & Lens: The buying and selling in fairness shares of the corporate will start on the NSE Emerge with impact from April 8. The difficulty worth is Rs. 81 per share. Its fairness shares will probably be obtainable for buying and selling within the trade-for-trade surveillance section.

K2 Infragen: The corporate will make its debut on the NSE Emerge on April 8. The difficulty worth is Rs. 119 per share. Its fairness shares will probably be obtainable for buying and selling within the trade-for-trade surveillance section.

Navisha Joshi

Uncover the newest enterprise information, Sensex, and Nifty updates. Get hold of Private Finance insights, tax queries, and skilled opinions on Moneycontrol or obtain the Moneycontrol App to remain up to date!

<!–

(perform(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “//join.fb.web/en_GB/sdk.js#xfbml=1&model=v2.10”;

fjs.parentNode.insertBefore(js, fjs);

}(doc, ‘script’, ‘facebook-jssdk’)); –>

Adblock check (Why?)