Cyclone Biparjoy, which has intensified into an “extraordinarily extreme cyclonic storm” from “very extreme cyclonic”, is more likely to hit south-southwest Gujarat and adjoining Pakistan coasts quickly. Contemplating this, an orange alert has been sounded in Saurashtra and Kutch. Twelve groups of the Nationwide Catastrophe Response Drive (NDRF) and an equal variety of State Catastrophe Response Drive (SDRF) have been placed on standby in Gujarat to be deployed to cope with the state of affairs after the arrival of the cyclone.

Whereas the authorities put together to verify there’s minimal harm as a result of cyclone, there’s some bit that we will do at a person degree for ourselves to verify we face minimal harm in case of a pure catastrophe like this one. Shopping for a complete automobile insurance coverage coverage is one such factor that may aid you throughout pure calamities equivalent to cyclones, floods, earthquakes, and so forth.

It is very important notice that not all automobile insurance coverage insurance policies supply protection towards cyclones. Since a variety of car homeowners select third-party legal responsibility insurance policies, they miss out on protection towards calamities like cyclones, although these insurance policies are cheaper.

For protection towards cyclones, floods, earthquakes, and so forth., one wants to purchase a complete automobile insurance coverage coverage or a standalone own-damage coverage.

Advantages of automobile insurance coverage coverage throughout cyclone

Cashless declare

In case your automobile has been severely broken throughout a cyclone, you possibly can attain out to your insurance coverage firm and request for cashless declare. The insurer is accountable for getting your broken automobile to the closest storage and setting the payments.

No-claim bonus

A complete automobile insurance coverage coverage additionally provides you the good thing about no declare bonus (NCB). This implies you get a reduction in your premium renewals for those who do not increase any claims within the coverage phrases. Moreover, you additionally get to switch your present NCB with a brand new coverage.

Straightforward declare course of

A complete automobile coverage additionally brings with it the good thing about hassle-free inspection and declare course of, permitting one to avail high-quality providers throughout a pure catastrophe.

increase declare after a cyclone?

-Firstly, needless to say in case your automobile is submerged in water on account of cyclone impact, you don’t begin the engine. It’s because if water has entered the automobile, cranking the engine is usually a very dangerous thought which may solely improve the harm. Look forward to the insurance coverage firm consultant to evaluate the damages.

-Inform your insurance coverage supplier as quickly as you get an opportunity to examine your automobile. It’s advisable to succeed in out to them by means of a name as an alternative of writing an electronic mail or visiting the workplace in such situation.

-One of many vital steps whereas elevating a declare is accumulating proof. An efficient means to do that is clicking footage and recording movies of damages accomplished by the cyclone. Be sure you seize the precise damages. Moreover, information relating to cyclone can act as supporting proof.

-Be sure you have all the main points relating to your automobile insurance coverage helpful earlier than you attain out to the insurance coverage firm as it could actually assist in processing your declare easily.

-After you have accomplished the above, file a declare utilizing the app of the insurance coverage firm or visiting the web site. One can even take the assistance of insurance coverage supplier consultant for submitting the declare.

-As soon as the verification is finished, the automobile will probably be repaired on the storage.

-The declare will probably be settled primarily based on the method one opts for: Cashless or Reimbursement.

Complete loss

When shopping for a automobile insurance coverage, one of many vital phrases to remember is IDV or the insured declared worth, which implies the utmost present worth of the automobile.

A complete loss implies a state of affairs through which the automobile harm is past restore. If the whole expense of restore is larger than 75 % of the IDV of the automobile, the insurance coverage firm is liable to settle the declare by paying the IDV, declaring the automobile as complete loss. Complete loss conditions are widespread throughout a cyclone.

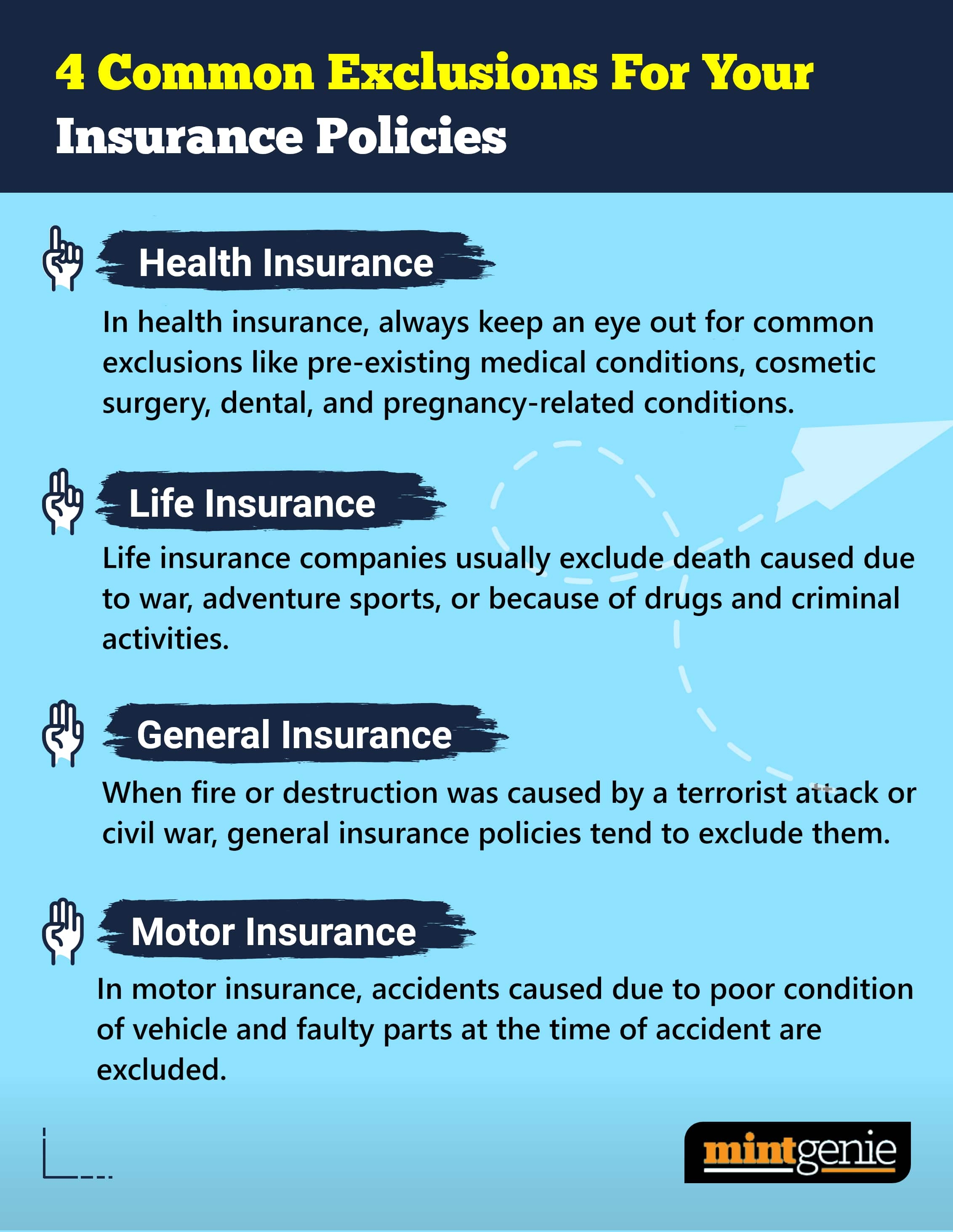

Right here we describe the widespread exclusions for well being, life, motor and common insurance coverage insurance policies.

First Printed: 12 Jun 2023, 12:34 PM IST

Matters to comply with

Adblock take a look at (Why?)