Rahul Gandhi

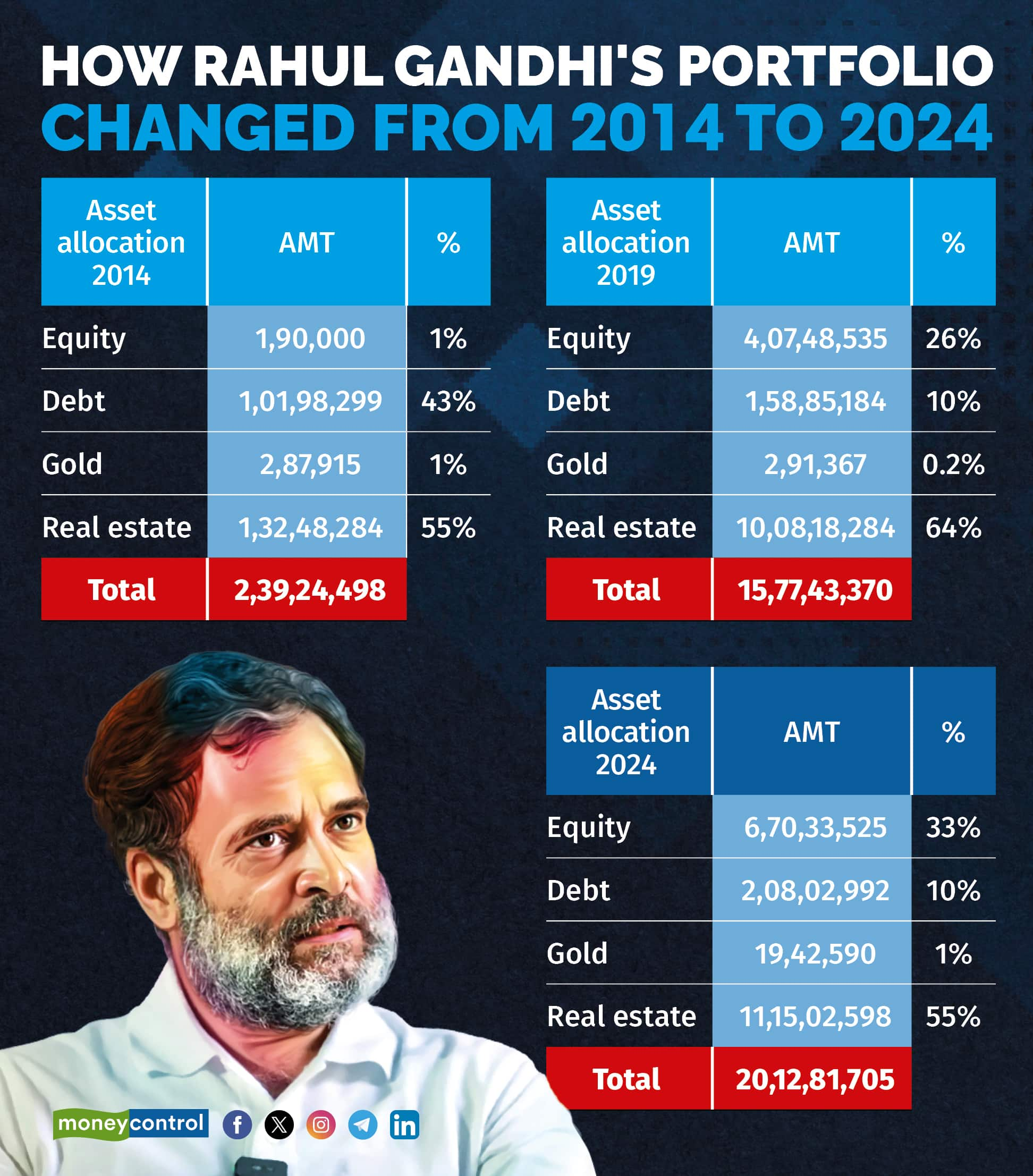

An evaluation of Rahul Gandhi’s present portfolio, as per the affidavit he filed when submitting his nomination for his constituency Wayanad, in Kerala, exhibits that his portfolio seems diversified and throughout asset lessons.

Nevertheless, it’s price noting that his allocation to equities in 2014, the 12 months by which the Congress-led United Progressive Alliance (UPA) misplaced the Lok Sabha elections to the Narendra Modi-led Nationwide Democratic Alliance (NDA), was zero.

Whereas the diversification might have been based mostly on the suggestions of the Congress chief’s funding advisor, the rise in fairness market within the final 10 years throughout which Modi has been in energy seems to have given confidence to Gandhi to speculate extra money in fairness markets.

From nil to 30 %

Gandhi’s 2014 affidavit exhibits that he had no investments in listed fairness shares and even in fairness mutual funds (MF). He did have a small allocation (100 shares price Rs 1,900 every) to an organization known as Younger Indian. Gandhi is a director on Younger Indian, an organization that owns the Nationwide Herald newspaper amongst different property, together with actual property. Other than Gandhi, different Congressmen are director of the corporate like Sonia Gandhi and Mallikarjuna Kharge. Gandhi nonetheless owns 1,900 shares – which is valued on the similar Rs 1.90 lakh – of Younger Indian, as per his 2024 affidavit.

Younger Indian’s possession of an organization known as Related Journals Ltd (AJL), which owns Nationwide Herald and actual property close to Delhi’s ITO, has been the topic of extended authorized proceedings between the Gandhis and businesses, notably ED and the IT division.

Rahul Gandhi’s asset allocation – 2014-24

Rahul Gandhi’s asset allocation – 2014-24

Nevertheless, by Could 2019, Gandhi’s portfolio had matured. His fairness investments had gone as much as Rs 4.07 crore. That was 26 % of his general portfolio, which was valued at Rs 15.77 crore then. As per his newest submitting (March 2024), his fairness investments had gone as much as Rs 6.70 crore. This interprets to 33 % of his portfolio.

Story continues beneath Commercial

To make sure, it’s not doable to calculate the exact returns that his fairness portfolio has made over time as a result of the affidavits don’t point out when he purchased and bought shares and mutual funds. Additionally the rise in his fairness portfolio is modest between 2019 and 2024 (Rs 2.62 crore).

An fairness portfolio goes up on account of a mixture of an increase in share costs (in case you purchase shares instantly) or web asset values (mutual funds) and by making incremental investments.

However it’s clear that between 2014 and 2024, Gandhi has invested and allotted extra in equities.

“As time has passed by, Gandhi’s confidence has grown. And this exhibits in his portfolio; he has allotted extra to equities over time. He additionally seems to trust within the Indian economic system,” says Srikanth Bhagavat, managing director of Hexagon Capital Advisors.

Rising fairness markets have definitely helped Gandhi. During the last 10 years (between January 1, 2014 until date), the S&P BSE Sensex went up by 13 % on a compounded foundation. Mid-cap shares (BSE Midcap index went up by 20 %) and small-cap shares (BSE Smallcap index went up by 21 %) have additionally gone up.

Mutual funds and direct equities

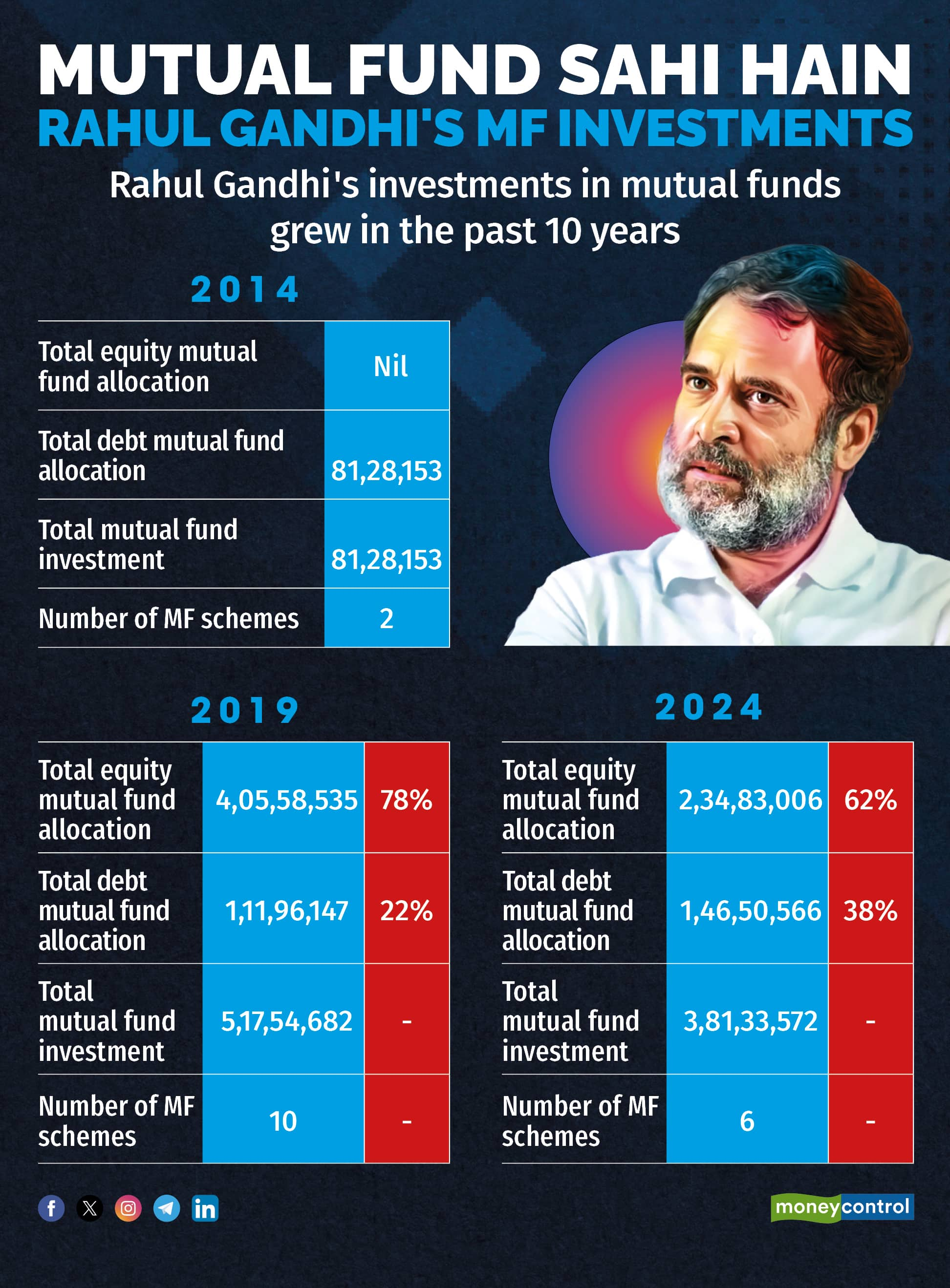

His confidence in Indian equities additionally present in the best way he has shuffled the portfolio between 2019 and 2024.

Rahul Gandhi’s mutual fund investments 2014-2024

Rahul Gandhi’s mutual fund investments 2014-2024

In 2019, Gandhi was invested solely in mutual funds, for his fairness investments. He had invested in 10 mutual fund schemes, throughout large-cap, mid-cap and small-cap. By 2024, he had shifted a few of that to direct equities. He nonetheless owns mutual funds, although they’re now largely concentrated between HDFC Mutual Fund (India’s third-largest fund home with assts below administration of Rs 6.19 trillion) and ICICI Prudential Mutual Fund (India’s second-largest fund home with property below administration of Rs 6.90 trillion). Parag Parikh Flexi Cap Fund is the one different fund home’s scheme in his portfolio, that constitutes 5 % of his MF allocation.

Rahul Gandhi’s asset allocation: Not sufficient gold

Whereas Gandhi seems to have taken benefit of the huge fairness rally that Indian shares markets have had over the previous 10 years, he has missed out on the gold rally. His allocation to gold, as per his 2024 affidavit is woefully low at simply 1 %. This interprets to Rs 19 lakh, cut up between bodily gold jewellery valued at Rs 4.20 lakh and Sovereign Gold Bonds with Rs 15 lakh. “Although the SGB is a brand new and good addition to his portfolio, which exhibits financialisation of his financial savings, simply 1 % gold allocation (of his general portfolio) is means too low. He has missed out on all the gold rally,” says Viral Bhatt, founding father of Cash Mantra.

Gold has given a return of 9 % between 2014 and 2024 – the ten years of Modi’s authorities. Nevertheless, a lot of this has come within the final 5 years, when gold costs went up by 15 % since December 2018 until date.

Adblock take a look at (Why?)