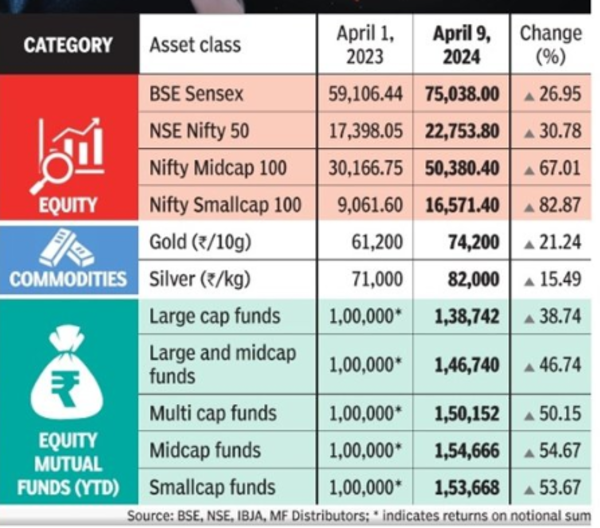

Buyers who diligently invested within the markets, even for simply the final yr, had been delighted when the 2023-24 monetary yr ended. Most asset lessons — the Indian fairness markets, mutual funds or bullion — delivered good-looking returns, which averaged to about 44%. The Nifty Midcap and Smallcap shares delivered 67% and 82% within the yr respectively.

The Indian fairness markets proceed reaching recent highs as inflows proceed into shares and mutual funds from retail buyers, establishments and excessive internet price people (HNIs).Whereas mutual fund investments — a significant a part of that are in equities — left buyers delighted with excessive returns, gold dazzled for buyers this yr.

“The fairness markets have had a bull run. Within the wake of geopolitical aftershocks, gold has risen considerably, delivering good returns. Furthermore, folks’s religion in gold has remained intact for the reason that Covid-19 pandemic and confidence pushed investments to gold,” mentioned Haresh Acharya, director of the India Bullion and Jewellers’ Affiliation. “Regardless of geopolitical upheaval, India Inc posted wholesome progress, maintaining market indices excessive. Low financial institution rates of interest and the unavailability of different appropriate asset lessons made buyers deal with fairness markets,” mentioned a monetary guide.

“Many new demat accounts had been opened and SIP inflows improved by way of the yr,” he added.

Mutual funds stay well-liked

Over the previous yr, mutual fund investments in India have trended upwards. In FY 2024, belongings below administration (AUM) by fairness mutual funds in Gujarat surpassed Rs 2 lakh crore, as reported by the Affiliation of Mutual Funds in India (AMFI). By March 31, 2024, fairness mutual fund belongings for Gujarat buyers stood at Rs 2.38 lakh crore, with the state’s total AUM reaching Rs 3.78 lakh crore.

Buyers had been drawn by the spectacular efficiency of largecap, small-cap and mid-cap mutual funds, which delivered 50% returns on common. The launch of latest fund gives (NFOs) and the rising curiosity of younger buyers contributed to this surge. Technological developments within the sector have additionally made investing extra accessible. Kartik Patel, a mutual fund advisor from Ahmedabad, mentioned,“Constant influx by way of systematic funding plans (SIPs) and lump sum funds was maintained by way of the yr, reflecting sustained investor confidence.”

On a record-breaking spree, gold dazzles buyers

Gold costs have soared previous the Rs 75,000-mark, signalling a sturdy part for the valuable metallic. The pattern of investing in gold is anticipated to persist. Dinesh Thakkar from Tradebulls predicts additional will increase, particularly with potential US Federal Reserve price cuts in 2024.

“Historic patterns counsel important returns when the Fed slashes charges. Nevertheless, sturdy US financial knowledge might restrict these cuts, doubtlessly moderating gold’s ascent. Nonetheless, investor curiosity and geopolitical tensions are projected to push gold costs to new highs, presumably reaching $2,500 on COMEX and surpassing Rs 75,000 on MCX,” he mentioned. Spot gold costs within the worldwide market hit a document of $2,400.05 per troy ounce. Since June 2019, when gold value Rs 35,000 per 10g in Ahmedabad, its worth has greater than doubled, up 114% in lower than 5 years.

Haresh Acharya, the director of IBJA, attributes the rise to geopolitical strife and financial uncertainty, prompting important gold purchases by people, HNIs and central banks. “Buyers have their eyes on the US Fed announcement of price cuts. This may increasingly additional gasoline a rally in gold and silver,” he added.

Fairness market scales new highs in FY24

The Indian fairness markets did nicely within the final fiscal yr regardless of world volatility. The Nifty Realty index appreciated by round 130% within the final fiscal whereas Nifty Auto, Nifty PSU Banks, Nifty Oil and Gasoline and Nifty Healthcare gave greater than 50% returns.

Vaibhav Shah, director of Monarch Networth Ltd, mentioned, “India has been the quickest rising main financial system and the inventory market thus did nicely in 2023-24 regardless of world market volatility. Within the 2023-24 monetary yr, the nation noticed a document excessive gross GST assortment of Rs 20.14 lakh crore. We’ve additionally seen sturdy manufacturing exercise together with progress in companies. Indian buyers are investing greater than Rs 15,000 crore each month by way of SIPs, with the entire variety of buyers within the nation crossing 9 crore. This has resulted in 24% returns from the BSE Sensex and 28% for the Nifty, whereas the Nifty Midcap appreciated by 58% in FY24.”

Bull run raises curiosity in major market

In FY24, India noticed 76 corporations increase about Rs 62,000 crore by way of mainboard IPOs. This was a rise from the Rs 52,000 crore raised in FY23. Samir Gandhi, director of Goldmine Shares Personal Restricted, famous that the secondary market’s efficiency is commonly linked to the first market’s exercise, albeit with some lag. After the Covid market downturn in March 2020, sentiments have improved, resulting in a surge within the indices and extra IPOs.

The pattern of will increase in IPOs started in FY21 with Rs 31,268 crore, and the sums raised grew persistently by way of FY22, FY23 and FY24, with Rs 111,547 crores, Rs 52,116 crore and Rs 61,767 crore as of March 14 respectively. Gandhi highlighted that whereas the banking, monetary companies and insurance coverage (BFSI) sector had been outstanding, the previous two years have seen a number of sectors take part within the IPO market, indicating a widening base.

Devarsh Vakil of HDFC Securities sees a surge within the Indian inventory market forward, with extra corporations elevating funds in comparison with the final fiscal yr. “The approaching yr seems promising, particularly for brand new, well-liked on-line manufacturers planning to go public. With a historical past of sturdy returns and excessive liquidity, investor curiosity in IPOs stays excessive,” he mentioned.

Actual property reveals momentum

The actual property sector in Ahmedabad and Gujarat has additionally seen costs rise within the final monetary yr. Land markets round main cities within the state have seen steep value will increase whereas inside the metropolis limits; costs of constructed properties and people below development have appreciated by between 5% and 10% in a yr, relying on location.

Dhruv Patel, president of CREDAI Ahmedabad, mentioned, “In response to a number of analysis experiences, common costs of residential and industrial properties have elevated by round 10% in Ahmedabad within the final monetary yr because of infrastructure growth and higher employment alternatives. Areas resembling SG Highway, Sindhu Bhavan Highway and Iskcon Ambli Highway have seen costs rise by 8-10% within the residential section. Nevertheless, Ahmedabad remains to be essentially the most inexpensive main metropolis for housing within the nation.”

Adblock take a look at (Why?)