In at this time’s quickly evolving office panorama, safeguarding worker well being has grow to be a non-negotiable precedence for organisations. Investing in complete company medical health insurance is a key software in fostering worker satisfaction, loyalty, and total productiveness.

Significantly in India, the place healthcare bills can quickly escalate, insurance coverage can function a crucial monetary security web for workers. Customising your company medical health insurance protection to make sure most advantages on your workers requires an intricate understanding of assorted add-ons.

To begin with, one ought to contemplate the Day 1 Pre-existing Ailments/Particular Ailments (PED/SD) protection. Pre-existing situations comparable to diabetes or hypertension and particular illnesses like cataract or hernia, usually subjected to ready durations underneath retail insurance coverage, may be lined from day one underneath company insurance coverage. This reduces hurdles throughout declare processing, easing the method for workers.

Maternity cowl, a pivotal add-on, takes care of maternity-related bills, together with pre and post-natal care. Contemplating the rising price of maternity care in India, it’s important to have this add-on, particularly in case your worker demographic traits in the direction of youthful people planning to begin households.

In an analogous vein, day 1 little one protection is a vital add-on, offering protection for all medical bills from childbirth, a function often not obtainable underneath retail plans till 90 days post-birth.

Holding tempo with societal change, insurers now provide protection for LGBTQ and live-in companions, reflecting the shift in the direction of higher inclusivity within the office. By choosing such protection, corporations can embrace the variety of their workforce and ship a transparent message of acceptance and equality.

Contemplating that many Indian workers bear healthcare duties for his or her aged dad and mom, protection for folks/parents-in-law turns into an important add-on. It not solely gives an ideal aid to workers but in addition boosts their satisfaction, thereby enhancing their productiveness.

Pre and put up hospitalisation add-on covers medical bills incurred earlier than hospital admission and after discharge. This add-on may be customised primarily based on the length of protection, which often ranges from 30 to 180 days. The longer the length, the bigger the security web for workers coping with critical well being points.

Residence hospitalisation is one other add-on price contemplating. This protection may be useful for the therapy of diseases comparable to dengue or pancreatitis that may be managed at residence. It ensures that the shortage of hospital rooms or the shortcoming of a affected person to succeed in a hospital doesn’t hinder entry to high quality healthcare.

Given the rising considerations round psychological well being, it’s important to incorporate protection for psychological counselling. This ensures that workers have entry to skilled psychological well being companies when required. It additionally contributes in the direction of making a supportive and inclusive work surroundings.

Cashless Outpatient Division (OPD) cowl, though partly lined underneath pre and put up hospitalisation, is more and more being sought as a standalone profit. Since a major chunk of OPD bills in India is commonly out-of-pocket, together with this cowl in your coverage can enormously ease the monetary burden in your workers.

Company buffer is an add-on designed for conditions the place an worker’s well being cowl has been exhausted on account of unexpected medical emergencies or crucial diseases. Corporations can go for this extra protection offering additional monetary assist to their workers of their hour of want.

Essential diseases, comparable to most cancers or coronary heart illness, usually contain substantial therapy prices. By together with a crucial sickness cowl in your company insurance coverage coverage, corporations can present in depth monetary assist for his or her workers in case of such dire well being conditions. This cowl usually presents a lump sum fee, guaranteeing vital bills may be managed.

To make your best option of customizations on your company medical health insurance, an intensive understanding of your organisation’s demographic, the particular wants of your workers, and the trade norms is significant. A one-size-fits-all method might not yield the perfect outcomes, therefore customization is the way in which ahead. In any case, organisations should assume a fiduciary duty to make sure that their workforce is protected.

It is necessary to keep in mind that tailoring a company medical health insurance coverage requires balancing complete protection with price range constraints. Nonetheless, offering a well-rounded insurance coverage plan helps create a wholesome, glad, and motivated workforce, making it a worthy funding.

Anuj Parekh is the Co-Founder and CEO of HealthySure

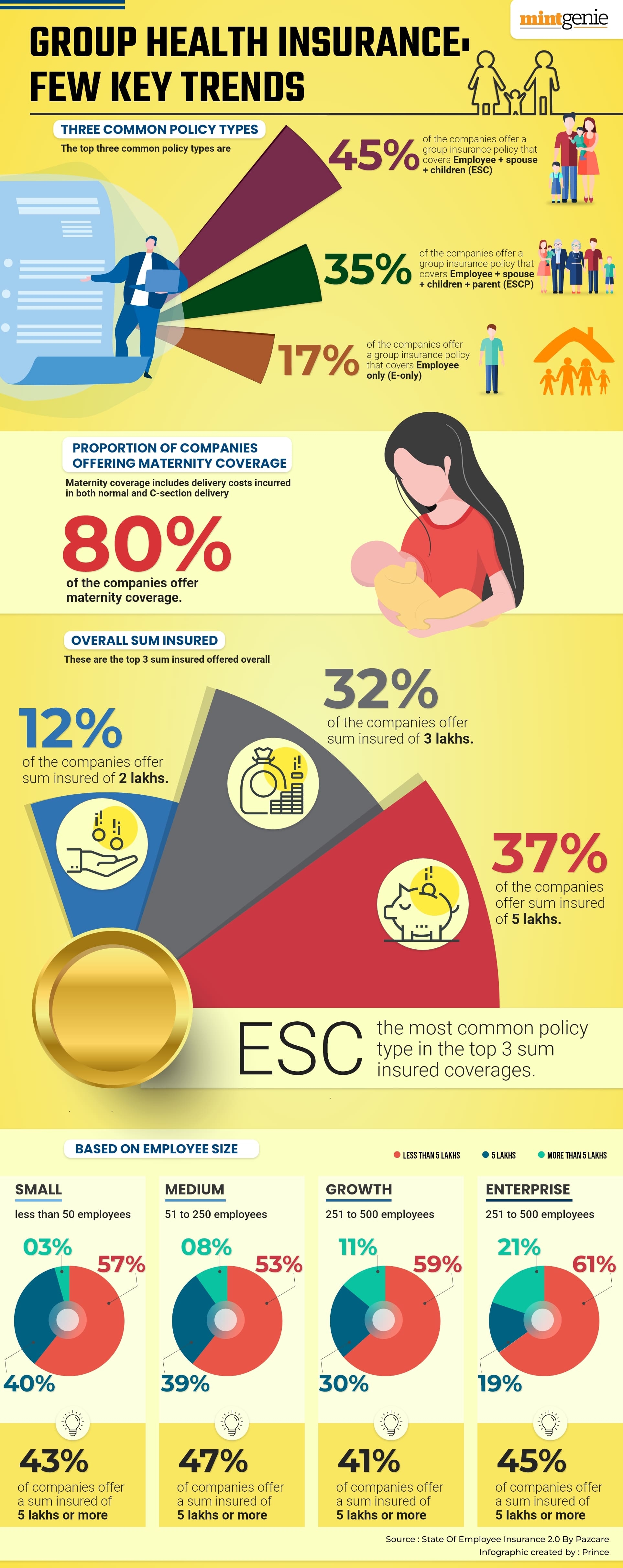

Group medical health insurance: Few key traits

First Revealed: 20 Jun 2023, 09:14 AM IST

Matters to comply with

Adblock check (Why?)