The flexibility of choices buying and selling gives loads of alternatives within the inventory market. Merchants can modify their method to choices buying and selling to match their particular person targets and particular funding goals. On this article, we’ll go over three completely different possibility buying and selling strategies that may support traders in minimizing losses and maximizing positive factors.

Collar Technique

Traders whose main concern is the potential lack of a inventory holding typically make use of a collar technique. The collar technique includes buying an underlying asset for funding, equivalent to shares, whereas concurrently buying a put choice to restrict the draw back danger and promoting a better name choice to earn revenue and prohibit the upside potential. Traders whose wealth is concentrated in a single inventory place and who could also be unable to diversify away from that place might discover collar technique notably interesting. Nevertheless, this system additionally comes with a restricted type of loss and a restricted degree of revenue. The insurance coverage price could be lowered by writing a name possibility, making collar strategies interesting.

Traders seeking to make use of the collar technique might must maintain up-to-date with occasions which will have an effect on the value of underlying property. A useful instrument is the financial calendar, which might establish financial occasions equivalent to financial stories, company earnings bulletins, or central financial institution coverage choices which will have an effect on underlying asset costs. The financial calendar reveals each monetary occasion and financial indicator influencing shares and Foreign exchange. Traders can use this data to regulate the collar technique by deciding on acceptable strike costs for the put and name choices or by avoiding the timing of the development to flee potential volatility.

Lined Name Or Revenue Technology Methods

When a inventory is predicted to stay comparatively unchanged for an prolonged interval, traders can make use of a method generally known as lined calls or buy-write to chop down on their holding prices. Relatively than letting the inventory sit dormant, an investor might promote increased name choices, permitting them to earn the price of the premium whereas concurrently decreasing the prices related to proudly owning the inventory.

For example, a inventory bought for a long-term function might fall under the decision possibility’s strike value. Thus, the investor might unload increased calls and generate income from the premium. Contrarily, if the inventory value rises above the strike value, the investor will most definitely promote the inventory however incur extra losses. Nevertheless, a lined name is a secure guess for traders who want to generate profits whereas conserving shares of a enterprise they suppose will keep moderately regular.

Supply: Pexels

The Lengthy Straddle Technique

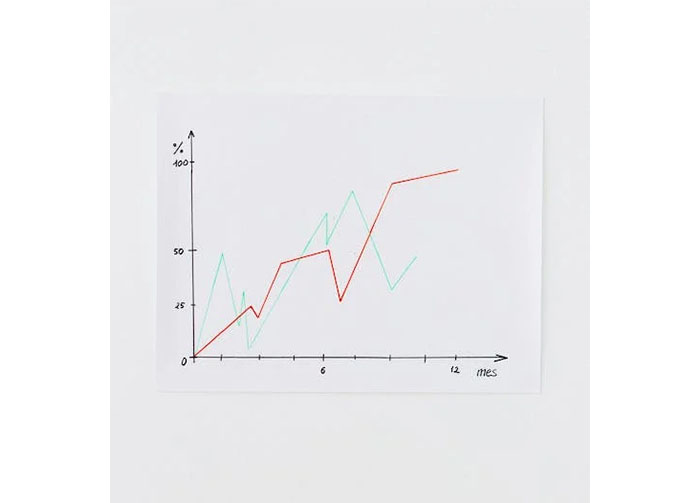

The lengthy straddle is an choices buying and selling method that includes a excessive diploma of danger. It’s a plan meant to be worthwhile when the inventory could be very unstable and strikes quickly up or down. Therefore the lengthy straddle permits you to buy two choices (a name possibility and a put possibility) on the identical inventory on the identical strike value and expiration date. If the inventory value drastically shifts, the technique advantages since one possibility’s worth will rise whereas the opposite’s falls.

This method gives a better potential for reward, however solely a considerable change within the inventory value will make it worthwhile. Subsequently, solely seasoned merchants who can tolerate better uncertainty ought to put it to use.

Choices buying and selling could be tailor-made to the targets and danger tolerance of the investor via the usage of the collar, lined name/revenue producing, and lengthy straddle strategies.

Adblock check (Why?)