Look who’s again.

After a protracted absence, energetic particular person traders have returned with a vengeance. And whereas which will actually be true to some extent within the GameStop Corp.

GME,

saga, the larger questions for traders of all stripes are whether or not an obvious resurgence on the retail buying and selling entrance will final and what it is going to imply for the inventory market as U.S. benchmark indexes march to all-time highs.

It’s been a very long time coming.

Shares noticed the strongest bull market in historical past following the 2008 monetary disaster “with none outstanding retail curiosity in it,” stated Chris Konstantinos, chief funding strategist at RiverFront Funding Group, in an interview.

He famous that whole bond fund flows have outpaced inventory flows by practically $3 trillion since 2007. Actually, particular person traders appeared fascinated with nearly anything, from actual property to cryptocurrencies, Konstantinos stated.

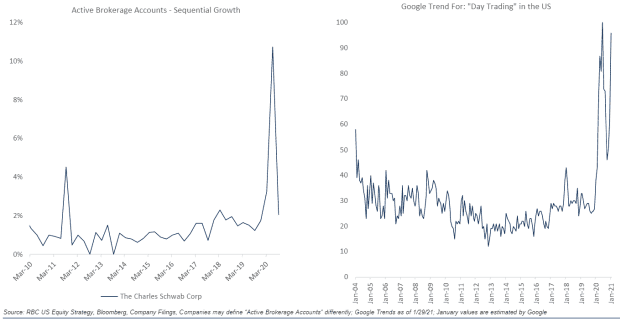

A shift acquired below manner final yr because the coronavirus pandemic took maintain. Sequential progress in accounts at brokers corresponding to Charles Schwab Corp.

SCHW,

that cater to particular person traders “was outstanding” on the finish of the second quarter of 2020 and was adopted by a serious surge in progress within the following quarter, stated Lori Calvasina, head of U.S. fairness technique at RBC Capital Markets, in a Feb. 2 be aware.

On the identical time Google searches for “day buying and selling” have been additionally on the rise, she famous (see charts beneath).

RBC Capital Markets

Calvasina and others acknowledged {that a} mixture of lockdown-related boredom and stimulus checks from the U.S. authorities doubtless performed a job within the uptick in particular person investing curiosity.

The jury is out on whether or not the uptick in retail buying and selling curiosity will endure, stated Ed Clissold, chief U.S. strategist at Ned Davis Analysis Group, in an interview. It’s unclear how a lot of the pickup in retail buying and selling merely displays people throwing more money by way of stimulus checks on the market, he stated.

That form of buying and selling feels extra like playing than investing, he stated, noting that “frothy” market motion tends to fade rapidly away.

However others argued that particular person traders are more likely to stick round.

‘Structural change’

Calvasina stated RBC suspects a “structural change could also be afoot and that retail traders are more likely to stay greater gamers within the U.S. fairness market going ahead.”

In that case, that can require an perspective adjustment by Wall Road professionals, who acquired used to paying little consideration to particular person traders.

In any case, highly effective waves of passive and systematic funding had rendered particular person traders largely irrelevant to analysts cooking up market forecasts, wrote strategists at Société Générale, in a Thursday be aware.

However the market volatility created by the GameStop scenario served as a wake-up name, the analysts stated.

Whereas GameStop and different closely shorted names soared, hedge funds and different traders have been seen liquidating lengthy positions elsewhere, to take earnings and canopy losses, placing strain on equities markets. Main benchmarks ended January on a bitter be aware, with the Dow Jones Industrial Common

DJIA,

S&P 500

SPX,

and Nasdaq Composite

COMP,

logging their largest weekly declines since October.

See: ‘My household gained’t let me go hungry’: Two younger merchants reveal the perils of attempting to surf GameStop’s epic wave

U.S. shares roared again previously week, nonetheless, with the S&P 500 and Nasdaq scoring all-time highs as GameStop tumbled greater than 80%.

Have to Know: GameStop’s meteoric good points have nearly totally disappeared — right here’s recommendation for individuals who didn’t get out in time

The SocGen analysts couched the phenomenon as a part of a broader pattern that has seen particular person traders driving demand for investments that take environmental, social and company governance, or ESG, requirements into consideration.

“Reasonably than criticizing retail traders and their behavioral pattens, it’s higher to fit them into the cash equation,” they wrote. “In any case, it isn’t solely workplace employees who’re locked down at house on snowy days but additionally very energetic day merchants with entry to cheap platforms.”

Cabin fever is hardly the one issue seen driving the renewed curiosity available in the market by particular person traders, whose ranks aren’t made up solely of rapid-fire day merchants.

Leveling the sector

Some particular person traders who beforehand shunned equities would possibly lastly be succumbing to the notion that ultralow yields on bonds and elsewhere depart little various to the inventory market. Equities nonetheless look engaging in the case of dividend or earnings yields, Konstantinos stated.

Furthermore, there’s the leveling of the taking part in area between institutional and particular person traders over the previous few many years. Regulation FD (for “full disclosure’) and different regulatory modifications in addition to the rise of low-fee buying and selling platforms have put particular person traders “on a better footing to institutional traders than at another time in historical past,” he stated.

Certainly, some market watchers have argued that the traditional branding of particular person traders because the “dumb cash” appears more and more misguided, notably after the GameStop episode confirmed supposedly “sensible cash” traders shorting greater than 100% of the corporate’s inventory, leaving them extensive open to a painful brief squeeze.

Calvasina famous that a number of the extra well-known trades pursued by particular person traders over the previous yr — shopping for shares in the course of a recession, shopping for airways and cruise traces final summer time, and implementing brief squeezes this winter — come from a playbook that’s been largely deserted by institutional traders over the previous decade in favor of growth-, momentum- and quality-investing methods.

On that time, extremely shorted names have outperformed the market since the March 23 lows in the case of each small- and large-cap shares, a improvement that sometimes happens after the market has put in a mid-recession low, she famous.

Nonetheless, the frenzy in retail buying and selling that surrounded the brief squeeze on GameStop and a handful of different closely shorted small-cap shares raised a crimson flag to traders looking out for the form of froth that indicators a rally is getting into the form of euphoric part sometimes adopted by a pullback.

Subsequent leg?

Whereas which will show to be the case within the close to time period, some traders contend a sustained pickup in energetic particular person investing curiosity might assist drive the following leg of a bull market.

Particular person traders might proceed to gas curiosity in additional value-oriented, smaller capitalization and better volatility names, Konstantinos stated.

And sustained curiosity in particular person securities might imply extra “dispersion,” or variation in returns between particular person shares and sectors, stated Clissold — a component that was lacking over the previous decade to the ache of energetic fund managers.

Calvasina argued that retail curiosity in particular shares is more likely to ebb and stream, because it has carried out over the previous yr, however in all probability gained’t fade away.

“Except the door closes (i.e. by way of a serious regulatory change), we miss out on why retail investor curiosity in buying and selling particular names will utterly go manner given how elevated money on the sidelines is amongst customers,” she wrote.