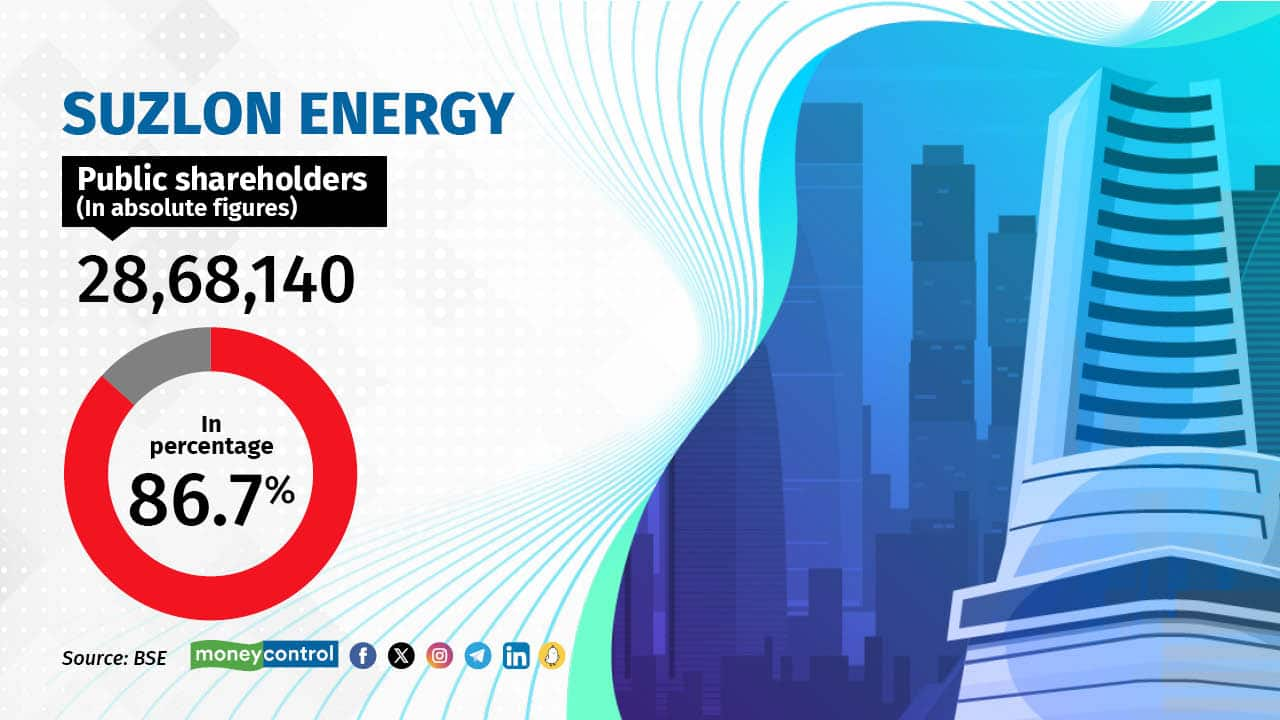

Whereas Nifty firms appear to be a horny proposition for retail buyers, different gamers, with their potential to ship optimistic returns, too, have a spot within the listing of the businesses with largest public shareholder base

Get ₹100 cashback on checking your free Credit score Rating on Moneycontrol. Achieve helpful monetary insights in simply two clicks! Click on right here

<!–

(operate(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “//join.fb.web/en_GB/sdk.js#xfbml=1&model=v2.10”;

fjs.parentNode.insertBefore(js, fjs);

}(doc, ‘script’, ‘facebook-jssdk’)); –>

Adblock take a look at (Why?)

![Yes Bank: Despite Rs 5000-crore fraud at the bank, the private lender has restored investor confidence over the past year, helping the company achieve the highest number of shareholders from the Nifty 500 index. [STOCK PRICE MOVE IN THE LAST 1-2 YEARS] Yes Bank: Despite Rs 5000-crore fraud at the bank, the private lender has restored investor confidence over the past year, helping the company achieve the highest number of shareholders from the Nifty 500 index. [STOCK PRICE MOVE IN THE LAST 1-2 YEARS]](https://images.moneycontrol.com/static-mcnews/2023/11/Yes-Bank.jpg)