Synthetics are the constructing blocks of the choices buying and selling world. Take into account attending to know them, since you may be capable to incorporate them as a part of an total choices buying and selling technique.

Photograph by Dan Saelinger

Key Takeaways

- Perceive the anatomy of artificial choices positions

- Find out about put-call-parity and the best way to apply it to create artificial positions

- Learn about totally different buying and selling situations wherein you would think about using artificial positions

Artificial, pieced collectively, made by people to mimic one thing else. In your closet, synthetics are garments that may be combined and matched to decorate and slenderize. And within the choices world, synthetics are what end result from the blending and matching of calls, places, and shares.

Synthetics: Piece by Piece

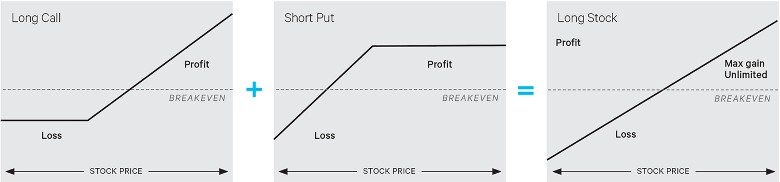

FIGURE 1: ANATOMY OF A SYNTHETIC STOCK POSITION. An extended name plus a brief put = an artificial lengthy inventory. For illustrative functions solely. Previous efficiency doesn’t assure future outcomes.

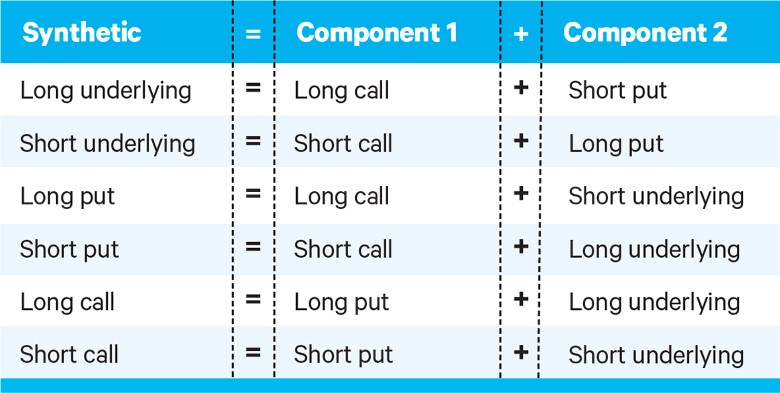

The Large Six

FIGURE 2: THE SIX BASIC SYNTHETICS. These six constructing blocks create six primary synthetics. For illustrative functions solely.

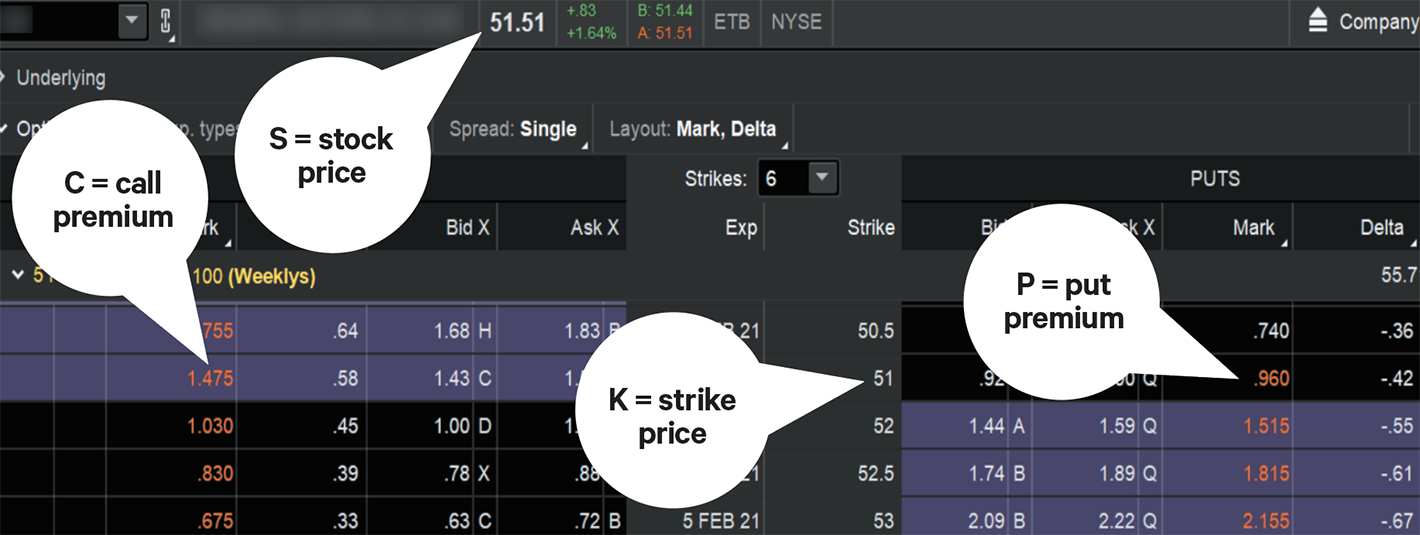

FIGURE 3: USING PUT-CALL PARITY. The 4 parts—inventory worth, name premium, put premium, and strike worth—may be put collectively algebraically to assist with choices pricing. Chart supply: The thinkorswim® platform. For illustrative functions solely. Previous efficiency doesn’t assure future outcomes.

Decorate With Synthetics

You get the thought. There’s a complete wardrobe’s price of methods which can be solely doable when you’ve opened your self as much as the world of synthetics. Take into account attempting one on in paperMoney®. You may discover it matches your technique aims like a pair of spandex shorts.

Don’t Snag That Artificial

You know the way that fab-looking polyester mix will sometimes get caught on a tree department, and subsequent factor , it’s unraveling? Yup. The identical may be stated for choices synthetics. Take into account a couple of potential snags:

- Early train. Commonplace-listed choices contracts are American model, which implies they are often exercised at any time. So in the event you’re brief an ITM possibility as a part of an artificial, it’s doable to get assigned forward of expiration. That’s not essentially a nasty factor. Simply one thing to keep watch over.

- Dividends. Dividends are paid to the proprietor of document as of the ex-dividend date. That’s essential for 2 causes. First, an artificial lengthy inventory place isn’t precise possession of the inventory. Second, generally the proprietor of an ITM name will train early, giving up the remaining time worth of the choice in alternate for a declare on the dividend. In case you’re not snug with the ins and outs of dividend threat, it’s greatest to avoid brief ITM calls round dividend dates.

- Pin threat. ITM choices—even when ITM by one penny—are routinely exercised at expiration. However the proprietor can override that if, for instance, the inventory strikes after the shut. And what if the inventory settles proper on the strike? It’s not a standard prevalence, however it occurs extra typically than you may assume. Simply one other means an artificial is barely totally different from the true factor.

Doug Ashburn isn’t a consultant of TD Ameritrade, Inc. The fabric, views, and opinions expressed on this article are solely these of the creator and might not be reflective of these held by TD Ameritrade, Inc.