The declare settlement ratio for all times insurance coverage barely decreased in 2022-23 to 98.45%, in comparison with 98.64% in 2021-22, in keeping with the Insurance coverage Regulatory and Improvement Authority of India (IRDAI) annual report. This lower is mirrored in each the private and non-private sectors, with Life Insurance coverage Company (LIC) settling at 98.52% (down from 98.84%) and personal counterparts marking 98.02% (a slight drop from 98.11%).

Stay TV

Loading…

The medical insurance sector, nonetheless, revealed a unique narrative.

The ratio is decided by dividing the whole variety of claims permitted by the variety of claims acquired by the insurance coverage firm.

For instance, if the life insurance coverage supplier acquired a complete of 100 dying claims and settled 90 of them, then the declare settlement ratio is 90%.

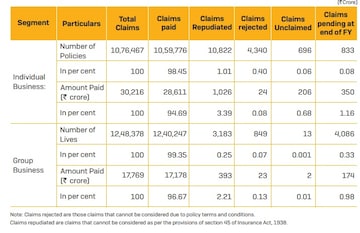

Precise dying claims of life insurers

(Supply: IRDAI annual report)

The declare settlement ratio additionally portrays the underwriting processes that the corporate follows.

This is a have a look at quarterly declare settlement ratios of some life non-public insurance coverage suppliers:

| Life Insurance coverage Firm | Declare Settlement Ratio Q2- FY2024 | Declare Settlement Ratio Q1- FY2024 |

| ICICI Prudential Life Insurance coverage | 98.14% | 97.9% |

| TATA AIA Life Insurance coverage | 90.55% | 77.3% |

| HDFC Life | 96.62% | 96.7% |

| Bajaj Allianz Life Insurance coverage | 91.79% | 93.5% |

| Max Life Insurance coverage | 95.90% | 86.3% |

| SBI Life Insurance coverage | 95.67% | 95.8% |

(Supply: Public disclosure out there on firm’s web site)

(Edited by : Shoma Bhattacharjee)

First Revealed: Jan 1, 2024 6:34 PM IST

Adblock take a look at (Why?)