The fund supervisor who wager towards U.S. mortgages earlier than the 2008 disaster and acknowledged the deep worth in GameStop bought out his stake totally earlier than the wild rally within the videogames retailer. That, and Warren Buffett’s newest strikes, have been among the many revelations of Tuesday night time’s wave of 13-F filings on the Securities and Trade Fee. Extra on that in a second.

GameStop is now the poster baby for what are referred to as “stonks,” the seemingly one-way-only ascent in usually hopeless equities. Vincent Deluard, director of world macro at StoneX, expects the insanity to proceed. “On the one hand, the market is obscenely overpriced and I’m sure that shares will ship destructive actual returns within the subsequent decade. However, the underlying drivers of the bubble are unlikely to go away within the subsequent months: easy-money and monetary repression are right here to remain,” he says.

A contemporary $1,400 verify is prone to make it into the arms of Individuals by April, special-purpose acquisition corporations must make purchases with all of the firepower they’ve gathered, private-equity and venture-capital corporations have practically $2 trillion in dry powder, and plenty of paused company inventory buyback applications will proceed, he says.

“Within the U.S., fiscal and financial authorities have inflated a large stonk bubble. When all is claimed and completed, Europeans could have financial savings beneath their mattresses, Asians could have much more productive property, and Individuals could have humorous memes,” Deluard says.

Inflation, which buyers are more and more betting on, is the plain reply to the issues the U.S. faces. “Inflation will act as a ‘debt jubilee,’ will restore the equilibrium between the asset-owning previous and pauperized youth, and can permit a stealth default on unfunded liabilities that the boomer era awarded itself,” he writes.

What is going to profit from a interval of inflation? Deluard has some fascinating concepts. Latin American currencies already mirror a decade of weak point and a really poor response to the COVID-19 pandemic. On a commodity export mannequin, Brazil’s actual

BRLUSD,

is 37% undervalued. The Chilean peso

CLPUSD,

is 20% beneath its March excessive, whereas its important commodity export, copper

HG00,

is 15% above its 2018 excessive.

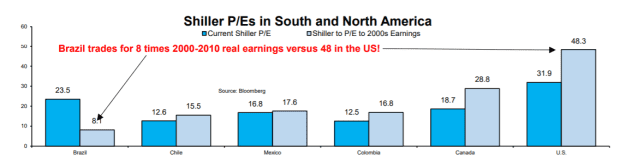

Deluard says it makes extra sense to match Latin American inventory costs now to the 2000-2010 decade. “The 2010s was a misplaced decade for Latin America: commodity costs cratered and the U.S. greenback strengthened, a horrible combo for USD-indebted commodity exporters. If, as I imagine, the 2020s will resemble the 2000s (weak USD, reflation, outperformance of EM, worth, and inflation-sensitive sectors), the denominator of the Shiller P/E should be shifted by a decade,” he says.

After performing his Shiller shift, MSCI Brazil

907600,

trades on simply 8 instances earnings, in contrast with 48 instances earnings for the U.S.

The identical evaluation finds Spain

972400,

additionally is reasonable, at 10.5 instances earnings. Spain can be getting funding from the Subsequent Technology European Union plan, might even see inward migration as work-from-anywhere takes maintain, and its prime banks Santander and BBVA have giant Latin American holdings. “Simply as COVID has accelerated the migration from Wall Road to Florida, Spain, with its low cost housing, vigorous tradition, and unbelievable seashores, will appeal to loads of highly-paid professionals from Northern Europe and the U.Ok. (Brexit will even assist),” he says.

The excitement

Retail gross sales surged 5.3% in January, a acquire far forward of the 1% enhance seen in an economist ballot. “The outstanding surge in gross sales is concentrated in big-ticket gadgets, notably furnishings (+12.0%) and electronics (14.7%), suggesting that a few of the newest spherical of one-time stimulus funds discovered its approach to retailers fairly rapidly. However different retailers did nicely too, with web gross sales up 11.0%, clothes up 5.0%, and common merchandise up 5.5%. The distinction with December’s weak point, when the surge in Covid instances and the accompanying tightening of restrictions hit spending, is stark,” stated Ian Shepherdson, chief economist at Pantheon Macroeconomics, in a be aware to purchasers.

Producer costs additionally rose by greater than forecast, growing 1.3%. Industrial manufacturing additionally rose greater than forecast in January.

Some 2.9 million Texans didn’t have energy as of Wednesday morning, in response to the PowerOutage web site. Tesla

TSLA,

Chief Government Elon Musk vented his frustration on Twitter

TWTR,

and former presidential candidate Beto O’Rourke stated “we’re nearing a failed state in Texas.”

Warren Buffett’s Berkshire Hathaway

BRK.B,

trimmed its place in iPhone maker Apple

AAPL,

— nonetheless by far its largest holding — whereas taking new stakes in telecom Verizon Communications

VZ,

and oil producer Chevron

CVX,

his newest 13-F submitting with the Securities and Trade Fee exhibits. Verizon and Chevron each rose in premarket commerce, whereas Apple fell.

Scion Asset Administration — run by Michael Burry, the fund supervisor popularized in “The Large Brief” for betting towards mortgages forward of the U.S. mortgage disaster — bought out of GameStop

GME,

earlier than its meteoric transfer, its 13-F exhibits. He purchased name choices in banking large Citigroup

C,

pharmaceutical Pfizer

PFE,

and meals maker Kraft Heinz.

KHC,

Different filings confirmed Point72 Asset Administration, the hedge fund run by New York Mets proprietor Steven A. Cohen, shopping for a put possibility on the SPDR S&P Biotech ETF

XBI,

and Invoice Ackman’s Pershing Sq. lowering its stake in home-improvement chain Lowe’s

LOW,

and restaurant operator Restaurant Manufacturers

QSR,

Hashish agency Sundial Growers

SNDL,

filed a combined shelf permitting it to promote $1 billion of inventory or warrants.

The markets

After the large spike on Tuesday within the yield on the 10-year Treasury

TMUBMUSD10Y,

— essentially the most since Pfizer first stated in November 2020 its COVID-19 vaccine was efficient — the benchmark U.S. debt obligation was yielding 1.29%.

U.S. inventory futures

ES00,

have been a contact decrease. Gold futures

GC00,

have been buying and selling beneath $1,800 an oz, whereas bitcoin futures

BTC.1,

have been buying and selling above $51,000

The chart

Through Scott Grannis of the Calafia Seashore Pundit, right here’s the ratio of copper-to-gold costs, in contrast with the yield on the 10-year Treasury. “This chart means that rates of interest are solely simply starting to show larger. Copper and practically each different commodity are up fairly strongly since final March; crude oil costs have practically tripled over the identical interval,” he says.

Random reads

In all probability used for royal burial rites, a 5,000-year-old brewery was discovered within the historical Egyptian metropolis of Abydos.

Tiny wasps are being deployed at a historic mansion to cease moths damaging treasures.

Mount Etna erupted once more, closing the close by Catania airport.

Have to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model can be despatched out at about 7:30 a.m. Japanese.

Need extra for the day forward? Join The Barron’s Each day, a morning briefing for buyers, together with unique commentary from Barron’s and MarketWatch writers.