New KYC guidelines for mutual fund traders: Are you a mutual fund investor? Chances are you’ll have to replace your KYC as soon as extra! New KYC guidelines ranging from April 1st imply tens of millions may have to replace their info or danger not having the ability to make transactions.

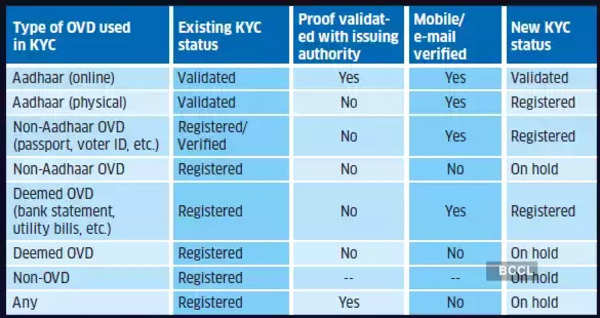

In keeping with ET, many traders are discovering out that their present KYC standing is now not legitimate. The validity will depend on the id or tackle proof offered throughout registration.The regulator now accepts a narrower vary of formally legitimate paperwork (OVD) like Aadhaar, passport, and voter ID, excluding beforehand accepted paperwork corresponding to financial institution statements and utility payments.

In case your KYC was completed with non-OVD paperwork or in case your e mail/cell weren’t verified, your standing can be put ‘on maintain’. In such instances, you will not be capable of make transactions, together with for current SIPs or new investments, or redeem cash.

These traders have to bear a brand new KYC course of by submitting any of the formally legitimate paperwork to a mutual fund home, KYC Registration Company (KRA), or mutual fund platform.

Amol Joshi, Founding father of PlanRupee Funding Companies, stated that every one traders with KYCs on maintain should full the method once more. As soon as their KYC standing is up to date to ‘validated’, they will resume transactions.

ALSO READ | Why it might be the fitting time to spend money on gilt funds; verify prime performers

Additionally, many different traders maintain a ‘KYC registered’ standing. These traders accomplished their preliminary KYC with both bodily Aadhaar or a non-Aadhaar OVD (which could not be validated by the issuing authority), however their cell numbers and e mail IDs have been validated by the KRA. Whereas they will transact with fund homes they have already got accounts with, newer fund homes stay inaccessible to them.

To entry all fund homes, these traders have to acquire a ‘KYC validated’ standing for his or her mutual fund investments. This requires submitting formally legitimate paperwork as proof of id/tackle. They will request this modification via the KRA or mutual fund portal. If completed via anyone fund home, the up to date KYC will apply to all mutual fund investments linked to the PAN.

KYC challenges for mutual fund traders

Buyers are discovering that KYC points are extra advanced than anticipated. Even when that they had beforehand submitted up to date formally legitimate paperwork (OVDs), their KYC might nonetheless be thought of invalid. Mahesh Mirpuri, a mutual fund distributor, notes that many KRAs wrestle to validate KYCs even when traders present Aadhaar or passport as id proof. For those who use an OVD apart from Aadhaar, you may have to redo KYC every time you make investments with a brand new fund home.

Moreover, completely different KYC Registration Companies have various lists of acceptable formally legitimate paperwork, which impacts the validation course of.

For instance, whereas KFintech accepts a driving license as an OVD, CAMS doesn’t. Trying a re-KYC or KYC modification might be fairly difficult. Distributors and monetary advisers spotlight quite a few points with redoing KYC. Firstly, traders whose PAN and Aadhaar should not linked can not replace their KYC; linking the 2 is important earlier than any modifications are permitted. Secondly, some KYC modification requests are rejected as a result of minor discrepancies like variations in higher and decrease case utilization in names or addresses. This typically ends in a number of rounds of KYC modifications for validation.

Even when conducting the method on-line, traders could encounter obstacles. Amol Joshi remarks, “Even the web KYC is damaged.” He cites a case the place a shopper’s on-line KYC modification request was rejected as a result of ‘unmasked’ Aadhaar and an ineligible tackle. Joshi questions why KYRAs cannot masks Aadhaar of their data as an alternative of maintaining the KYC on maintain. Senior residents and DIY traders, missing middleman help, could face challenges in finding out KYC points. Mahesh Mirpuri finds the present KYC guidelines peculiar, questioning the relevance of e mail IDs in KYC. He wonders why Aadhaar-based KYC does not acknowledge a financial institution assertion as id proof, regardless of Aadhaar accepting it.

ALSO READ | RBI Floating Price Financial savings Bonds at over 8%: Is it the fitting time to take a position? Key options to know

Current KYC adjustments and persevering with challenges for mutual fund traders

Ranging from April 1, your KYC standing may need turn out to be invalid relying on the kind of proof you submitted, amongst different elements.

Distinguished figures within the mutual fund (MF) trade have voiced frustration concerning the chaos surrounding KYC. Nilesh Shah, MD of Kotak Mutual Fund, expressed his exasperation after receiving an e mail from a KRA placing his KYC ‘on maintain’. He shared his sentiments on his X (previously often known as Twitter) social media deal with, stating, “After three many years available in the market and filling each kind for KYC over time, together with biometric verification, my coronary heart pains to obtain such an e mail. What number of occasions does the KYC have to be completed? Clearly, our KRA companies/Registrar can do a greater job.”

Radhika Gupta, MD and CEO of Edelweiss Mutual Fund, additionally shared on X, “KYC is an issue crying to be fastened as of yesterday. In a world the place we have now Aadhaar and a few of the finest digital public infrastructure on the planet, it additionally appears very doable.”

MF traders’ KYC troubles persist. After April thirtieth, KRAs are set to start verifying inconsistencies between KYCs and PANs of unitholders. Any discrepancies within the identify or date of delivery between the PAN and MF folio might result in points. Joshi cautions, stating that we should always anticipate extra KYC-related challenges when MFs validate the identify and date of delivery in folios in opposition to the offered PAN.

Regardless of the KYC course of’s flaws, traders ought to prioritize resolving it shortly to forestall their funds from being frozen when wanted.

Adblock take a look at (Why?)