There’s a motive why pre-existing illnesses like hypertension are sometimes dubbed because the silent killer. The signs go unnoticed at instances or get traced when it would already be too late. A number one explanation for heart problems mortality, hypertension is a rising concern amongst all age teams however severely impacts the aged.

In any case, one in each three senior residents in India is recognized with hypertension, reveals information by the Union Ministry of Household and Well being Welfare. The danger has solely gotten exacerbated within the aftermath of the pandemic.

It’s, subsequently, important to take each doable measure to defend oneself towards the hazards of this situation. Step one to preparedness is having a complete medical health insurance coverage that provides enough protection for a broad spectrum of medical bills and healthcare providers.

In actual fact, traditionally hypertension protection got here with a ready interval however now, plans cowl pre-existing illnesses from day 1, i.e., with none ready interval.

What are pre-existing illnesses?

The insurance coverage corporations classify an sickness or medical situation as a pre-existing illness (PED) if a person has had it as much as 48 months earlier than buying the coverage. Thus, if a senior citizen or somebody already impacted by excessive or extreme BP is trying to purchase a brand new medical health insurance plan, they may sometimes fall underneath this class for the insurer.

In such instances, most well being plans used to come back with a ready interval, i.e., the timeline, which ranges from 2-4 years, till which the policyholder can’t file any claims. The interval might, nevertheless, differ relying on age, illness, and the insurance coverage coverage purchased.

Now, let’s take a look at the options to contemplate when deciding on a plan that covers hypertension-

Excessive sum insured

Hypertension is a persistent situation requiring routine medicines, diagnostic exams, and physician consultations, together with particular way of life adjustments. This recurring outlay will inevitably have a financial influence, particularly if you’re a senior citizen. Therefore, when deciding on the sum insured on your medical health insurance coverage, consider these bills and select the next sum insured, as it would present holistic financial safety.

In actual fact, some plans additionally supply as much as a 100% wellness profit or low cost on premiums on the time of renewal for sustaining a wholesome way of life. Some plans now even let you carry forward the unconsumed sum insured as much as 10 instances the bottom cowl.

No ready interval

Search for new-age plans that cowl PEDs or pre-existing illnesses proper from day 1. A whole lot of related dangers include a situation like hypertension. There’s a danger of stroke, incapacity or different cardiovascular illnesses, so medical emergencies usually come unannounced.

If there’s a ready interval concerned, likelihood is that your medical health insurance won’t come to your rescue if you want it probably the most. Some plans even supply a rider that allows you to remove the ready interval for a bit of additional premium. So, select a plan that may present fast entry to high quality healthcare for hypertension-related points.

No co-payments or capping

Plans for senior residents earlier got here with quite a lot of limits like room hire capping or co-payment clauses or sub-limits. All of those limit one’s protection indirectly or the opposite. Whereas room hire capping limits the type of room you will get, the co-payment clause requires you to shell out a sure share of the hospital invoice from your individual pocket. So, go for a plan that comes with minimal restrictions and permits you extra flexibility.

Significance of declaring PED to the insurer

As a basic rule, when buying a medical health insurance plan, you need to all the time be clear with the insurer about any present well being situations. Withholding medical historical past can have extreme penalties, corresponding to denial or rejection of claims, and, in some instances, even coverage cancellation.

At a time of medical misery, the very last thing you would wish is to get your declare rejected and pay a hefty quantity out of your individual financial savings. Subsequently, all the time declare situations, corresponding to hypertension, and ask your insurer to share the choice of well being plans that cowl PED accordingly.

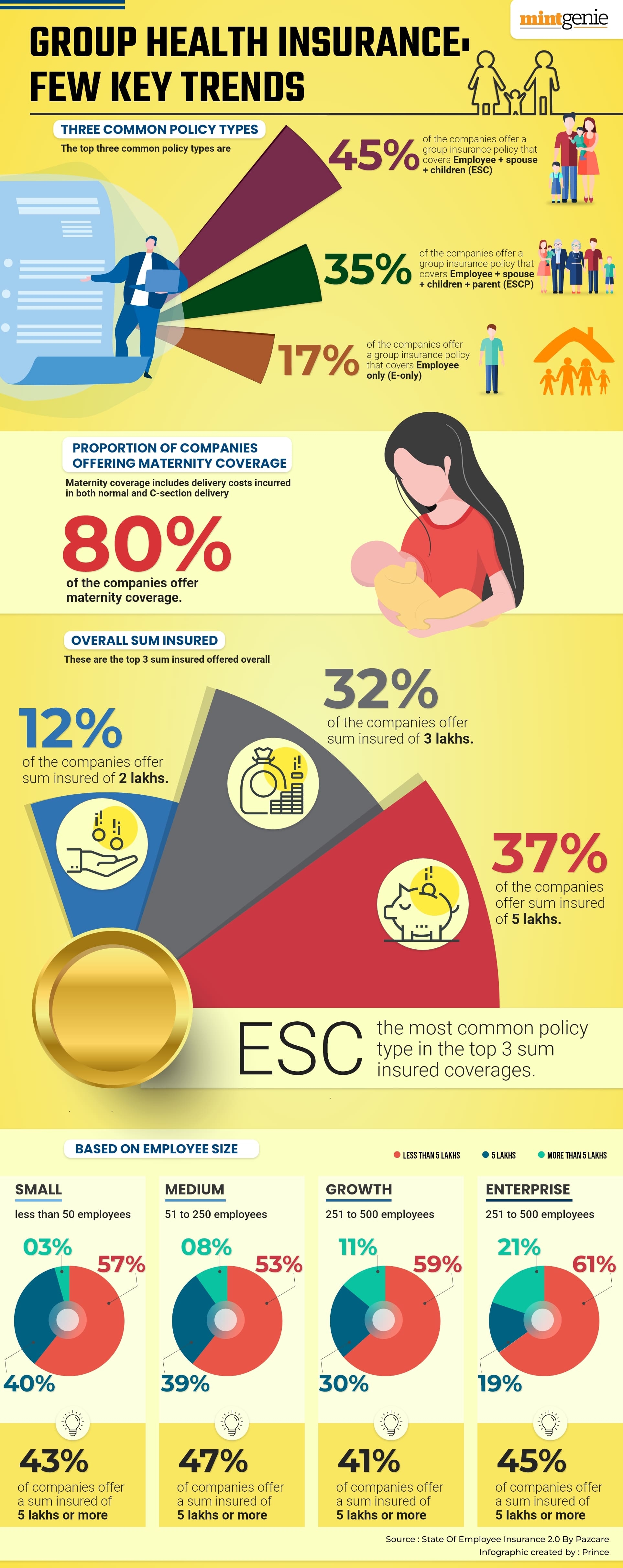

Group medical health insurance: Few key traits

First Printed: 11 Jun 2023, 10:49 AM IST

Matters to observe

Adblock take a look at (Why?)