![NZD/USD Elliott Wave technical analysis [Video] – FXStreet NZD/USD Elliott Wave technical analysis [Video] – FXStreet](https://www.investallign.com/wp-content/uploads/2024/03/J6_coFbogxhRI9iM864NL_liGXvsQp2AupsKei7z0cNNfDvGUmWUy20nuUhkREQyrpY4bEeIBucs0-w300-rw.webp)

NZD/USD Elliott Wave technical evaluation

Perform: Counter Pattern

Mode: Corrective

Construction: Blue wave C

Place: black wave 2

Route subsequent increased levels: Black wave 3

Particulars: Blue wave C of two is in play and searching close to to finish.After that black wave 3 will begin. Wave Cancel invalid stage: 0.57750

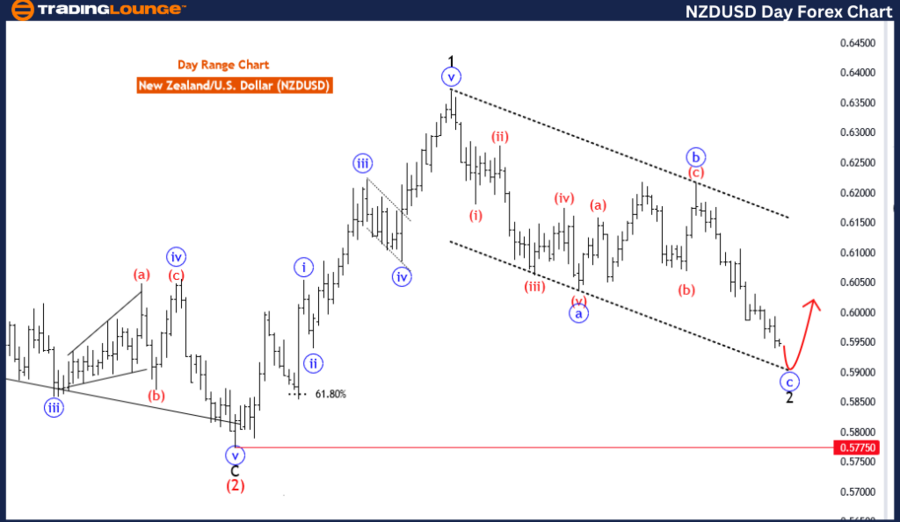

The NZDUSD Elliott Wave Evaluation for the day chart offers insights into potential value actions of the New Zealand Greenback in opposition to the US Greenback, utilizing Elliott Wave ideas for technical evaluation.

Recognized as a “Counter Pattern” state of affairs, the evaluation signifies that the present market path opposes the prevailing pattern, suggesting a possible reversal or corrective motion in opposition to the broader value pattern. This implies that merchants might anticipate a brief deviation from the first pattern earlier than a possible resumption or continuation.

Described as “Corrective” in mode, the evaluation means that the present market motion reveals traits of corrective value motion, indicating a brief pause or retracement inside the broader market pattern. This means that merchants might count on a corrective section earlier than the potential continuation of the first pattern.

The “STRUCTURE” is recognized as “blue wave C,” offering readability on the present wave depend inside the Elliott Wave cycle. This aids merchants in understanding the continued corrective sample and its relation to the broader Elliott Wave construction.

Positioned as “black wave 2,” the evaluation highlights the present wave depend inside the corrective section, indicating the particular section of the correction inside the broader Elliott Wave cycle. This implies that the market is at present present process a correction earlier than doubtlessly resuming its upward motion.

The “DIRECTION NEXT HIGHER DEGREES” is said as “black wave 3,” suggesting the anticipated path for the next higher-degree wave. This means that when the present corrective section completes, the market might resume its upward motion inside the broader Elliott Wave construction.

Within the “DETAILS” part, it’s famous that “blue wave C of two is in play and searching close to to finish. After that black wave 3 will begin.” This means that the present corrective section is ongoing, with the expectation of completion earlier than a possible resumption of the broader pattern.

In abstract, the NZDUSD Elliott Wave Evaluation for the day chart provides merchants precious insights into potential corrective actions, vital ranges to observe, and the anticipated path inside the broader Elliott Wave construction, aiding in knowledgeable buying and selling selections.

NZD/USD day chart

NZD/USD Elliott Wave technical evaluation

Perform: Counter Pattern.

Mode: Impulsive as C.

Construction: crimson wave 5.

Place: Blue wave C.

Route subsequent increased levels: Black wave 3.

Particulars: Crimson wave 4 of C accomplished , now crimson wave 5 of C is in play. Wave Cancel invalid stage: 0.57750

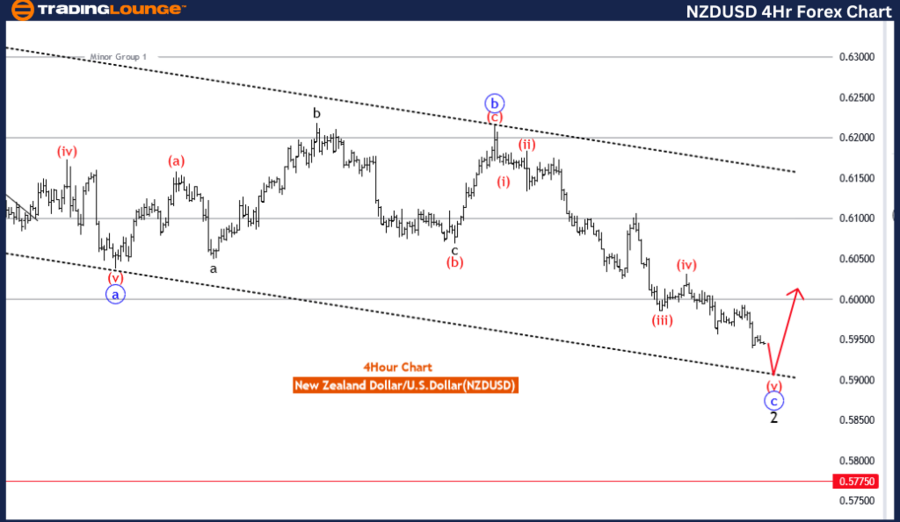

The NZDUSD Elliott Wave Evaluation for the 4-hour chart provides insights into the potential value actions of the New Zealand Greenback in opposition to the US Greenback, using Elliott Wave ideas for technical evaluation.

Recognized as a “Counter Pattern” state of affairs, the evaluation means that the present market path opposes the prevailing pattern, indicating a possible reversal or corrective motion in opposition to the broader value pattern. This means that merchants might anticipate a brief deviation from the major pattern earlier than a possible resumption or continuation.

Described as “Impulsive as C” in mode, the evaluation signifies that the present market motion reveals traits of impulsive value motion, suggesting robust and decisive actions within the path of the counter pattern transfer.

The “STRUCTURE” is recognized as “crimson wave 5,” offering readability on the present wave depend inside the Elliott Wave cycle. This aids merchants in understanding the continued counter pattern transfer and its relation to the broader Elliott Wave sample.

Positioned as “blue wave C,” the evaluation highlights the present wave depend inside the counter pattern transfer, indicating the particular section of the corrective sample inside the broader Elliott Wave cycle.

The “DIRECTION NEXT HIGHER DEGREES” is said as “black wave 3,” suggesting the anticipated path for the next higher-degree wave. This means that when the present counter pattern transfer completes, the market might resume its upward motion inside the broader Elliott Wave construction.

Within the “DETAILS” part, it’s famous that “crimson wave 4 of C accomplished, now crimson wave 5 of C is in play.” This means that the present counter pattern transfer is ongoing, with the expectation of additional draw back motion earlier than a possible reversal or continuation of the broader pattern.

In abstract, the NZDUSD Elliott Wave Evaluation for the 4-hour chart provides merchants precious insights into potential counter pattern actions, corrective phases, and significant ranges to observe inside the broader Elliott Wave construction, aiding in knowledgeable buying and selling selections.

NZD/USD four-hour chart

NZD/USD Elliott Wave technical evaluation [Video]

[embedded content]

Adblock take a look at (Why?)