gradyreese/iStock by way of Getty Photographs

The inventory market’s conventional worth discovery worth has been battered to demise by irrational gamers at establishments in addition to amongst retail gamers. It has turn out to be an unpleasant reality of life in at the moment’s investing situation. We thought we might had our fill of madness over the Robinhood Markets, Inc. (HOOD) GameStop Corp. (GME) nuttiness, however we did not. Case after case since then has confirmed past comprehension of rational gamers {that a} knee-jerk mentality has damaged a gap within the dike of endurance and customary sense and has flooded the panorama of investor minds.

The shares of PENN Leisure, Inc. (NASDAQ:PENN) come to thoughts

It isn’t merely the scared retail rabbits amongst us with zero endurance. It additionally inhibits the precincts of hedge funds the place one would assume extra educated minds preside over purchase, promote or maintain choices. The colossal mispricing of PENN Leisure, Inc. inventory, together with my very own expectations, bears examination.

No matter many optimistic numbers in Penn’s latest 1Q23 earnings launch, the inventory, which started to erode late final 12 months, has tanked one other 10%. I’ve been a robust fan of PENN inventory, as I’ve identified over many SA articles. Actually, in my final name on March 20, I put a worth goal (“PT”) of $50 on the inventory. The Penn worth at writing is $29. My take, evidently manner mistaken.

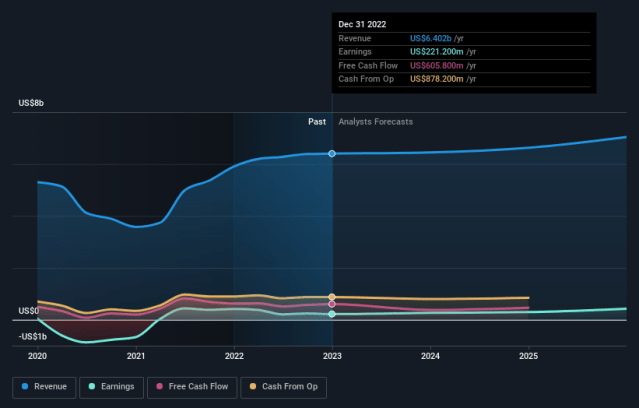

WSW

Above: Ahead flat situation logical in a manner however doesn’t sq. with the upside the sector will see assuming there is no such thing as a deep recession forward.

It was based mostly on my inside-the-industry view. Having been a part of prime administration within the {industry} for many years, having identified lots of the key individuals who run Penn, and having an outlook about restoration of the U.S. regional on line casino area, I noticed actual worth ignored by Mr. Market. That evoked much more enthusiasm in my thoughts for the inventory. I even thought-about elevating my steering above $50 earlier than I settled for that PT.

So, the query that settled into my thoughts was what headwinds did I not see, that others did? Maybe I ought to have recalculated the valuation based mostly on information I had bypassed. I made a case that actually was a loser from day one. Apologies.

Readers might take into account my general batting common regardless of this three-strike, big-time whiff. I am not right here with a wheelbarrow of excuses. A nasty name is a part of the sport. However, this is my batting common in keeping with Tip Ranks:

Success charge: 60.69%

Common return: 22.90%.

World rank amongst monetary bloggers/analysts: 424 out of 24,866.

Not like some baseball commenters, I am not making an attempt to make use of the “damage listing” as an excuse for a whiff on Penn. Tip Ranks scores aren’t universally seen as a gold normal. But they’re, generally, suppliers of fairly good weightings over time. Your name as as to if you deem them relative or not. The purpose is, a whiff is a whiff, interval.

I am not working and hiding from what clearly was a strikeout on Penn. I personal it, not everybody does. So, let’s transfer forward and study what I’ll have missed, or equally so, what Mr. Market continues to be lacking, within the valuation of PENN shares on the present screaming purchase worth.

Looming recession? Positive, add to that the scary prospect that begins to seem like the dug-in positions on the debt deal between the Home and the clueless denizens of the Oval Workplace are nearing the cliff’s edge. Additionally, bake within the notion that the early post-covid pent up regional on line casino demand might have shot its load and income beneficial properties are cooling down. Penn is the largest participant within the area with no big-time Vegas presence.

Penn’s 43 properties are sprinkled in what’s the greatest geographical footprint in its class – minus Las Vegas. Its 1Q23 outcomes, if something, ought to have appeared optimistic each to holders and potential buyers. Income was up 7percenty/y to $1.67b. Adjusted EBITDA $483m a 23.5% y/y decline largely as a result of a rebalanced income feed, as will increase from Northeast phase have been offset by declines within the Southern properties.

The web income acquire shift was a operate of upper tax charges in Northeastern properties vs. flatter efficiency in decrease gaming tax areas of the South. That, plus a litigation settlement, have been the principal culprits in lower-than-consensus efficiency. Total analyst’s response to the 1Q23 efficiency had a little bit of a bearish tone, which clearly might need triggered some selloff sentiment that has but to recuperate.

Then there are the humorous joker, however lifeless critical, impacts of incidents that ship lightning bolts of worry in company board rooms, fears which have little or no affect within the grand scheme of what might trigger large buyer departures.

Penn had one such incident early this month. A number of its Barstool Sports activities division thought rapping of lyrics that contained clearly objectionable phrases was humorous. The response was immediate and he was fired. However Barstool’s PR crew assertion was a logical, take us for what we’re, warts and all. Penn Founder Dave Portnoy, in fact, didn’t approve the miscue, however held that Barstool’s enterprise was what it was – its viewers will get it.

The brouhaha clearly contributed to a lot detrimental sentiment that continued to hit the inventory and nonetheless does. And that’s indeniable fact {that a} scared rabbit mentality knee-jerks firms nowadays – unrelated to its actual world outcomes. The rapping incident revealed a case of unhealthy judgment, with out query. However for it to contribute to be a big-time bearish outlook on the shares exceeds to the sting of madness.

Penn knew when it paid $501m for Barstool that its head man in Dave Portnoy was each a media genius with out parallel in his discipline, in addition to a periodic free cannon. He has 20 months to go on his contract, and there may be some feeling across the enterprise that he may determine to take a hike and spend his time reducing these great coupons on his cash-out $100m.

Barstool

The day the rapper fiasco got here public, Penn shares traded at $30.35. The aftermath took PENN inventory down $5.15 inside 24 hours. That reveals how weak market valuations could be in a world of knee-jerkism. No person approves of unhealthy style – let’s stipulate that. It was an expression of tone-deafness by the Barstool host. However what is way extra disturbing to critical holders of Penn shares is the biting of nails and tremors of company PR division that may shake free a $5 hit to a inventory on what quantities to a single few phrases of unhealthy style.

This is a guess: Guess what number of Penn on line casino patrons and sports activities bettors expressed their distaste on the comment and cancelled their loyalty playing cards? Out of twenty-two,000, my guess no person. My guess, too, that nearly nobody cared a method or one other how Penn reacted to the tone-deaf rapper. By the way in which, Penn reported that in 1Q23, the corporate added 350,000 new loyalty members. My guess is that course of will proceed to develop as a result of Penn’s income progress has two engines.

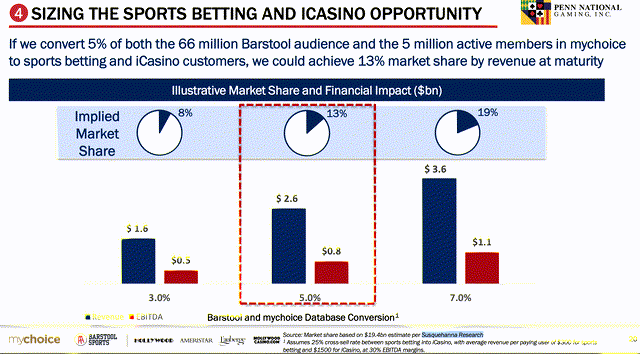

First, the post-covid return of valued, older demos within the slot enterprise. Second, within the quickly rising contribution of millennials to the database by the Barstool Sports activities portal. The slick free cannon type of Barstool Sports activities is a part of its DNA. It’s a part of why its sports activities betting enterprise has reached close to $275m for the quarter, exhibiting a small loss compared to different third tier friends. Barstool Sports activities is positioned to go worthwhile in our view by 3Q23.

For my part, 1Q23 outcomes weren’t so draconian as to evoke the diploma of bearish outlook on PENN shares, actually not sufficient to disappoint analysts to the diploma that it might have.

Nevertheless, administration is guiding revenues for the 12 months at $6.81b with a impartial EBITDAR, guiding at $1.875b to $2b. Penn has repurchased 50m shares at a mean worth of $30.36.

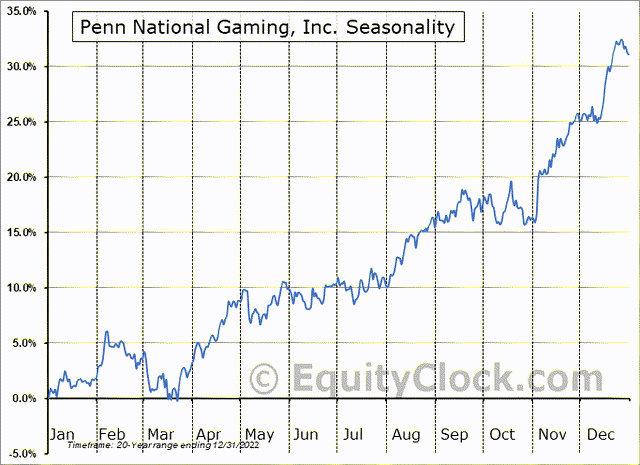

Above: Traditionally, income ranges are simply starting to maneuver into peak season in most of Penn’s geographic footprint areas.

The hedgies might have performed a task as a meaty buy-hold-sell technique over a brief time period. It’s a part of the DNA of many.

The composition of holders of Penn shares point out that 8 establishments maintain 52% of the excellent, amongst them numerous hedge funds. So, what we’ve seen right here may have gathered bearish steam from hedgies who appeared on the inventory seeing worth however starting to run for the exits abruptly when their estimates of earnings progress – like mine– proved mistaken.

Of Penn’s institutional holders, 11% are hedge funds. And intermediate spherical journey methods are widespread. The shares have had a long-time margin of security in my opinion as a result of its stability sheet has been a plus.

Brief curiosity at the moment sits at 15,197,460 common shares, the very best it has been in about one 12 months. I imagine it is a reflection of technique greater than pure disappointment in 1Q23 earnings outcomes. The shares had traded at a excessive of $37 attained final August. Brief curiosity then was 8,600,000 shares. So, brief positions on the inventory have since doubled similtaneously general working outcomes have proven sturdy post-covid restoration. And add to {that a} rising rosier image in digital each with Barstool Sports activities in addition to Penn’s acquisition of Ontario-based sports activities betting web site theScore.com.

We now have checked out discounted money circulate (“DCF”) worth in keeping with a number of formulae we seek the advice of within the means of arriving at our personal to sensitivity check our estimates going ahead.

DCF worth: $48.88 per share, indicating PENN is undervalued by 76%.

Alpha Unfold signifies an intrinsic worth of $59.85, simply above our March name PT of $50.

Our personal formulation concludes the worth on the similar $50 we guided again March, which falls in between the 2 famous above by different websites.

Conclusion

I believe what we see and I apparently didn’t see, or at the very least take into account, was the likelihood that PENN Leisure, Inc. shares represented what hedge funders thought-about a reasonably protected hedged brief place within the inventory of Penn, with a superb margin of security. Retail buyers who you’d assume have seen the bull case for the inventory based mostly on real-world fundamentals would have moved into the inventory – not on my say-so – however based mostly on 8 information in regards to the firm:

- The most important, most strong nationwide gaming operator within the area with no Vegas footprint per se.

- A on line casino operator with a sensible technique utilizing sports activities betting to develop its on line casino information base amongst youthful demos.

- The clear return in massive numbers of foundational older demo slot gamers throughout its complete 43 property portfolio.

- A strong stability sheet.

- Nearing profitability as a third-tier sports activities betting operator.

- An progressive touch-free service coverage on the property.

- A savvy administration that has confirmed it may well generate a robust working margin over time. Money available: $1.31b Lengthy-term debt: $11.66b. (That is clearly a consider a few of the bearish outlook, however it doesn’t counsel something near an issue, long-term.)

- Present ratio: 1.38 falls inside a snug zone to earn what we imagine is an efficient margin of security for the inventory going ahead to the stability of this 12 months and subsequent.

I am positive there are PENN components that may be cited to offset these eight positives as there are in all shares. I am not simply being cussed by not dropping my steering as a result of I imagine in PENN Leisure, Inc. and its future. So what I see is identical set of macro headwind threats dealing with your entire market if a debt deal fails, or extra particularly, if we get a big-time recession, as some imagine.

Adblock check (Why?)