Persevering with its bull run for the fourth straight month, the benchmark index Sensex hit its vital psychological mark of 67,000 for the primary time on July 18, 2023. It then prolonged positive aspects for 3 consecutive days to hit its newest peak of 67,619.17 on July 20.

On this newest rally, Sensex has surged already over 22 % until date from its 52-week low of ₹55,158, hit on July 27, 2022. This has been pushed by unfettered FPI (overseas portfolio investor) flows into Indian equities, enhancing macroeconomic circumstances, rising development and the tip of India’s price hike cycle, which began in January final yr. Nonetheless, now valuations appear to have change into a priority for the buyers.

“India is the most important recipient of FPI flows YTD amongst rising markets. The sale in China continues. In July, until the twenty first FPIs have invested ₹43,804 crore in India. This determine consists of funding by way of inventory exchanges, major markets and bulk offers. FPIs proceed to put money into financials, cars, capital items, realty and FMCG. FPI shopping for in these sectors has contributed vastly to the surge in costs of shares in these sectors and the Sensex and Nifty scaling report highs. The priority, nonetheless, is the rising valuations. At excessive valuations some adverse triggers can result in sharp correction,” mentioned VK Vijayakumar, Chief Funding Strategist at Geojit Monetary Providers.

Going ahead, market valuations could be determined primarily based on the end result of earnings development and the expansion visibility throughout sectors, acknowledged specialists.

In a current notice, Sriram BKR, Senior Funding Strategist at Geojit Monetary Providers has shared some key highlights of Sensex’s journey to the vital 67,000 ranges. Let’s have a look.

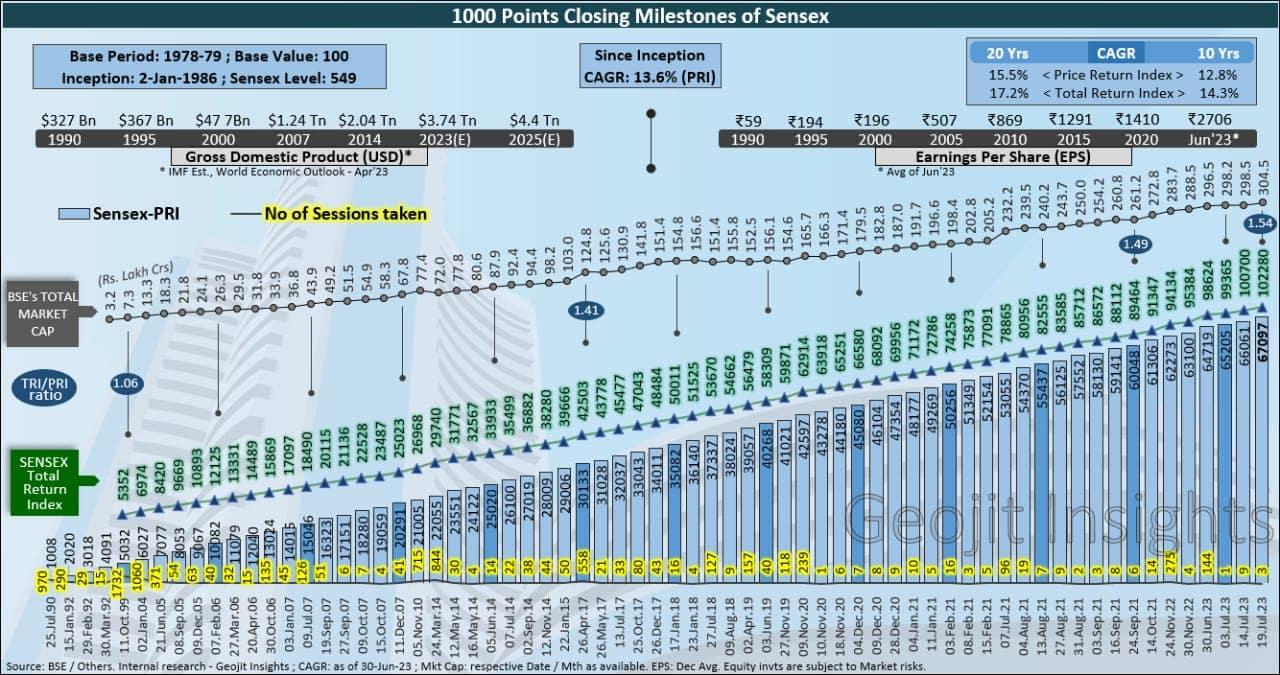

- Whereas the rally between 63,000 to 64,000 milestone took about 144 classes or 7.1 months, the newest 3,000 factors to 67,000 occurred in simply 13 classes.

- The newest 7,000-point surge from 60,000 happened in 450 classes or 22.1 months.

- It took 31.3 years for the Index to climb to the primary 30,000 factors milestone in April 2017. The following 30,000 factors took solely 4.4 years.

- BSE’s whole market capitalization crossed the outstanding 300 lakh crore mark earlier this month.

- BSE’s whole market capitalization jumped by over ₹6 lakh crore in simply 3 classes, throughout which Sensex moved from 66,000 to 67,000 ranges.

- Sensex whole return index, stood 1.54 instances the worth index, which was 1.06 instances in 1999 and 1.41 instances when Sensex crossed 30000.

- Sensex common EPS computed by the trailing 12M PE as of June 23, stood at round ₹2,706, a ten % development YoY, 29 % CAGR over 2 years and 20 % CAGR in 3 years.

- By way of funding development, ₹1,00,000 invested in June-2003 could be price round ₹24 lakhs as of 30-Jun-23 in whole return index phrases.

supply: Geojit

First Revealed: 26 Jul 2023, 08:37 AM IST

Matters to observe

Adblock check (Why?)