Small cap mutual fund schemes have rewarded the affected person and disciplined investor. These funds have given a 21 % CAGR (compounded annual progress charge) over the past 10 years, outperforming mid cap funds (19 %) and enormous cap (14 %) funds. Nonetheless, small cap funds usually are not for everybody. Excessive-risk profile buyers with a time horizon of greater than 10 years can think about investing within the prime performing schemes within the small cap class. Nippon India Small Cap Fund (NSF) is one such. It has delivered comparatively higher risk-adjusted returns since its launch.

Small cap mutual fund schemes have rewarded the affected person and disciplined investor. These funds have given a 21 % CAGR (compounded annual progress charge) over the past 10 years, outperforming mid cap funds (19 %) and enormous cap (14 %) funds. Nonetheless, small cap funds usually are not for everybody. Excessive-risk profile buyers with a time horizon of greater than 10 years can think about investing within the prime performing schemes within the small cap class. Nippon India Small Cap Fund (NSF) is one such. It has delivered comparatively higher risk-adjusted returns since its launch.

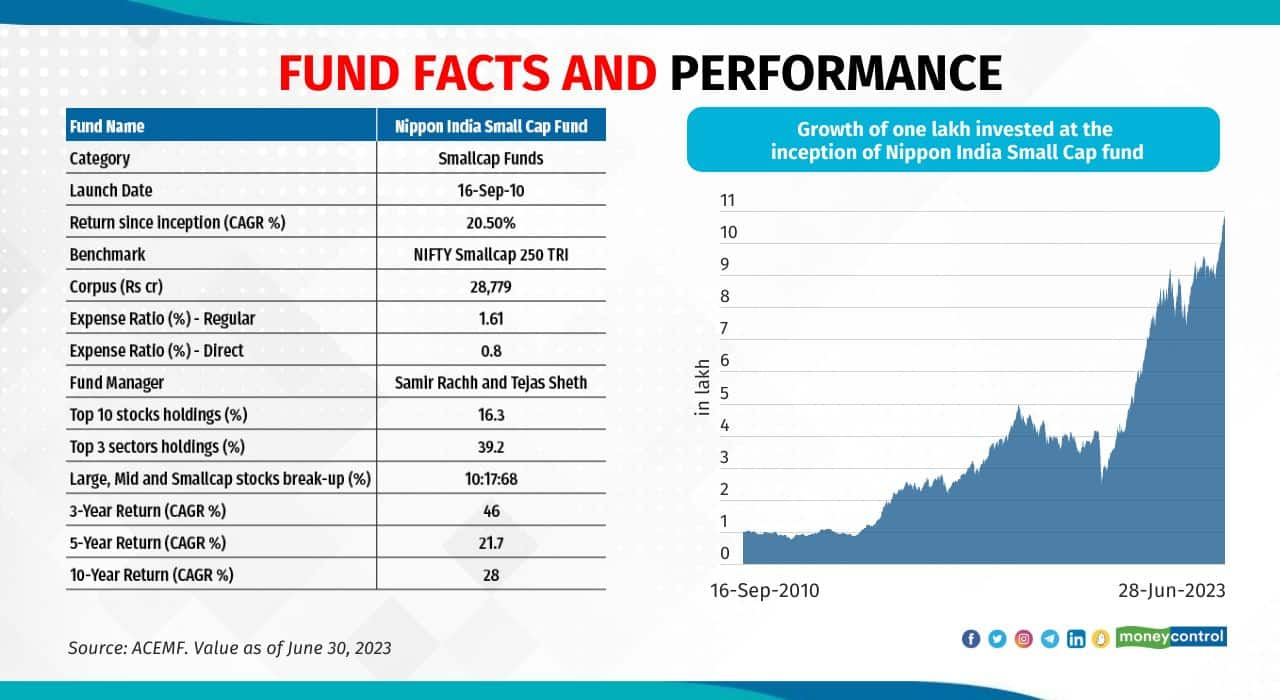

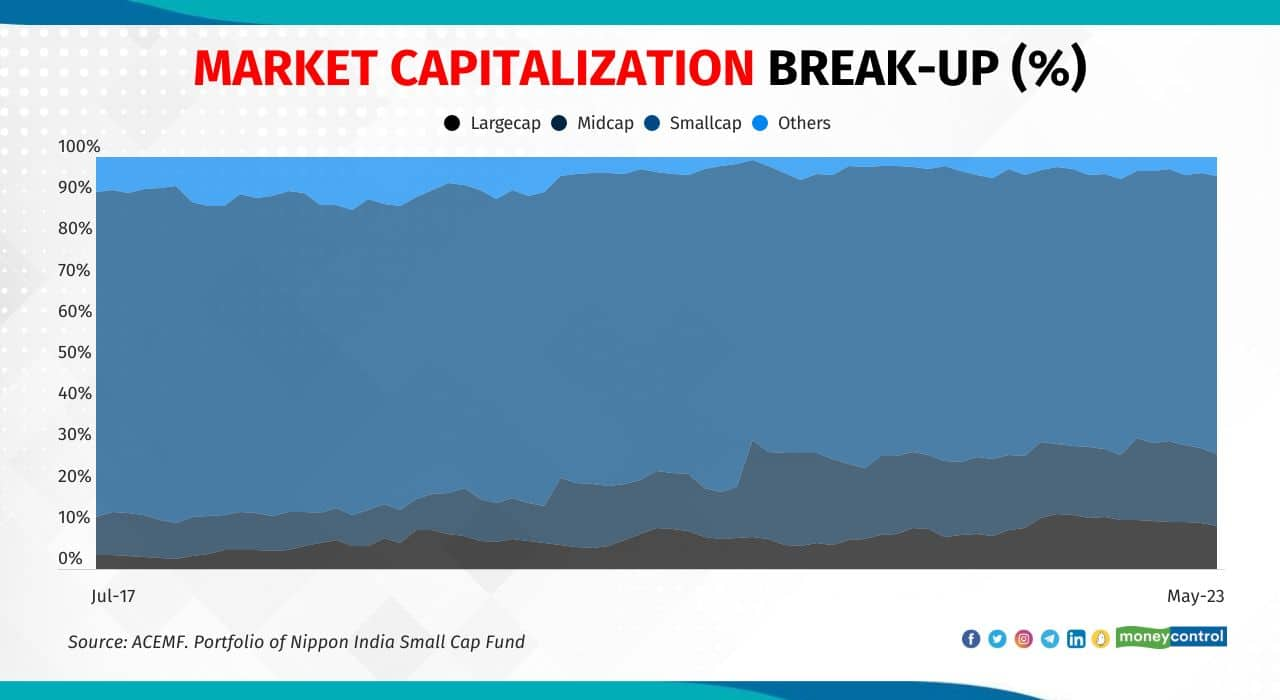

Profile: Nippon India Small Cap Fund (NSF) invests not less than 65 % of its corpus in corporations which might be ranked inside 250 by way of market capitalisation.

Profile: Nippon India Small Cap Fund (NSF) invests not less than 65 % of its corpus in corporations which might be ranked inside 250 by way of market capitalisation.

Fund managers: Samir Rachh (since 2017) and Tejas Sheth

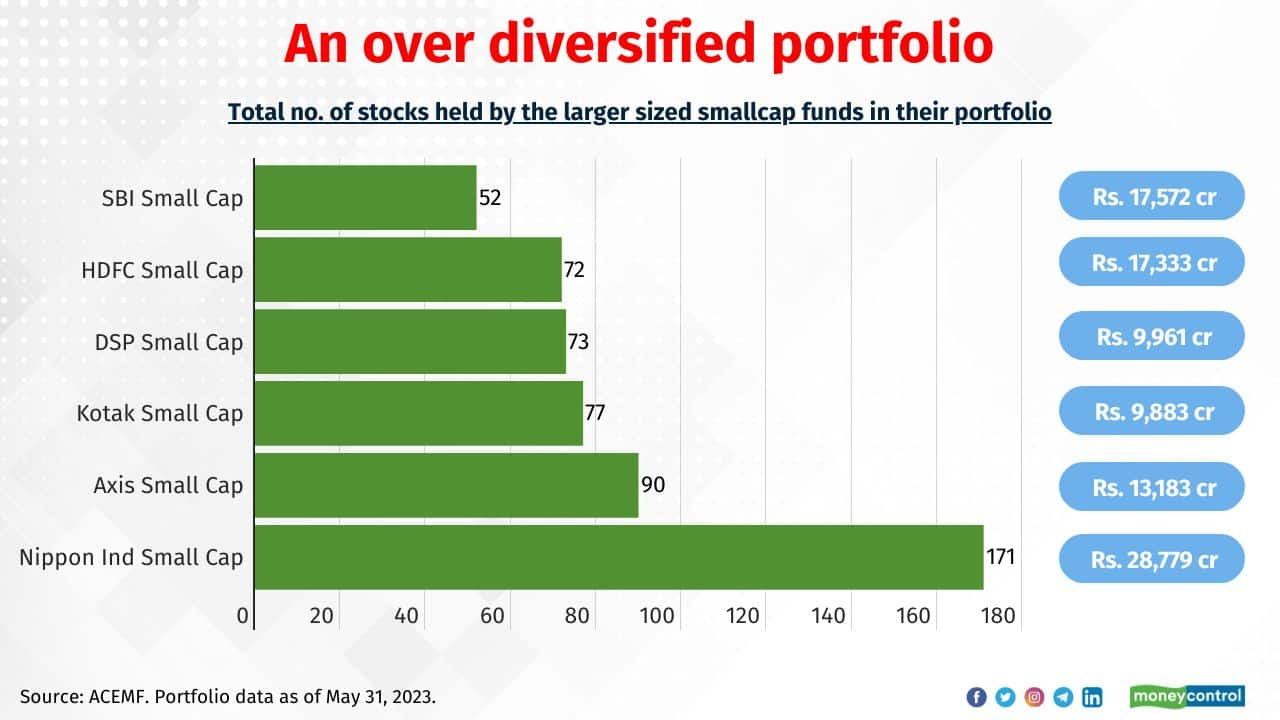

Dimension: Rs 28,779 crore; largest fund within the small cap class

Appropriate for high-risk buyers

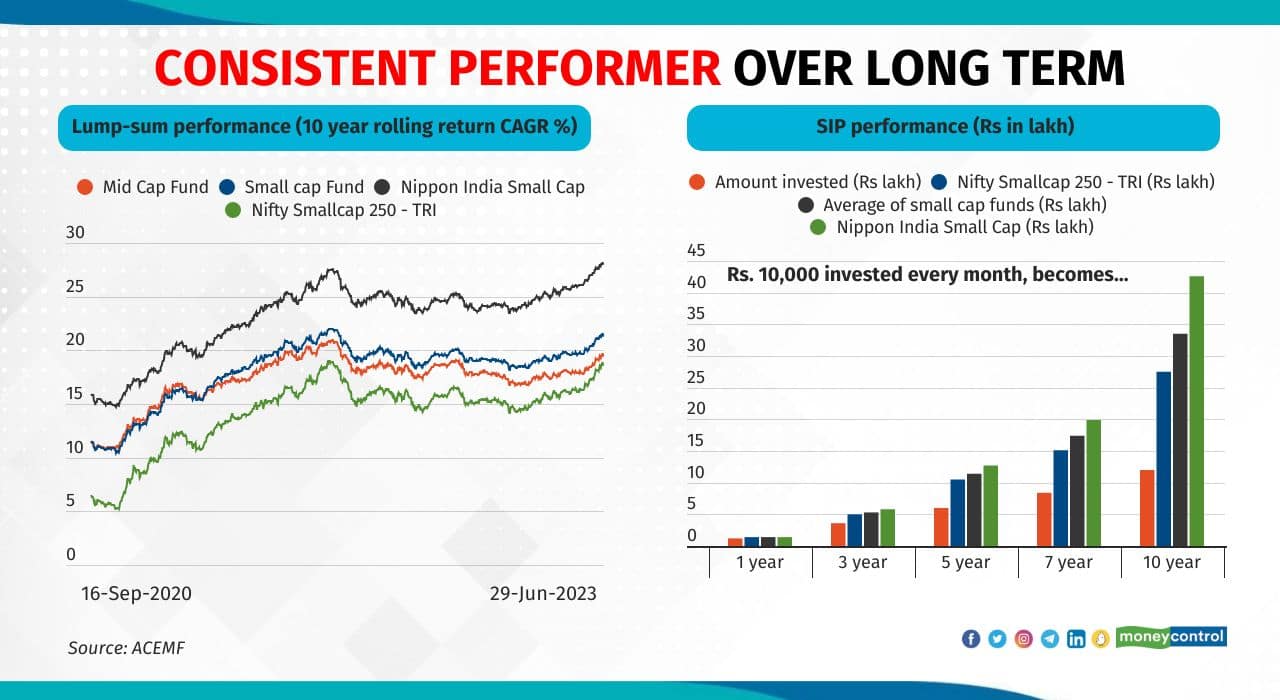

Small cap shares are extra delicate to macroeconomic modifications that result in extra volatility within the brief run. However prudent inventory choice throughout the small cap universe and identification of shares within the early levels of progress have helped top-performing schemes like NSF ship higher risk-adjusted returns over the long run. Efficiency as measured by 10-year rolling returns over the previous 13 years (since inception of the scheme) reveals that NSF delivered a compound annual progress charge (CAGR) of 23 %, whereas the Nifty Smallcap 250 TRI (Whole Returns Index) delivered 14 %.

Small cap shares are extra delicate to macroeconomic modifications that result in extra volatility within the brief run. However prudent inventory choice throughout the small cap universe and identification of shares within the early levels of progress have helped top-performing schemes like NSF ship higher risk-adjusted returns over the long run. Efficiency as measured by 10-year rolling returns over the previous 13 years (since inception of the scheme) reveals that NSF delivered a compound annual progress charge (CAGR) of 23 %, whereas the Nifty Smallcap 250 TRI (Whole Returns Index) delivered 14 %.

NSF has been constant in delivering superior returns. It was principally both a Quintile 1 or Quintile 2 performer throughout the class up to now. Prudent inventory choice and strong execution technique by the fund managers have helped to ship higher returns over time.

NSF has been constant in delivering superior returns. It was principally both a Quintile 1 or Quintile 2 performer throughout the class up to now. Prudent inventory choice and strong execution technique by the fund managers have helped to ship higher returns over time.

Additionally see: Smallcap MFs outshine: Prime schemes surge as much as 12 instances in 10 years

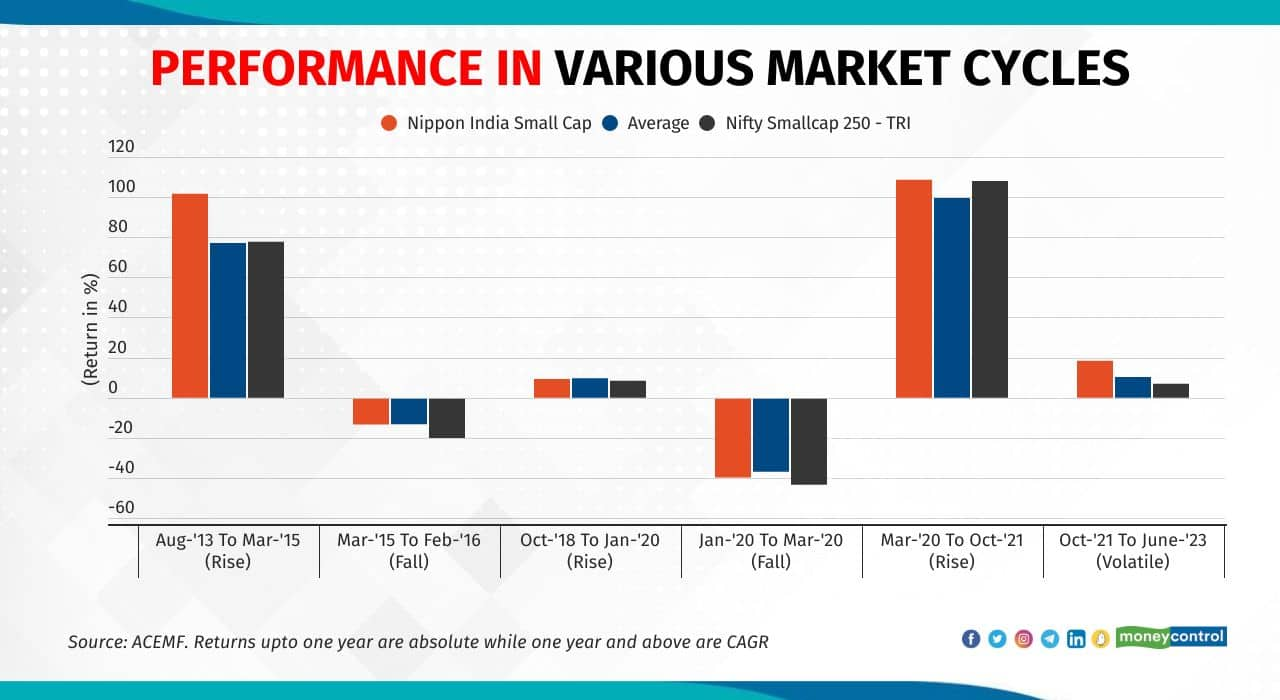

NSF has carried out comparatively effectively throughout cycles. NSF has been one of many prime three performers within the present unstable market the place shares throughout segments traded excessive. The hole in valuations between small caps and enormous caps and between small and mid caps has widened over the past 12 to 18 months. Fund Supervisor Samir Rachh says the revenue restoration of smaller corporations has been as robust as that of huge corporations, with the breadth of Indian earnings being at their greatest in over a decade. “The revenue pool which the small cap universe provides is exclusive and maybe excessive rising. Additional, the steadiness sheets and governance requirements are at par” he provides.

NSF has carried out comparatively effectively throughout cycles. NSF has been one of many prime three performers within the present unstable market the place shares throughout segments traded excessive. The hole in valuations between small caps and enormous caps and between small and mid caps has widened over the past 12 to 18 months. Fund Supervisor Samir Rachh says the revenue restoration of smaller corporations has been as robust as that of huge corporations, with the breadth of Indian earnings being at their greatest in over a decade. “The revenue pool which the small cap universe provides is exclusive and maybe excessive rising. Additional, the steadiness sheets and governance requirements are at par” he provides.

Responding as to if that is the suitable time to spend money on small cap funds, Ravi Kumar T V, Founder, Gaining Floor Funding Providers, says that on the power of a greater progress atmosphere, first rate earnings from the robust outcomes proven by the manufacturing and consumption sectors and a rise in family spending owing to greater per capita revenue, buyers can spend money on the small cap class for long-term progress potential.

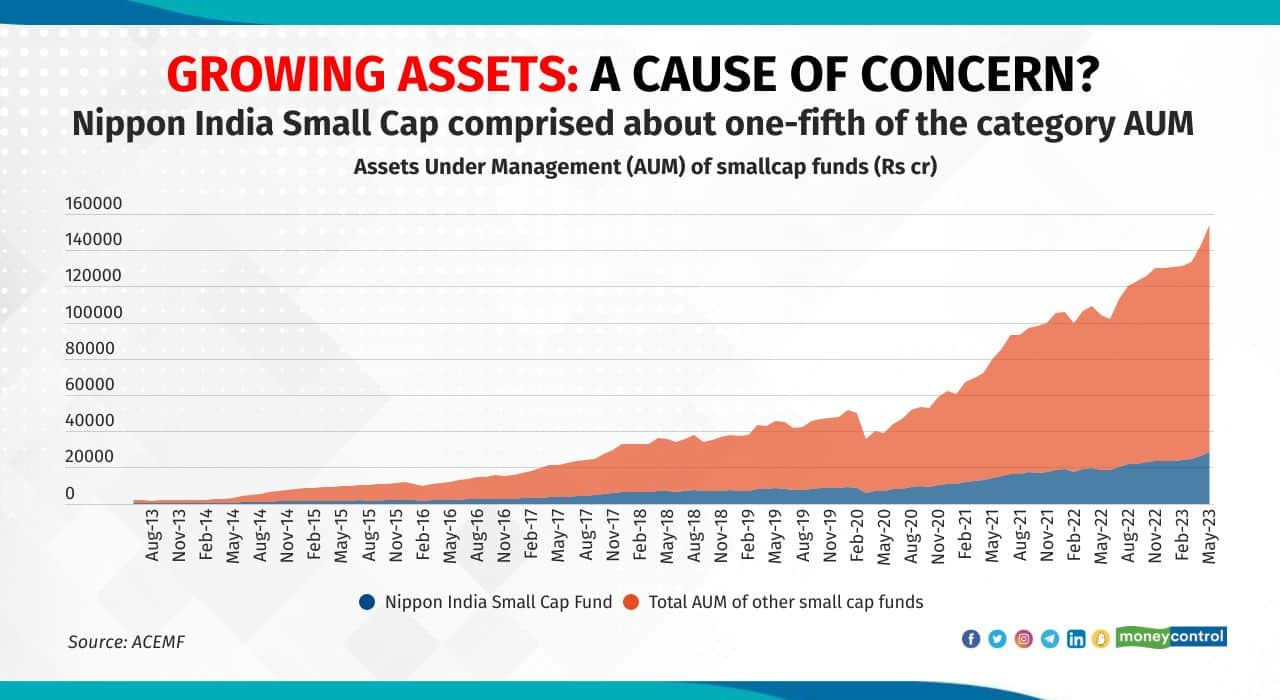

With a corpus measurement of Rs 28,779 crore, NSF is the biggest fund within the small cap class and accounts for about one-fifth of the small cap class belongings below administration. Bigger asset measurement has been one of many deterrent elements for small cap funds. It’s difficult for these funds to churn their portfolio to maintain up with market dynamics, resulting in sharp short-term underperformance.

With a corpus measurement of Rs 28,779 crore, NSF is the biggest fund within the small cap class and accounts for about one-fifth of the small cap class belongings below administration. Bigger asset measurement has been one of many deterrent elements for small cap funds. It’s difficult for these funds to churn their portfolio to maintain up with market dynamics, resulting in sharp short-term underperformance.

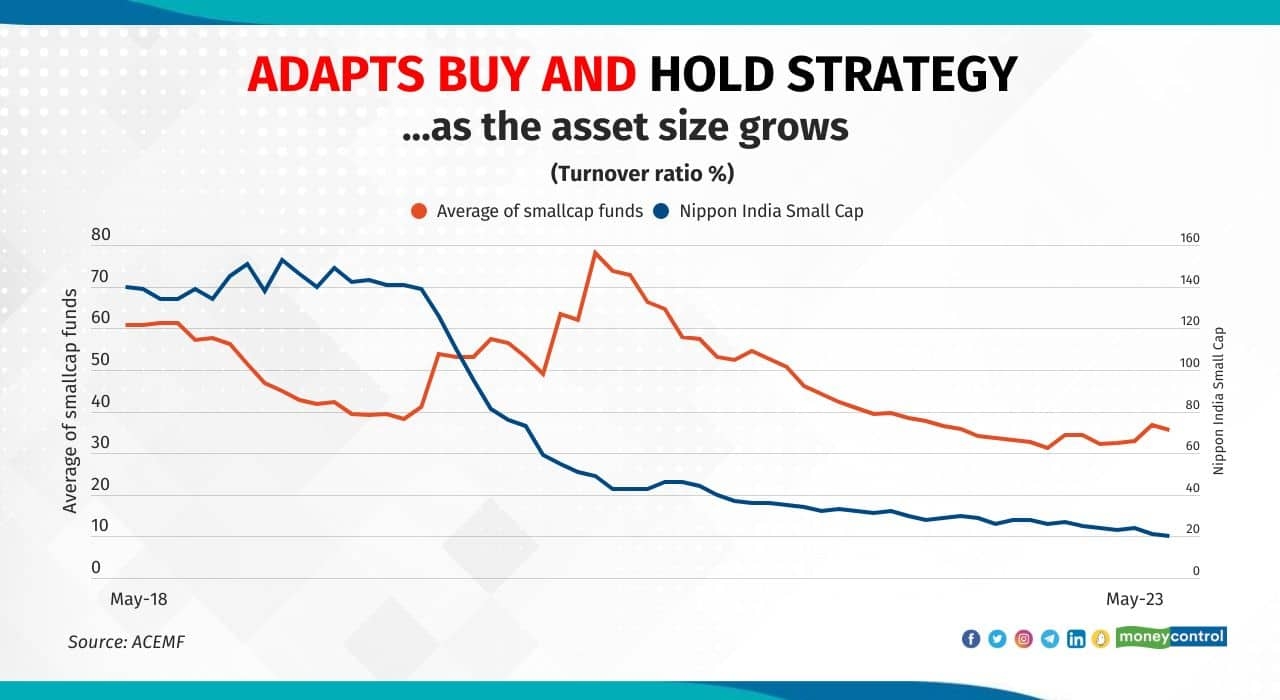

Rachh explains, “main challenges within the small cap class is that liquidity tends to be poor and influence prices greater. You can’t churn the portfolio like different fairness classes do. One of the simplest ways within the small cap house is long-term investing and diversification. Since we wish to affiliate with an organization over the long run, we concentrate on the standard of promoters and good companies. Coming into on the proper value additionally issues”.

Learn right here: 12 new midcap shares that PMS fund managers picked these days. Do you personal any?

As of Might 2023, NSF has an over diversified portfolio, holding 171 fairness shares, of which 137 are small cap shares. Rachh says, “The important thing to producing alpha is to have the ability to constantly carry winners into the highest 25 shares”. As per the newest information, about 34 % of the belongings have been invested within the prime 25 shares holdings.

As of Might 2023, NSF has an over diversified portfolio, holding 171 fairness shares, of which 137 are small cap shares. Rachh says, “The important thing to producing alpha is to have the ability to constantly carry winners into the highest 25 shares”. As per the newest information, about 34 % of the belongings have been invested within the prime 25 shares holdings.

A caveat to taking bigger positions in small caps is that getting in is straightforward however getting out, difficult. Additionally, the likelihood of going mistaken is greater in small caps in comparison with giant caps. Rachh explains that like largecaps one can not exit at will from small cap shares on account of liquidity points. Subsequently, one should be very cautious of what one is shopping for, ensuring to decide on good corporations that won’t must be bought or these that may actually have patrons once they have to be bought.

Therefore, buyers in NSF ought to be ready for short-term underperformance when markets are down.

During the last three years, NSF has not traded a lot and follows a purchase and maintain technique. That is mirrored in its turnover ratio, which was simply 20 % (as of Might 2023), in opposition to the 34 % common of the class.

During the last three years, NSF has not traded a lot and follows a purchase and maintain technique. That is mirrored in its turnover ratio, which was simply 20 % (as of Might 2023), in opposition to the 34 % common of the class.

Additionally see: Cautious of market highs, these large-caps exit MF portfolio

NSF additionally invests 10-12 % in giant cap corporations not just for liquidity but in addition for taking publicity in some sectors that aren’t obtainable within the small cap house. It retains 18-20 % within the midcap house.

NSF additionally invests 10-12 % in giant cap corporations not just for liquidity but in addition for taking publicity in some sectors that aren’t obtainable within the small cap house. It retains 18-20 % within the midcap house.

Additionally learn: Motilal Oswal Nifty Microcap 250 Index Fund NFO: Take a look at these favourite microcap shares of lively MFs, PMSes & AIFs

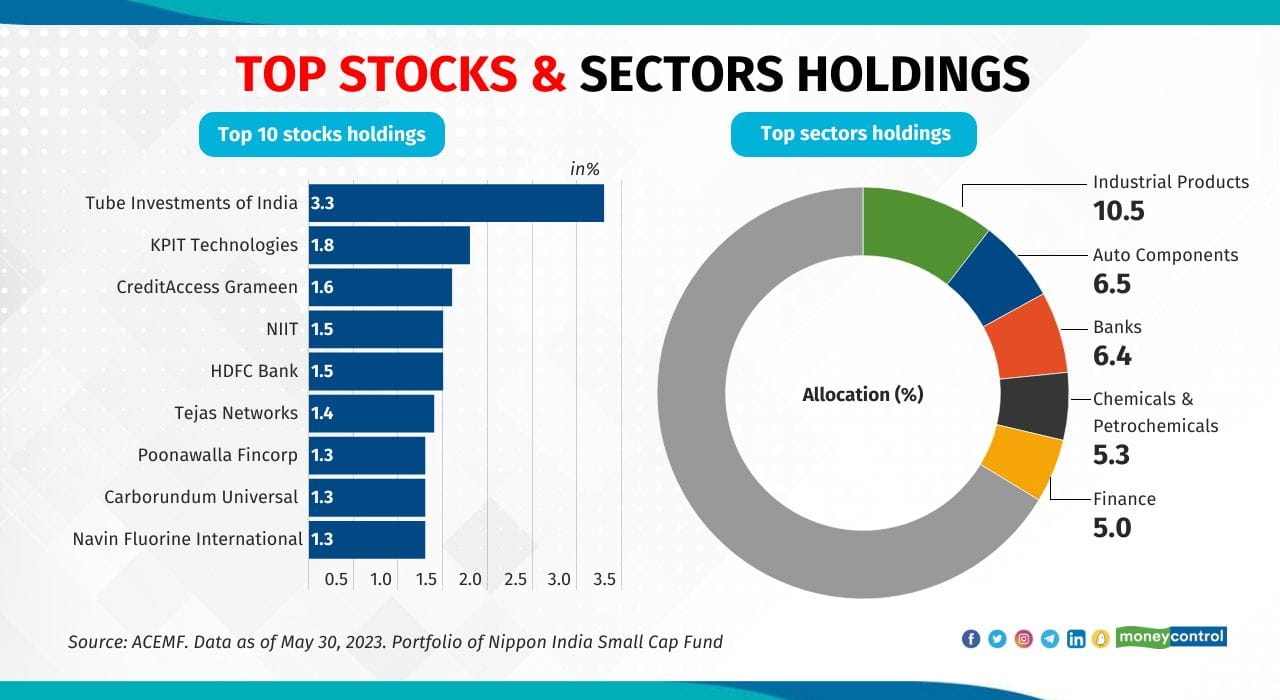

Prudent inventory choice has helped NSF. Lengthy-term holdings comparable to Tube Investments of India, Deepak Nitrite and Navin Fluorine Worldwide turned multi-baggers and rewarded the scheme. Its latest additions embrace Krishna Institute of Medical Sciences, Gateway Distriparks and Angel One.

Prudent inventory choice has helped NSF. Lengthy-term holdings comparable to Tube Investments of India, Deepak Nitrite and Navin Fluorine Worldwide turned multi-baggers and rewarded the scheme. Its latest additions embrace Krishna Institute of Medical Sciences, Gateway Distriparks and Angel One.

NSF could be a part of your core portfolio with a time horizon of 10 years and extra. Investing in a staggered method is advisable at this juncture.

NSF could be a part of your core portfolio with a time horizon of 10 years and extra. Investing in a staggered method is advisable at this juncture.

Additionally learn: Over 1,200% returns in 2 years, however not over but: MF nonetheless maintain these multibagger smallcap shares

Adblock take a look at (Why?)