Tax planning is the evaluation and association of an individual’s monetary scenario to maximise tax breaks and reduce tax liabilities in a authorized and an environment friendly method.

Tax guidelines may be difficult, however taking a while to know and use them on your profit can change how a lot you find yourself paying (or getting again) if you file on tax day.

Listed here are some key tax planning and tax technique ideas to grasp earlier than you make your subsequent cash transfer.

Observe your funds

A NerdWallet account is the neatest approach to monitor your financial savings, bank cards, and investments collectively in a single place.

1. Tax planning begins with understanding your tax bracket

You possibly can’t actually plan for the long run in case you don’t know the place you might be in the present day. So the primary tax planning tip is to determine what federal tax bracket you’re in.

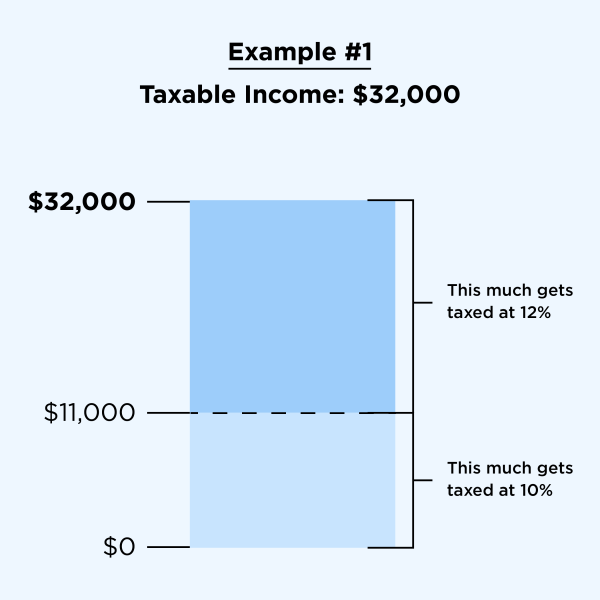

The US has a progressive tax system. Meaning individuals with greater taxable incomes are topic to greater tax charges, whereas individuals with decrease taxable incomes are topic to decrease tax charges. There are seven federal revenue tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Irrespective of which bracket you’re in, you most likely gained’t pay that price in your total revenue. There are two causes:

-

You get to subtract tax deductions to find out your taxable revenue (that’s why your taxable revenue normally isn’t the identical as your wage or whole revenue).

-

You don’t simply multiply your tax bracket by your taxable revenue. As an alternative, the federal government divides your taxable revenue into chunks after which taxes every chunk on the corresponding price.

Instance: Let’s say you’re a single filer with $32,000 in taxable revenue. That places you within the 12% tax bracket for the 2023 tax 12 months (taxes filed in 2024). However do you pay 12% on all $32,000? No. Really, you pay solely 10% on the primary $11,000; you pay 12% on the remainder.

2. The distinction between tax deductions and tax credit

Tax deductions and tax credit could also be the perfect a part of making ready your tax return. Each cut back your tax invoice however in very other ways. Figuring out the distinction can create some very efficient tax methods that cut back your tax invoice.

-

Tax deductions are particular bills you’ve incurred you can subtract out of your taxable revenue. They cut back how a lot of your revenue is topic to taxes.

-

Tax credit are even higher — they offer you a dollar-for-dollar discount in your tax invoice. As an illustration, a tax credit score valued at $1,000 lowers your tax invoice by $1,000.

|

$10,000 tax deduction |

$10,000 tax credit score |

|

|

Tax deduction |

–$10,000 |

|

|

Taxable revenue |

||

|

Calculated tax |

||

|

Tax credit score |

–$10,000 |

|

|

Your tax invoice |

||

3. Taking the usual deduction vs. itemizing

Deciding whether or not to itemize or take the usual deduction is an enormous a part of tax planning as a result of the selection could make an enormous distinction in your tax invoice.

What’s the customary deduction?

Principally, it’s a flat-dollar, no-questions-asked tax deduction. Taking the customary deduction makes tax prep go loads sooner, which might be an enormous motive why many taxpayers do it as a substitute of itemizing.

Congress units the quantity of the usual deduction, and it’s usually adjusted yearly for inflation. The usual deduction that you simply qualify for is dependent upon your submitting standing, because the desk under reveals.

|

Submitting standing |

Commonplace deduction 2023 |

Commonplace deduction 2024 |

|---|---|---|

|

Married, submitting collectively |

||

|

Married, submitting individually |

||

|

Head of family |

What does ‘itemize’ imply?

As an alternative of taking the usual deduction, you possibly can itemize your tax return, which suggests taking all the person tax deductions that you simply qualify for, one after the other.

-

Usually, individuals itemize if their itemized deductions add as much as greater than the usual deduction. A key a part of their tax planning is to trace their deductions by the 12 months.

-

The downside to itemizing is that it takes longer to do your taxes, and you’ve got to have the ability to show you certified on your deductions.

-

You utilize IRS Schedule A to say your itemized deductions.

-

Some tax methods might make itemizing particularly enticing. For instance, in case you personal a house, your itemized deductions for mortgage curiosity and property taxes might simply add as much as greater than the usual deduction. That would prevent cash.

-

You would possibly be capable to itemize in your state tax return even in case you take the usual deduction in your federal return.

-

The excellent news: Tax software program or a great tax preparer can assist you determine which deductions you’re eligible for and whether or not they add as much as greater than the usual deduction.

|

Promotion: NerdWallet customers get 25% off federal and state submitting prices. |

|

|

|

Promotion: NerdWallet customers can save as much as $15 on TurboTax. |

|

Promotion: NerdWallet customers get 30% off federal submitting prices. Use code NERD30. |

4. Regulate common tax deductions and credit

Tons of of attainable deductions and credit can be found, and there are guidelines about who’s allowed to take them. Listed here are some large ones (click on on the hyperlinks to study extra).

Prepare for easy tax submitting with a $50 flat payment for each state of affairs

Powered by

Don’t miss out in the course of the 2024 tax season. Register for a NerdWallet account to realize entry to a tax product powered by Column Tax for a flat price of $50 in 2024, credit score rating monitoring, customized suggestions, well timed alerts, and extra.

for a NerdWallet account

5. Know what tax data to maintain

Conserving tax returns and the paperwork you used to finish them is important in case you’re ever audited. Usually, the IRS has three years to determine whether or not to audit your return, so hold your data for at the least that lengthy. You additionally ought to cling on to tax data for 3 years in case you file a declare for a credit score or refund after you have filed your unique return.

Maintain data longer in sure instances — if any of those circumstances apply, the IRS has an extended restrict on auditing you:

-

Six years: For those who underreported your revenue by greater than 25%.

-

Seven years: For those who wrote off the loss from a “nugatory safety.”

-

Indefinitely: For those who dedicated tax fraud otherwise you didn’t file a tax return.

6. Tweak your W-4

A W-4 tells your employer how a lot tax to withhold out of your paycheck. Your employer remits that tax to the IRS in your behalf.

This is how you can use the W-4 for tax planning.

-

For those who bought an enormous tax invoice if you filed and don’t need to relive that ache, it’s possible you’ll need to improve your withholding. That would enable you to owe much less (or nothing) subsequent time you file.

-

For those who bought an enormous refund final 12 months and would slightly have that cash in your paycheck all year long, do the alternative and cut back your withholding.

-

You most likely stuffed out a W-4 if you began your job, however you possibly can change your W-4 at any time. Simply obtain it from the IRS web site, fill it out and provides it to your human sources or payroll staff at work. You might also be capable to regulate your W-4 instantly by your employment portal if in case you have one.

7. Tax methods to shelter revenue or minimize your tax invoice

Deductions and credit are a good way to chop your tax invoice, however there are different tax planning methods that may assist with tax planning. Listed here are some common methods.

Put cash in a 401(okay)

-

The IRS doesn’t tax what you divert instantly out of your paycheck right into a 401(okay). In 2023, you possibly can funnel as much as $22,500 per 12 months into an account. For those who’re 50 or older, you possibly can contribute as much as $30,000. In 2024, that rises to $23,000 and $30,500, respectively.

-

In case your employer matches some or all your contribution, you’ll get free cash in addition.

Put cash in an IRA

You could have till the tax deadline to fund your IRA for the earlier tax 12 months, which provides you further time to do some tax planning and make the most of this technique.

-

The tax benefit of a conventional IRA is that your contributions could also be tax-deductible. How a lot you possibly can deduct is dependent upon whether or not you or your partner is roofed by a retirement plan at work and the way a lot you make. You pay taxes if you take distributions in retirement (or in case you make withdrawals previous to retirement).

-

The tax benefit of a Roth IRA is that your withdrawals in retirement aren’t taxed. You pay the taxes upfront; your contributions aren’t tax-deductible.

-

Earnings in your investments develop tax-free in a Roth and tax-deferred in a conventional IRA.

This desk illustrates these accounts in motion.

Roth IRA vs. conventional IRA

|

TRADITIONAL IRA |

|

|---|---|

|

Contribution restrict |

|

|

$6,500 in 2023 ($7,500 if age 50 or older). |

$6,500 in 2023 ($7,500 if age 50 or older). |

|

|

|

|

|

Early withdrawal guidelines |

|

|

|

» MORE: How you can discover the correct of IRA for you

Open a 529 account

These financial savings accounts, operated by most states and a few instructional establishments, assist individuals save for faculty.

-

You possibly can’t deduct contributions in your federal revenue taxes, however you would possibly be capable to in your state return in case you’re placing cash into your state’s 529 plan.

-

There could also be gift-tax penalties in case your contributions plus another items to a specific beneficiary exceed $17,000 in 2023 or $18,000 in 2024.

Fund your versatile spending account (FSA)

In case your employer provides a versatile spending account, make the most of it to decrease your tax invoice. The IRS helps you to funnel tax-free {dollars} instantly out of your paycheck into your FSA yearly. In 2023, the restrict is $3,050. In 2024, that rises to $3,200.

-

You’ll have to make use of the cash in the course of the calendar 12 months for medical and dental bills, however you may also use it for associated on a regular basis objects corresponding to bandages, being pregnant take a look at kits, breast pumps and acupuncture for your self and your certified dependents. Chances are you’ll lose what you don’t use, so take time to calculate your anticipated medical and dental bills for the approaching 12 months.

-

Some employers would possibly allow you to carry over as much as $610 to the following 12 months ($640 in 2024).

Use dependent care versatile spending accounts (DCFSAs)

This FSA with a twist is one other helpful approach to cut back your tax invoice — in case your employer provides it.

-

The IRS will exclude as much as $5,000 of your pay that you’ve got your employer divert to a dependent care FSA account, which suggests you’ll keep away from paying taxes on that cash. That may be large for fogeys, as a result of before- and after-school care, day care, preschool and day camps are normally allowed makes use of. Elder care could also be included, too.

-

What’s coated can differ amongst employers, so take a look at your plan’s paperwork.

Maximize well being financial savings accounts (HSAs)

Well being financial savings accounts are tax-exempt accounts you need to use to pay medical bills.

-

Contributions to HSAs are tax-deductible, and the withdrawals are tax-free, too, as long as you utilize them for certified medical bills.

-

If in case you have self-only high-deductible well being protection, you possibly can contribute as much as $3,850 in 2023 and $4,150 in 2024. If in case you have household high-deductible protection, you possibly can contribute as much as $7,750 in 2023 and $8,300 in 2024. For those who’re 55 or older, you possibly can put an additional $1,000 in your HSA.

-

Your employer might supply an HSA, however you may also begin your personal account at a financial institution or different monetary establishment.

Adblock take a look at (Why?)