The typical wage hike this 12 months shall be 9.5%, in accordance with a research of 1,414 firms throughout 40 sectors by world HR agency, Aon India. Nevertheless, the averages cover disparities, and increments depend upon a variety of things, together with the person’s efficiency, how related his abilities are, the corporate’s monetary efficiency and even the prospects of the sector it operates in. If increments are low, the same old purpose assigned by any administration is that the corporate wants to chop prices.

It’s a paradox that although firms are endlessly making an attempt to chop prices, many keep away from taking steps that may improve the revenue of their workers with out including to the wage invoice. If firms restructure their compensation packages by changing taxable emoluments with some tax-free perks, they will decrease the tax legal responsibility of their workers. “The wage construction performs a important function in figuring out the tax legal responsibility of a person. Many tax deductions and exemptions should not out there below the brand new tax regime, however sure tax-free allowances may be availed of even below the brand new regime,” says Avinash Godkhindi, Managing Director and CEO of Zaggle Pay as you go Ocean Providers.

Additionally Learn: Tax-free allowances may be availed below new revenue tax regime too: Avinash Godkhindi, CEO, Zaggle Pay as you go

There are a number of such tax-exempt allowances, together with meals coupons and reimbursement of bills on gas and journey, newspapers and periodicals, telephone and Web. The taxable parts of the wage, such because the particular allowance, may be diminished to make place for the tax-exempt allowance. Taxpayers who pay a low lease can think about decreasing the home lease allowance (HRA) as properly. The HRA exemption is linked to the fundamental pay and is the least of the next three choices: the precise HRA acquired, 50% of primary pay (40% in non-metros), and precise lease paid minus 10% of primary pay. In case you pay a excessive lease and might declare exemption, preserve it excessive, but when the lease is low, exchange it with another allowance. Taxpayers who reside in their very own homes and don’t pay lease may also cut back the HRA.

A few of the tax-free emoluments have prescribed quantities, whereas others should be inside cheap limits. The reimbursement for conveyance and gas, as an illustration, may be very excessive for workers who must journey so much throughout the course of the day. It isn’t uncommon for a advertising and marketing govt to get a conveyance reimbursement of Rs.25,000-30,000 per thirty days, however the workers who should not required to journey can’t count on such a excessive quantity. A rising variety of firms have already launched flexi advantages of their compensation buildings. The worker is given the pliability to design his wage by selecting appropriate allowances from a bouquet of advantages.

Additionally Learn: Earnings tax planning for FY 2023-24: Final date is March 31, don’t make these errors

Standard in Wealth

Some advantages are taxed otherwise than others. As an illustration, an worker should buy moveable belongings (computer systems, laptops, white and brown items, even furnishings) within the identify of the corporate and get reimbursed for the quantity. Beneath Part 17(2), the worker is taxed for 10% of the worth of the asset. So, in case you purchased a laptop computer price Rs.80,000, you may be taxed for under Rs.8,000. In about 5 years, the e book worth of the merchandise depreciates to just about zero and the corporate sells it to the worker for a nominal sum (normally Rs.1). “IT firms have been providing this to workers for years. Now others have additionally began providing this profit,” says Archit Gupta, CEO of tax submitting portal, ClearTax.

Corporations don’t need to change

Not all firms are keen to take this route. They’re reluctant to implement tax-friendly choices as a result of they’re anxious about infringing tax guidelines and need to persist with what they see as a tried and examined system. In consequence, their workers find yourself paying a better tax due to the archaic pay construction. “An organization can doubtlessly assist its workers save about `1 lakh in tax by way of these tax-efficient choices with out incurring any price or including to the executive workload,” says Sudhir Kaushik, CEO of tax submitting portal TaxSpanner. “That is equal to giving the worker a beneficiant elevate with out including a rupee to the wage invoice,” he provides.

Corporations are additionally involved that rolling out these advantages would improve the executive workload as a result of further paperwork. This isn’t solely true. “The flexi advantages within the wage can now be managed digitally, which really eases the compliance burden for each the worker and the employer,” says Godkhindi. He says the Zaggle card eliminates the necessity to carry paper-based vouchers or submit them to the employer for claiming reimbursements (see interview, web page 5).

Retirement financial savings as tax-saver

The NPS may be one other huge tax-saver within the wage package deal. Beneath Part 80CCD(2), as much as 10% of the fundamental wage put within the NPS on behalf of the worker is tax-free. It’s a voluntary profit and the worker is free to choose out if he thinks it doesn’t go well with him. The NPS profit can cut back the tax legal responsibility of the person considerably, particularly within the greater tax brackets. In case your primary wage is Rs.1 lakh, and the corporate places Rs.10,000 within the NPS in your behalf, your annual tax will cut back by virtually Rs.37,500.

Readers ought to be aware that this tax break is over and above the Rs.1.5 lakh deduction below Part 80C and the Rs.50,000 deduction for NPS contributions below Part 80CCD(1b). What’s extra, this tax profit may be availed of even below the brand new tax regime. “The tax advantages and options of the NPS are unmatchable, however there’s very low consciousness in regards to the pension scheme amongst HR professionals,” says Nehal Mota, Co-founder of wealth advisory platform, Finnovate.

That is evident from the lukewarm response to the pension scheme. Although the Part 80CCD(2) choice has been there for greater than eight years and corporations are more and more choosing this tax-saving alternative, there are solely 19 lakh subscribers below the company NPS class. Hyderabad-based monetary adviser Nitin Vyakaranam, who offers monetary wellness recommendation to workers of corporates, says barely 5-6% of workers go for the NPS profit. That is stunning as a result of tax deductions have historically been the most important driver of funding choices.

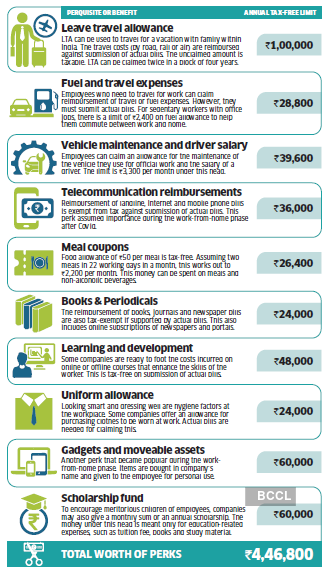

10 perks that may minimize tax

If a taxpayer within the 30% bracket will get even 7-8 of those perks, his annual tax outgo can cut back by greater than Rs.1 lakh. Some perks have specified limits, however for others the quantity needs to be cheap. Precise payments are required for tax exemption.

“For some individuals, saving for a long-term purpose that stretches too far into the long run will not be a precedence. They can’t visualise themselves in that scenario when they’re younger,” says Vyakaraman.

Apart from the tax breaks it gives, the NPS has every part one might search for in a retirement product. The pension scheme is tightly regulated by the PFRDA, making it very secure and safe. The fund administration and different bills are very low in comparison with the costs in mutual funds and insurance coverage. There’s a excessive diploma of flexibility and transparency in the best way that the scheme works.

Consultants pay much less tax

Lately, many professionals have opted to depart full-time jobs and develop into consultants. This offers them some tax benefits, however additionally they should forgo the advantages of being a full-time worker. Consultants can declare deduction for workrelated bills, corresponding to gas and transportation, phone, Web, and even the depreciation of mounted belongings. Nevertheless, they’re basically working a enterprise, so one has to keep up books of accounts and get an audit report in case the gross receipts exceed Rs.25 lakh in a 12 months.

Nevertheless, the introduction of the presumptive taxation choice in 2017 has made issues very handy for these working as consultants. Beneath Part 44ADA, particular person professionals are exempted from sustaining books of accounts. A flat 50% of revenue is presumed to be bills and so they should pay tax solely on the stability 50%. So, in case you are a guide with an revenue of Rs.20 lakh, below presumptive taxation, you may be taxed just for Rs.10 lakh.

Consultants are additionally not eligible for a lot of advantages supplied to common workers, together with group medical health insurance, Provident Fund and all of the allowances in a compensation package deal. All they get is a flat cost after a ten% TDS. This will increase the take-home pay for the person, however monetary planners warn in opposition to choosing this association. They are saying common salaried employment permits one to construct longterm financial savings by way of the Provident Fund and different terminal advantages.

Consultants additionally should spend extra time on tax compliance. If gross revenue exceeds Rs.40 lakh, one has to mandatorily register for GST. This additionally means submitting GST returns each month. On the identical time, the GST paid on items and providers bought for one’s work may be offset in opposition to the GST paid by the corporate.

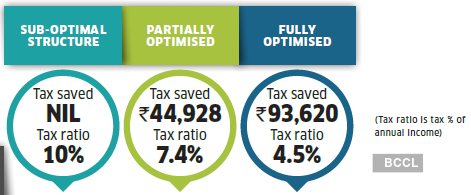

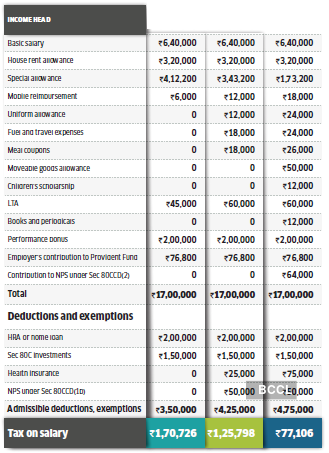

How a lot tax are you able to save?

Restructuring the wage can result in a considerably decrease tax.

Note1: That is the oldest wage construction with only a few allowances and principally taxable emoluments. The tax outgo may be very excessive for individuals who work in such firms.

Note2:A better LTA and a few extra tax-exempt allowances assist convey down the tax to an affordable degree for the worker. However there’s scope to save lots of extra tax.

Note3: Packing in additional tax-free perks lowers the tax outgo. The NPS profit is the change that makes a giant distinction. However not many firms provide this profit.

( Initially printed on Mar 18, 2024 )

Adblock check (Why?)