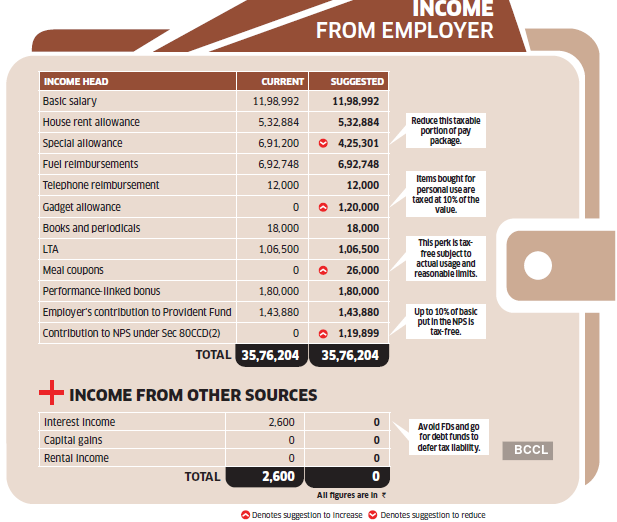

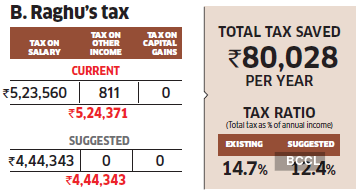

Bengaluru-based software program skilled B. Raghu earns properly, however nearly 15% of his earnings goes in tax. TaxSpanner estimates that Raghu can scale back his tax by Rs.80,000 if he opts for the NPS profit provided by his firm, and his pay construction is rejigged to incorporate some tax-free perks.

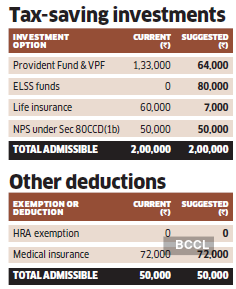

Raghu ought to begin by choosing the NPS profit. Below Part 80CCD(2), as much as 10% of the fundamental wage put within the NPS on behalf of the worker is taxfree. If his firm places Rs.9,992 (10% of his fundamental) within the NPS on his behalf each month, his tax will scale back by Rs.37,500. Since he already invests within the NPS below Sec 80CCD(1b), Raghu is aware of how the scheme works and the asset allocation that fits him.

Subsequent, he ought to discover the potential for changing the taxable emoluments in his wage with tax-free perks, similar to a gadget allowance and meal coupons. Below Part 17(2), devices purchased within the identify of the corporate and given to the worker for private use are taxed at solely 10% of their worth. If Raghu buys gadgets like computer systems, furnishings and ACs price Rs.1.2 lakh in a yr (Rs.10,000 per thirty days), his tax shall be lowered by Rs.33,700. Meal coupons price Rs.26,000 (Rs.2,167 per thirty days) will minimize the tax additional by round Rs.8,000.

Raghu’s firm gives group well being cowl to his household, however he has purchased medical insurance for himself, his spouse and mom individually as properly. He pays a premium of Rs.72,000, however will get deduction of solely Rs.50,000 below Part 80D as a result of his mom is under 60. When his mom turns into a senior citizen, Raghu can declare tax deduction for your entire premium paid.WRITE TO US FOR HELP

Paying an excessive amount of tax? Write to us at etwealth@ timesgroup.com with ‘Optimise my tax’ as the topic. Our consultants will inform you learn how to scale back your tax by rejigging your pay and investments.

Adblock take a look at (Why?)