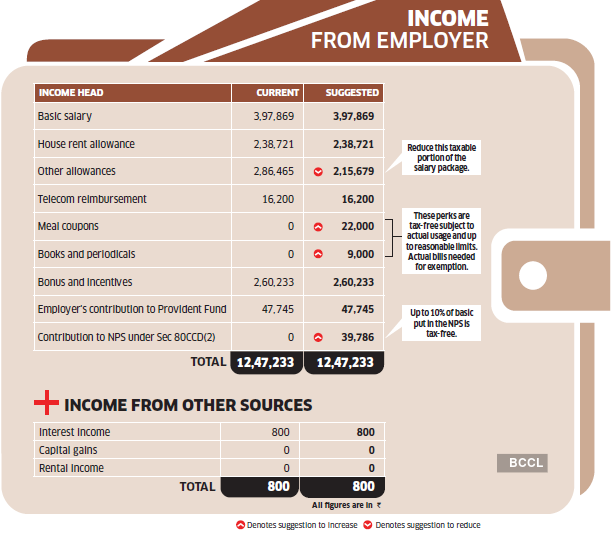

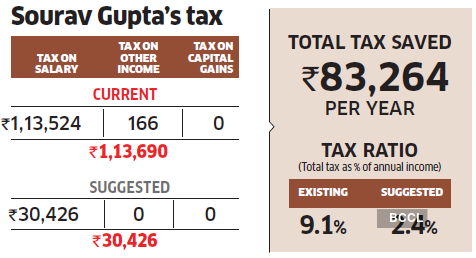

Kolkata-based advertising skilled Sourav Gupta earns effectively, however pays a excessive tax as a result of his wage construction is just not very tax-friendly and he doesn’t declare all of the deductions out there to him. TaxSpanner estimates that Gupta can scale back his tax by greater than Rs.83,000 if he claims HRA exemption by paying lease to his father, if his firm provides him the NPS profit, and he invests extra within the scheme on his personal. He additionally wants to purchase medical health insurance for his household and senior citizen mother and father.

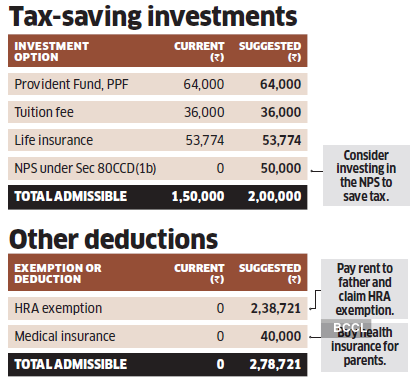

Gupta lives together with his mother and father of their home and, due to this fact, doesn’t declare exemption for HRA. If he pays Rs.25,000 lease to his father each month, your complete Rs.2.39 lakh HRA in his wage package deal may be tax-free, bringing down his tax by nearly Rs.50,000. The Rs.3 lakh lease acquired by his father will probably be taxed after 30% normal deduction, however since his father has no different earnings, there will probably be no tax.

Subsequent, Gupta ought to ask his firm for the NPS profit. Underneath Part 80CCD(2), as much as 10% of the essential put within the NPS is tax-free. If his firm places Rs.3,315 (10% of his fundamental pay) within the NPS each month, his annual tax will scale back by about Rs.8,000. One other Rs.10,400 may be saved if he invests Rs.50,000 within the NPS on his personal. The tax saving must be used to purchase medical insurance coverage for his household and his senior citizen mother and father. A premium of Rs.40,000 will reduce his tax by roughly Rs.8,300

Gupta also needs to ask his firm to rejig the wage construction by together with some tax-free perks. Newspaper allowance of Rs.9,000 (Rs.750 per thirty days) and meals coupons price Rs.22,000 (Rs.1,833 per thirty days) will scale back his tax by round Rs.6,500.

Well-liked in Wealth

In 2023-24, Gupta opted for the brand new tax regime. He ought to stick with the previous tax regime since his tax will probably be decrease.

WRITE TO US FOR HELP

Paying an excessive amount of tax? Write to us at etwealth@ timesgroup.com with ‘Optimise my tax’ as the topic. Our specialists will inform you tips on how to scale back your tax by rejigging your pay and investments.

Adblock take a look at (Why?)