SIPs (systematic funding plans) are setting new information every month with month-to-month SIP inflows exceeding ₹19,000 crore this March.

The advantage of investing and not using a break for the long run, to earn sturdy risk-adjusted returns, has caught on with retail traders.

Even so, choosing the fitting funds to your month-to-month SIP investments isn’t that simple a job.

That’s why we put over a 100 diversified fairness funds from large-cap, mid-cap, small-cap, giant & mid-cap, flexi-cap and multi-cap classes below the scanner to establish one of the best funds for systematic investing.

We took the 10-year SIP returns (XIRR) for these funds (direct plan alone) and in addition these of their respective benchmarks to know the funds that went previous the indices with their efficiency. A ten-year interval within reason lengthy sufficient to gauge the SIP efficiency of funds.

Lower than half the funds (44 out of 97 schemes) managed to beat normal benchmark indices on SIP mode. This implies selecting one of the best of funds should be performed rigorously.

The set of funds that managed to beat their benchmarks on SIPs have been additional put by way of the wringer by way of rolling returns and consistency of efficiency.

With the resultant set of funds that made the reduce with each SIP and rolling returns consistency, we provide you with a bunch of schemes which might be properly price your investments for the long run.

One level to notice right here is that a few of these funds could have had completely different mandates earlier than 2017-18 when SEBI’s rules on categorisation have been applied. However we go by the present class standing.

There are additionally some circumstances of administration adjustments as properly.

Learn on for extra on every of the diversified fund classes and the general star performers’ listing.

Giant-cap performers

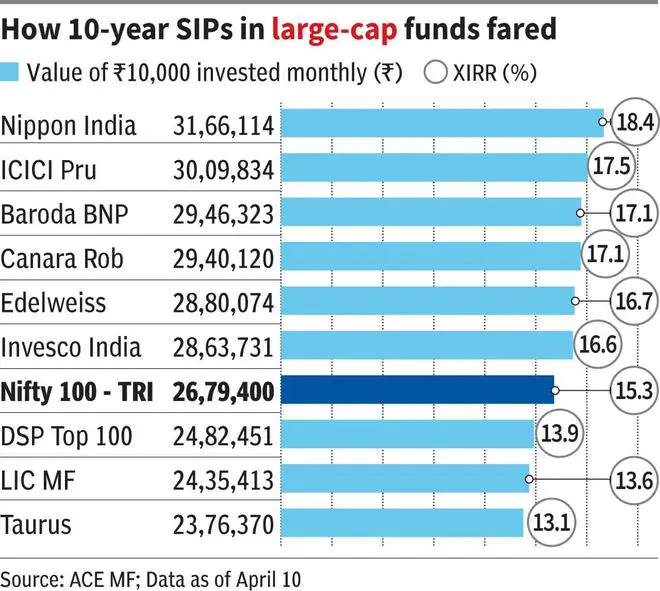

For the large-cap class, the Nifty 100 TRI is taken because the widespread benchmark for all of the schemes. Some could produce other benchmarks similar to Nifty 50 TRI, S&P BSE 100 TRI and so forth, however on the entire, Nifty 100 TRI is consultant sufficient of the area.

As many as 14 of the 24 large-cap funds with 10-plus years observe report have managed to beat the Nifty 100 TRI, which delivered 15.34 per cent returns (XIRR) over this era.

Among the many schemes that did properly, the highest 5 with 16.69-18.44 per cent returns from SIPs are Nippon India Giant Cap, ICICI Prudential Bluechip, Baroda BNP Paribas Giant Cap, Canara Robeco Bluechip Fairness and Edelweiss Giant Cap.

Among the many ones that misplaced out with underwhelming efficiency over the 10-year interval, recording a lot decrease returns than the Nifty 100 TRI, are Taurus Giant Cap, LIC MF Giant Cap, DSP Prime 100 Fairness, Franklin India Bluechip and PGIM India Giant Cap.

Lackadaisical mid-caps

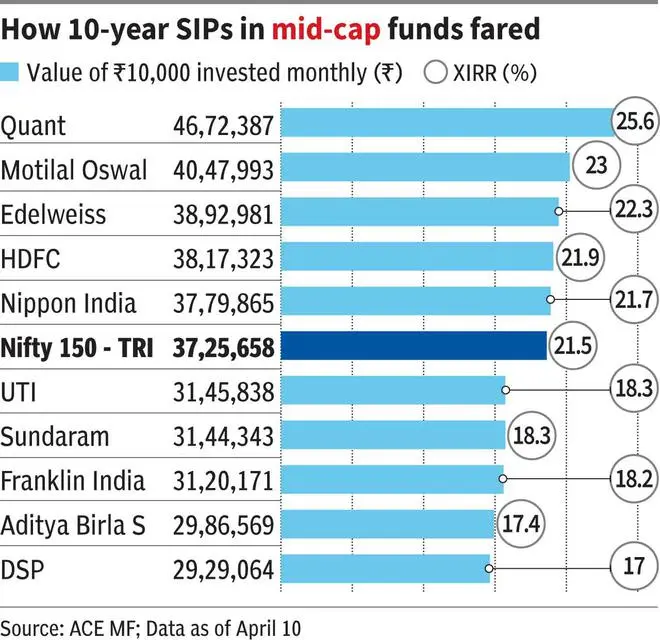

Within the final 10 years, SIPs in mid-caps didn’t grow to be that rewarding. Of the 21 funds within the class with a long-term observe report, solely 5 exceeded the returns of the Nifty Midcap 150 TRI by way of SIP returns.

Although some funds have the S&P BSE Midcap 150 TRI or different midcap indices as benchmarks, we’ve caught to the Nifty Midcap 150 TRI because the widespread benchmark.

Quant Midcap, Motilal Oswal Midcap, Edelweiss Midcap, HDFC Midcap Alternatives and Nippon India Development have been the outperformers.

These with lukewarm efficiency properly under the Nifty Midcap 150 TRI SIP returns (XIRR) of 21.46 per cent have been DSP Midcap, Aditya Birla Solar Life Midcap, Franklin India Prima, Sundaram Midcap and UTI Midcap, amongst many others.

Small-caps sizzle

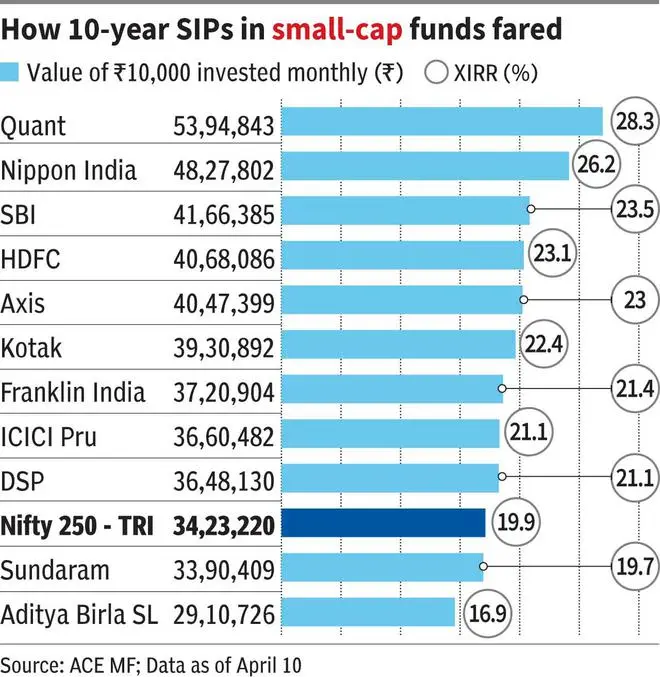

That is the phase that has acquired appreciable consideration in latest occasions, due to heavy investor curiosity and SEBI’s considerations.

Of the 12 small cap funds, as many as 10 have exceeded the benchmark Nifty Small Cap 250 TRI’s SIP returns of 19.89 per cent over a 10-year interval.

Small-cap funds from the homes of Quant, Nippon India, SBI, HDFC, Axis and Kotak carried out properly and exceeded the index’s returns.

Sundaram Small Cap mildly underperformed, whereas Aditya Birla Solar Life Small Cap’s efficiency was comparatively lacklustre.

Multi-caps taking root

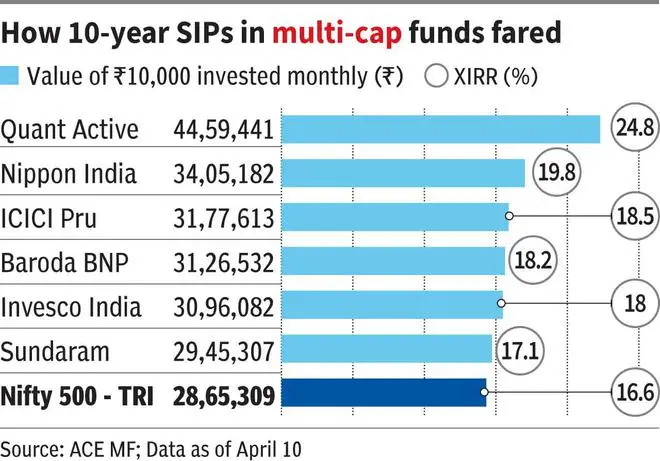

The class itself is barely three years previous, although many current funds modified their mandate to make themselves multi-cap schemes. Within the phase that has a SEBI mandate to speculate 25 per cent of the portfolio every in giant, mid and small-cap shares, there are six funds with a 10-year observe report and all six have managed to outperform the Nifty 500 TRI, which we set because the widespread benchmark.

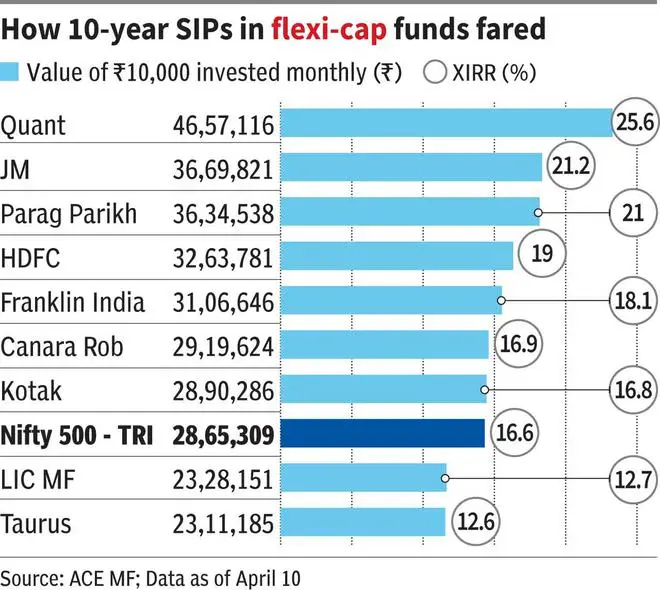

Flexi-caps on the ascent

It is a class that’s fairly standard amongst traders, due to the entire flexibility that the fund supervisor will get in deciding inventory allocations throughout market caps.

Of the 16 funds that carry a 10-year report, eight managed to outperform the Nifty 500 TRI’s SIP returns over this era.

Quant Flexicap, Parag Parikh Flexi Cap, HDFC Flexi Cap, Franklin India Flexi Cap and JM Flexicap are some funds which have performed properly on the SIP entrance, beating the Nifty 500 TRI’s efficiency.

Taurus Flexi Cap, UTI Flexi Cap, LIC MF Flexi Cap and Bandhan Flexi Cap are among the many underperformers.

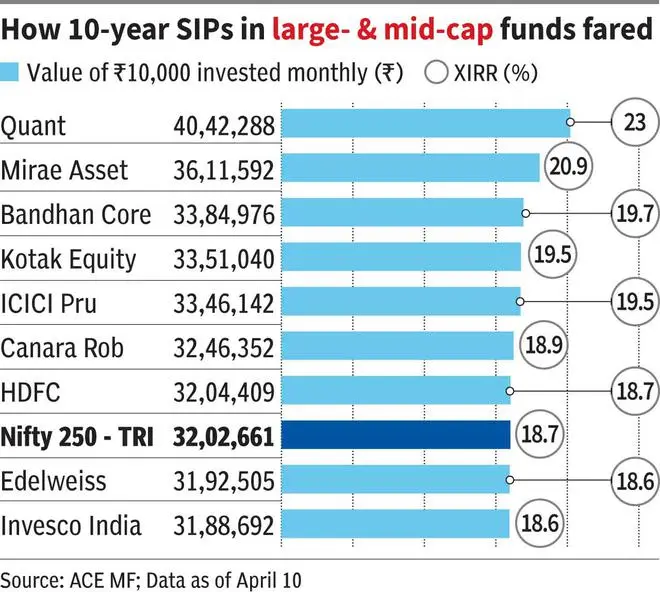

Giant & mid-caps reasonably constructive

This class — with 18 funds which have been round for 10 or extra years — noticed seven funds outperform the SIP return of the Nifty Giant Midcap 250 TRI, which was 18.66 per cent.

Quant Giant & Midcap, Kotak Alternatives, Mirae Asset Giant & Midcap and Bandhan Core Fairness have been among the many finest performers.

Aditya Birla Solar Life Fairness Benefit, Nippon India Imaginative and prescient, Franklin India Fairness Benefit and Financial institution of India Giant & Midcap Fairness have been amongst people who lagged the benchmark in SIP returns.

One other spherical of filters

Whereas SIP returns type one stage of filter, to get to one of the best funds, we want one other spherical of checks.

We set two limitations for closing choice — those that made the reduce with the SIP returns half have been additional put by way of two standards.

One, imply five-year every day rolling returns of a fund over the previous 10 years should be greater than that of the corresponding benchmark – Nifty 100 TRI for large-cap schemes, for instance. Some funds did properly solely within the post-Covid rally, whereas others recorded reasonable performances in the identical interval. Some, nonetheless, did properly throughout durations. Subsequently, a five-year rolling return interval is an efficient solution to choose them.

Two, on a five-year rolling foundation over the past 10 years, the fund will need to have crushed the benchmark not less than 60 per cent of the time, in order that we will safely assume that it’s moderately constant.

One level to notice right here is that in some circumstances the SIP returns of funds could also be among the many high few. However when the rolling return check is taken, there are funds that are inclined to lose out.

Primarily based on these standards, we’ve chosen the funds to contemplate for SIPs from every class.

Greatest fund decisions

Giant-cap funds: There are various funds that crossed the 60 per cent consistency threshold. Nevertheless, with a observe report of beating the Nifty 100 TRI greater than 75 per cent of the time, Mirae Asset Giant Cap, ICICI Prudential Bluechip, Baroda BNP Paribas Giant Cap, Canara Robeco Bluechip Fairness and Edelweiss Giant Cap are one of the best performers and may be thought of for SIPs.

Mid-cap funds: This class is hard when the rolling returns standards are taken. When the five-year rolling returns over April 2014-April 2024 are taken, just one fund exceeds the imply returns of the Nifty Midcap 150 TRI. Once more, with a rating of exceeding the benchmark almost 90 per cent of the time, Edelweiss Midcap fund alone makes the general reduce.

Though HDFC Midcap Alternatives and Motilal Oswal Midcap have delivered cheap efficiency, they don’t measure as much as our standards.

Maybe this area is best performed through the index fund route or through Giant & Mid-cap, flexi and multi-cap schemes.

Small-cap funds: When the imply five-year rolling returns over a 10-year interval exceeding the Nifty Small Cap 250 TRI and persistently beating the benchmark not less than 60 per cent of the time are taken under consideration, we get 5 funds that may be thought of for SIP investments.

Axis Small Cap, Nippon Small Cap and SBI Small Cap are one of the best of the lot they usually have outperformed the Nifty Small Cap 250 TRI 100 per cent of the time. HDFC Small Cap and Kotak Small Cap are moderately good decisions with outperformance for round 80 per cent and 87 per cent of the time.

Multi-cap funds: With solely six funds within the class which have a observe report of 10 or extra years, solely 5 schemes made the reduce on exceeding the imply rolling returns of the Nifty 500 TRI. After all, as a class itself, multi-cap funds are comparatively new.

Quant Lively, which outperforms on a regular basis, and Invesco India Multicap and ICICI Multicap with 64-65 per cent outperformance, fulfill all standards and may be thought of for long-term SIPs. These funds have been known as in a different way till the class happened three-odd years in the past and have considerably realigned their mandates.

Flexi-cap funds: Of the eight funds that handed the SIP standards and have been put to the rolling return checks, 5 have managed to come back out victorious.

Parag Parikh Flexi Cap and Quant Flexicap are one of the best within the class. Moreover, JM Flexicap, Canara Robeco Flexi cap and Kotak Flexicap are the three funds that go all standards set and are appropriate for SIP investments.

Giant & Mid-cap Funds: Among the many seven funds that obtained previous the 10-year SIP return standards, solely 4 managed to managed to beat the imply five-year rolling returns of the Nifty Giant Midcap 250 TRI from April 2014 to April 2024.

These 4 funds additionally simply handed beat the benchmark greater than 75 per cent of the time. Mirae Asset Giant & Midcap, Kotak Fairness Alternatives, Canara Robeco Rising Equities and Quant Giant & Midcap are funds that may be thought of for long-term SIPs.

For traders, there could also be a number of funds which have sound a observe report even exterior the listing.

However based mostly on our standards of SIP and rolling returns, the listing talked about below every class is a wholesome basket of funds.

Adblock check (Why?)