Bet_Noire

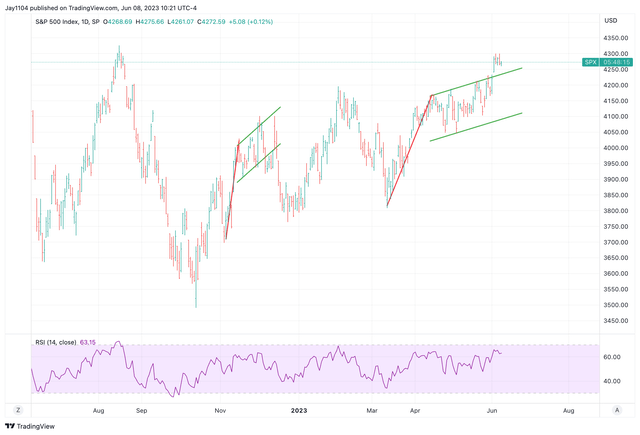

Inventory markets seem to have mispriced rate of interest threat and the trail for financial coverage. General, fairness markets have tried to front-run a Fed pause and a Fed rate-cutting cycle. That seems to be incorrect and is now prone to undergo the method of unwinding that mistake, organising what might be a really painful bull lure that has been happening for the reason that starting of April.

As famous first famous in the midst of April, bulls had been trapped for weeks under the 4,200 resistance certain earlier than lastly surging greater following the better-than-expected Might jobs report. However that surge has stalled out rapidly and is now prone to begin a technique of reversing, because the Treasury Common Account is replenished, and rates of interest climb because the market costs in a possible fee hike between now and July, and removes fee cuts from the trail of financial coverage.

For my part, this little surge above the 4,200 certain will show to be a bull lure of the worst form, with the S&P 500 Index (SP500) giving again its latest positive aspects.

Tops Have Come At These Valuations

The S&P 500 Index is now very costly on a P/E a number of, buying and selling at 19.5 instances earnings, which prior to now has served as a powerful resistance zone and a spot the place rallies have failed.

Bloomberg

Moreover, when wanting on the present valuation utilizing subsequent 12 months’s earnings estimates of $241.67, the S&P 500 has an earnings yield of 5.67%. With the present fee on the 10-yr Treasury (US10Y) at 3.75%, the unfold is now on the identical stage it was in mid-November and mid-February, when the S&P 500 had beforehand peaked.

Bloomberg

Yields Have Additional To Climb

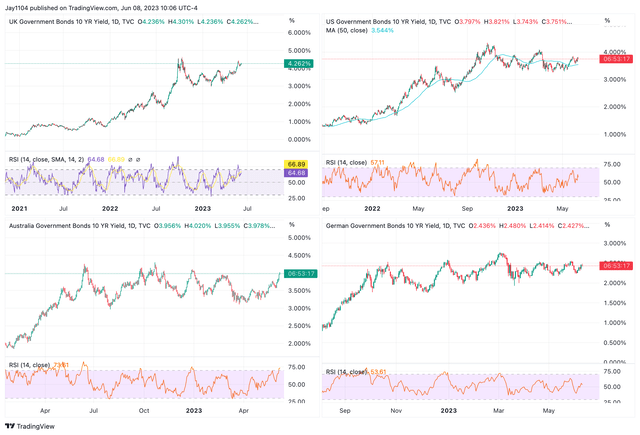

The issue is that not solely are shares costly on a P/E foundation in historic phrases, however they’re additionally costly versus bond yields presently. Making issues worse, yields are prone to proceed to rise on the again of the curve because the economic system continues to indicate indicators of holding collectively and placing recession off. Moreover, charges globally are as soon as once more heading greater, as central banks are re-engaging in fee hikes similar to Australia and Canada extra just lately.

Whereas the Fed is not prone to observe the 2 banks’ leads, the 2 central banks present examples of banks that had beforehand “paused” and had been compelled to restart the tightening course of. Moreover, inflation stays elevated in locations like the UK and isn’t coming down. That is placing upward stress on charges globally and, in some instances inflicting charges to problem and surpass their earlier cycle highs.

The British 10-year and Australian 10-year are actually again to buying and selling at their October highs, which tends to assist charges within the U.S. transfer greater as nicely. Moreover, the longer the U.S. economic system stays sturdy, and the longer inflation stays sticky, the extra probably it’s that charges within the U.S. will probably proceed to float greater.

Buying and selling View

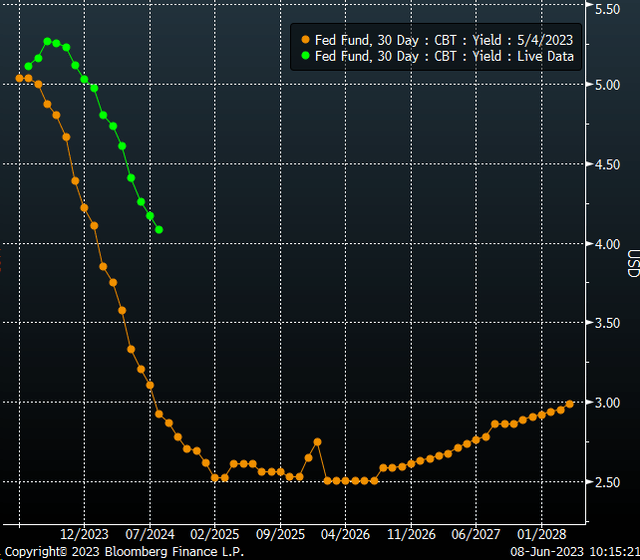

The opposite added threat is that Fed will not be executed elevating charges, as I initially famous again in Might. The market appears to be coming round to that thesis because it now sees a possible fee hike by one other 25 bps at nearly 80% by July.

Bloomberg

Moreover, fee cuts that had been as soon as priced into the market in 2023 have now been eliminated, as famous by the Fed Funds Futures curve. With the December Fed Fund futures presently buying and selling at 5.03%

Bloomberg

Technical’s Turning

Moreover, the technical sample of the S&P 500 displays that of a rising flag, which tends to be a reversal sample and is just like what was additionally seen in November. At the moment, the S&P 500 is in what is named the throw-over section of the sample, which is prone to consequence within the index dropping and coming again down and thru the latest buying and selling channel.

Buying and selling View

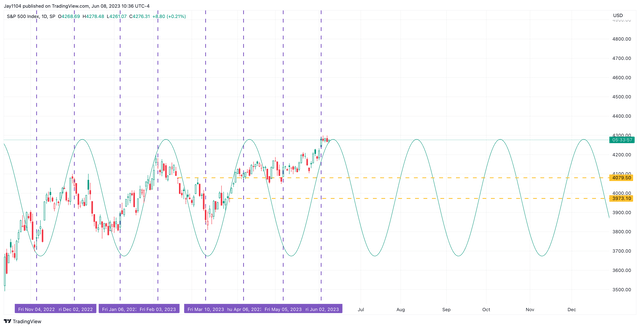

In the meantime, the S&P 500 has been buying and selling with a transparent cycle over the previous years of about 60 days. The latest peak within the cycle occurred simply this week, suggesting the index must be getting into the a part of the cycle that’s shifting decrease. These cycle adjustments are likely to occur across the time of the month-to-month job report. The one exception just lately seems to have been in Might, with a minor transfer decrease.

Buying and selling View

The transfer above the 4,200 to 4,225 area on the S&P 500 could show to be nothing greater than a blip in time that in the end sucked all of the bulls in, trapping them, because it then turned decrease, realizing it made a mistake not taking the danger for greater rates of interest extra critically.

Adblock take a look at (Why?)