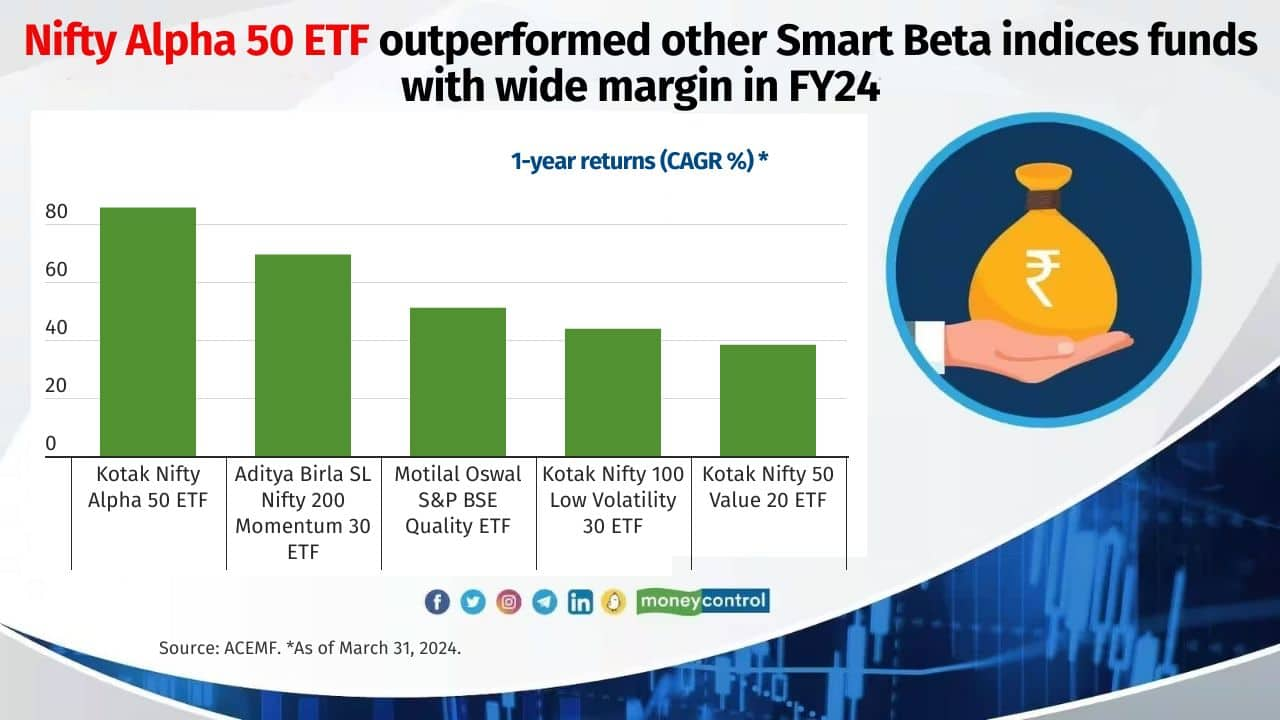

Kotak Nifty Alpha 50 ETF tracks ‘Nifty Alpha 50 index’, which measures the efficiency of the highest 50 shares when it comes to increased alpha chosen from the universe of 300 firms

Uncover the most recent enterprise information, Sensex, and Nifty updates. Get hold of Private Finance insights, tax queries, and skilled opinions on Moneycontrol or obtain the Moneycontrol App to remain up to date!

<!–

(perform(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src = “//join.fb.internet/en_GB/sdk.js#xfbml=1&model=v2.10”;

fjs.parentNode.insertBefore(js, fjs);

}(doc, ‘script’, ‘facebook-jssdk’)); –>

Adblock take a look at (Why?)