Mutual Fund SIP calculation: A number of well-managed mutual funds have given very excessive returns over the long run. One such scheme is Nippon India Progress Fund, which is a mid-cap mutual fund investing primarily in midcap shares.

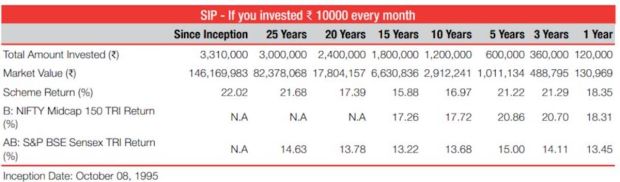

Based on the fund’s newest factsheet, it has given 22.02% annualised returns since its inception in 1995. Within the final 25 years, the fund has given annualised returns of 21.68% and 17.39% within the final 20 years.

Mutual Fund calculation quoted within the fund’s factsheet reveals if somebody had began a SIP of Rs 10,000 on this fund at inception, the worth of his funding as of Might 31, 2023 would have been approx Rs 14.6 crore. In 25 years, the Rs 10,000 SIP may have grown to Rs 8.2 crore.

That mentioned, the next are the 5 key factors to find out about this scheme as per the fund’s newest reality sheet.

Additionally Learn: These schemes flip Rs 10,000 SIP into Rs 3 crore to Rs 5 crore in 20 years

Nippon India Progress Fund Factsheet June 2023

Date of allotment: The fund’s inception date is October 8, 1995. It’s an open-ended fairness mutual fund scheme predominantly investing in mid-cap shares.

SIP returns: Based on the fund’s factsheet, the worth of a month-to-month SIP of Rs 10,000 on this fund since inception would have been round Rs 14.6 crore. In 25 years, the worth of Rs 10,000 SIP would have been greater than Rs 8.2 crore.

Present NAV: The NAV of this fund’s Progress Plan as of Might 31, 2023 was Rs 3215.7096. The NAV of this fund’s Direct Progress Plan was Rs 2493.9736.

Whole Expense Ratio: The fund’s expense ratio for the common plan of this fund is 1.75 and 0.99 for the direct plan.

Additionally Learn: Direct Plan vs Common Plan: The distinction it’s best to know earlier than beginning SIP in Mutual Funds

Prime 10 shares: As of Might 31, 2023, the highest shares through which the fund has invested greater than 2% of its property are AU Small Finance Financial institution Restricted (3.81%), Varun Drinks Restricted (3.13%), Cholamandalam Monetary Holdings Restricted (3.67%), Energy Finance Company Restricted (2.86%), Mahindra & Mahindra Monetary Providers Restricted (2.34%), Persistent Programs Restricted (2.4%), Supreme Industries Restricted (2.19%), Max Monetary Providers Restricted (2.32%), Devyani Worldwide Restricted (2.02%).

Disclaimer: The above content material is for data functions solely. There isn’t a assure or assurance that this fund will proceed to present related returns in future. Mutual Fund investments are topic to market dangers. Please seek the advice of your monetary advisor earlier than investing.

Adblock take a look at (Why?)