We’re just a few days in and 2021 is already being known as the 12 months of hope. It stays to be seen simply how far again to regular we’ll get this 12 months, however vaccine progress provides motive to be optimistic.

Irrespective of how nicely you have got accomplished within the inventory market, or if you happen to’re simply getting began, now’s the proper time to evaluate the taking part in subject and begin laying the groundwork in your investing technique transferring ahead. However the place to start?

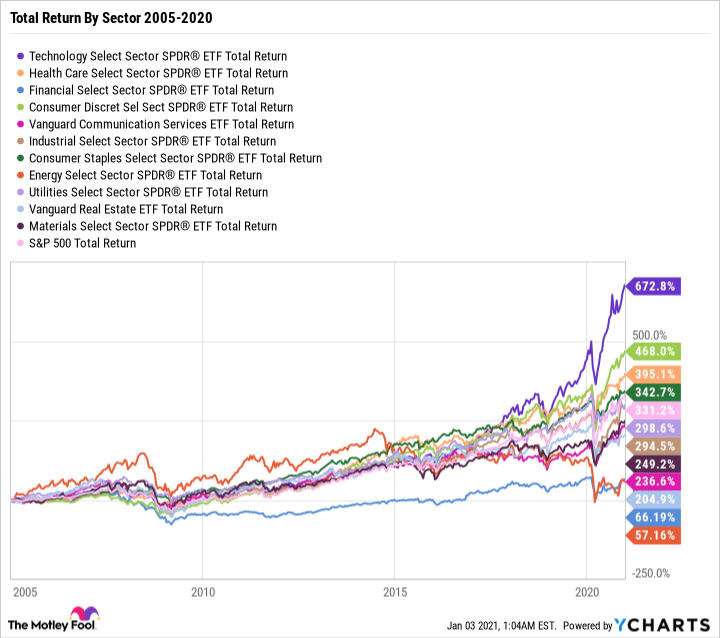

Broadly talking, there are 11 sectors within the S&P 500. We’ll use main Change Traded Funds (ETFs) as proxies for the efficiency of every sector. Every ETF accommodates massive and related corporations that act as a yardstick for measuring the sector’s efficiency.

Though particular person inventory performances fluctuate, every sector has sure traits that may make it a great, OK, or dangerous funding at completely different instances. This is a breakdown of a number of the finest sectors for 2021 — and the way they’ve carried out since 2005 (together with the monetary disaster) — so you possibly can construction your portfolio to satisfy your objectives for the brand new 12 months.

Picture supply: Getty Photographs.

The favored alternative: expertise

Weight within the S&P 500: 27.6%

Know-how Choose Sector SPDR Fund (NYSEMKT:XLK) complete return 2005–2020: 672%

High 5 largest U.S.-traded corporations by market capitalization:

- Apple

- Microsoft

- Taiwan Semiconductor

- NVIDIA

- Adobe

Unsurprisingly, the expertise sector has been the perfect performing sector since 2005. Tech shares have greater than doubled up to now two years, making it the perfect performing sector in each 2019 and 2020. Nonetheless, earlier than 2017, expertise was extra of a median performer and was usually outperformed by shopper discretionary, industrials, communication companies, and different sectors.

However instances have modified. Tech shares proceed to dominate the headlines and reward buyers with a number of the finest returns, greatest breakouts, and most game-changing paradigm shifts. Characterised by excessive development with some danger, expertise shares are at a few of their highest valuations in historical past. Though costly, a few of these shares may very well be good choices for aggressive buyers in 2021.

One other development alternative: shopper discretionary

Weight within the S&P 500: 12.7%

Client Discretionary Choose Sector SPDR (NYSEMKT:XLY) complete return 2005–2020: 468%

High 5 largest U.S.-traded corporations by market capitalization:

- Amazon

- Tesla

- Alibaba

- The Residence Depot

- Nike

Client discretionary corporations are cyclical as a result of they have a tendency to have increased gross sales throughout good financial instances however can turn out to be strained throughout financial declines. Nonetheless, main shopper discretionary corporations like Amazon, Nike, and Starbucks proceed to exhibit recession-proof traits due to robust buyer loyalty and rising gross sales.

Not like the companies, leisure, and journey industries, discretionary spending on items like automobiles and clothes has truly elevated all through the pandemic as a result of folks do not know what else to spend their more money on. In the course of the peak of the pandemic within the second quarter, spending on sturdy items declined by lower than 1% and nondurable items spending declined 4%, however companies declined 13%. Then within the third quarter, sturdy items rebounded 16% and nondurable items elevated over 6%, placing each metrics at a better degree than when the 12 months started. The straightforward idea that the pandemic is main People to spend cash on stuff, not experiences, helped propel the sector up 30% in 2020.

The balanced alternative: industrials

Weight within the S&P 500: 8.4%

Industrial Choose Sector SPDR Fund (NYSEMKT:XLI) complete return 2005–2020: 293%

High 5 largest U.S.-traded corporations by market capitalization:

- Honeywell

- United Parcel Service

- Union Pacific

- Boeing

- Raytheon Applied sciences

The commercial sector produced a near-300% complete return since 2005. Typically considered a boom-and-bust sector, industrials are literally extra balanced than they’re given credit score for. The sector outperformed the market in 5 out of the 16 years since 2005. And apart from 2008, when it declined about as a lot because the market, its worst three years produced complete returns of unfavorable 13%, unfavorable 4%, and unfavorable 1%. Industrials are enticing investments as a result of they have a tendency to pay beneficiant dividends and might be much less unstable than different dividend-paying sectors like vitality, supplies, and financials.

(

XLK Complete Return Degree knowledge by YCharts

An enormous tailwind for industrials heading into 2021 is the Federal Reserve’s dedication to maintain short-term rates of interest close to zero by a minimum of 2023 as a method to bolster spending within the wake of the pandemic. This tailwind advantages any firm in search of entry to low cost capital, together with tech and shopper discretionary. But it surely’s much more significant for capital-intensive companies like industrials.

The protected alternative: shopper staples

Weight within the S&P 500: 6.5%

Client Staples Choose Sector SPDR Fund (NYSEMKT:XLP) complete return 2005–2020: 340%

High 5 largest U.S.-traded corporations by market capitalization:

- Walmart

- Procter & Gamble

- Coca-Cola

- PepsiCo

- Costco Wholesale

In case you’re anxious a few recession, look no additional than shopper staples. Arguably probably the most recession-proof sector out there, shopper staples corporations garner constant demand for his or her merchandise regardless of market cycles. In the course of the monetary disaster of 2008, shopper staples outperformed all different 10 sectors and the general market.

Chock-full of stodgy dividend investments, shopper staples corporations additionally profit from a rising economic system. In any case, Walmart and Costco are more likely to promote extra TVs and different discretionary merchandise throughout increase instances. So, regardless of its quite low-growth status, the patron staples sector is one in every of simply 4 sectors that has outperformed the market since 2005 (the opposite three being tech, shopper discretionary, and healthcare).

The contrarian alternative: vitality

Weight within the S&P 500: 2.3%

Power Choose Sector SPDR Fund (NYSEMKT:XLE) complete return 2005–2020: 59%

High 5 largest U.S.-traded corporations by market capitalization:

- ExxonMobil

- Chevron

- Royal Dutch Shell

- Complete S.A.

- PetroChina

Regardless of being the perfect performing sector in 2005, 2007, and 2016, the vitality sector has been the worst-performing sector general since 2005. 2020 marked the third consecutive 12 months the place vitality was the worst-performing sector. Power shares have produced an abysmal 59% complete return in comparison with the market’s 328% since 2005.

Excessive oil and fuel provide coupled with low demand introduced the vitality trade to its knees in 2020. The long-term headwinds are regarding, too. Renewables, specifically photo voltaic, have come down in price. Oil and fuel is capital intensive (excessive debt). There’s international competitors — and with it, geopolitical danger. And naturally, there are environmental considerations.

There are many horrible vitality shares, however lowered share costs have additionally paved the best way for alternatives. For buyers keen to just accept a bit bit extra danger, the vitality sector may very well be a fantastic place to hunt for worth in 2021.

Your best option

2021 might very nicely be one other bull market the place expertise, shopper discretionary, industrials, and communication companies carry out nicely. However given excessive valuations within the tech and shopper discretionary sectors, the patron staples sector appears to have the perfect mixture of danger and reward in 2021.

Client staples will probably outperform a bear market. And opposite to widespread perception, shopper staples have confirmed they outperform the market over the long run, too. With the inventory market close to an all-time excessive, it appears finest to ease into 2021 with warning. Nonetheless, a low-interest charge surroundings and financial stimulus might very nicely end in one other nice 12 months for shares. Protecting some money on the sidelines will can help you make the most of discounted costs throughout a crash, the place it might serve you nicely to snag corporations with enticing long-term prospects from quite a lot of sectors.