The veteran worth investor John Rogers predicted the US is headed for a repeat of the “roaring twenties” a century in the past that may lastly encourage buyers to dump tech shares in favour of firms extra delicate to the economic system.

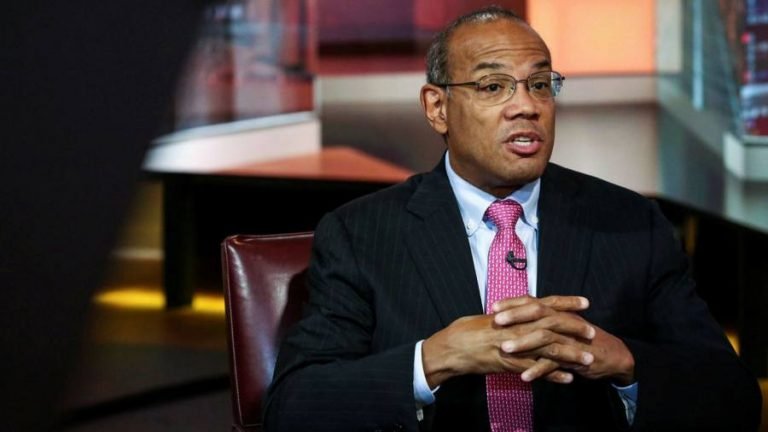

The founding father of Ariel Investments instructed the Monetary Occasions in an interview that worth investing “dinosaurs” like him stood to win as larger financial progress and rising rates of interest took the air out of a number of the hottest shares of latest years.

Rogers, who has spent a close to four-decade profession centered on shopping for under-appreciated shares, mentioned the frenzied shopping for of particular goal acquisition firms, or Spacs, signalled frothiness in elements of the market, even whereas a coming financial growth underpinned different share costs.

“This shall be a sustainable restoration. I believe there’s going to be sort of a roaring twenties once more,” Rogers mentioned, including that the energy of the financial restoration would shock individuals and problem the Federal Reserve’s ultra-dovish financial coverage.

The US central financial institution is “overly optimistic that they will preserve inflation beneath management”, he mentioned, and better bond market rates of interest would scale back the worth of future earnings for extremely in style progress shares equivalent to tech firms and for the sorts of speculative firms coming to market in preliminary public choices or through offers with Spacs.

“Spacs are an indication that progress shares are topping. A sign that the market is frothy,” mentioned Rogers, a self-styled contrarian and famed for his Affected person Investor e-newsletter for shoppers that debuted in 1983.

Worth investing relies on figuring out low-cost firms which might be buying and selling beneath their true value, an strategy lengthy espoused by Warren Buffett. Worth shares and people delicate to the financial cycle boomed after the web bubble burst in 2000, however the funding technique has been properly overwhelmed over the previous decade by fast-growing shares, led by US tech giants.

“We’ve been wanting just like the dinosaurs for therefore lengthy,” mentioned Rogers. “We’ve been ready for that booming financial restoration since 2009.”

Proponents of worth investing consider that the mixture of pricey progress inventory valuations and a sturdy restoration from the pandemic will trigger a major change between the 2 investing approaches.

Increased bond market rates of interest cut back the relative enchantment of proudly owning progress shares primarily based on their future earnings energy.

When 10-year bond yields rise, “progress shares look approach, approach too costly versus worth,” mentioned Rogers. “Worth shares are going to return out of the restoration very robust, they’ll have a tailwind from an earnings perspective. Their earnings are going to be right here and now, not 20, 30 years down the street.”

The Russell 1000 Worth index outperformed the equal progress index by 6 proportion factors in February, rising 5.8 per cent versus a drop of 0.1 per cent for the expansion index. That was the largest outperformance for worth since March 2001, in accordance with analysts at Financial institution of America.

“Though rising charges triggered the rotation, we see a bunch of different causes to favor worth over progress,” the analysts wrote final week, “together with the revenue cycle, valuation, and positioning that may drive additional outperformance.”

Rogers mentioned he anticipated larger total inventory market volatility from rising rates of interest this 12 months however worth ought to reward buyers because it did “20 years in the past as soon as the web bubble burst”. Ariel is bullish on “price producing financials” and Rogers mentioned most well-liked names included KKR, Lazard and Janus Henderson, whereas it was additionally bullish on conventional media, together with CBS Viacom and Nielsen.

Chicago-based Ariel is without doubt one of the few massive black-owned funding firms within the US, with $15bn of property beneath administration. It manages the oldest US mid-cap worth fund, relationship from 1986.