Within the fast-paced world of finance, new technological developments proceed to reshape the funding panorama. Mirror buying and selling has emerged as a revolutionary idea that harnesses the collective knowledge of skilled merchants to profit retail traders.

Mirror buying and selling, often known as copy buying and selling or social buying and selling, is a cutting-edge funding technique that permits people to copy the buying and selling choices of professional merchants. It operates on the premise that expert merchants have honed their experience over time, making sound funding decisions that result in optimistic returns.

Mirror buying and selling platforms bridge the hole between these professionals and retail traders, enabling the latter to reflect the previous’s trades routinely.

The method begins with retail traders choosing professional merchants based mostly on their efficiency, danger profile, and buying and selling methods. As soon as chosen, the platform mirrors the professional dealer’s trades within the traders’ accounts in real-time, proportionally adjusting the place sizes based mostly on the allotted capital.

What are some great benefits of mirror buying and selling?

Accessibility and ease: Mirror buying and selling democratizes the funding panorama, making it accessible to a broader viewers. Traders with restricted expertise can take part within the monetary markets with out in-depth data or time-consuming analysis.

Diversification: By following a number of professional merchants, traders can diversify their portfolios throughout varied methods and asset lessons. Diversification will help scale back danger and improve potential returns.

Studying alternative: Mirror buying and selling offers a worthwhile studying expertise for much less skilled traders. Followers can observe and study from professional merchants’ actions, gaining insights into market dynamics and funding methods.

Time effectivity: Traders can save time on market evaluation and decision-making by counting on professional merchants’ experience. That is notably useful for busy people who could not have the time to actively handle their investments.

What are the dangers related to mirror buying and selling?

Market dangers: Though mirror buying and selling goals to copy profitable merchants, there isn’t a assure of earnings. Markets are unpredictable, and even professional merchants can incur losses.

Dependency on professional merchants: The success of mirror buying and selling hinges on the efficiency of chosen professional merchants. Traders ought to conduct thorough analysis and diversify their decisions to mitigate dangers related to relying solely on one dealer.

Platform danger: Traders should select dependable mirror buying and selling platforms with sturdy safety measures and clear reporting. It’s essential to evaluate the platform’s monitor report and popularity earlier than entrusting funds.

Overconfidence bias: Traders could develop overconfidence and neglect their very own funding schooling when completely counting on professional merchants. It’s important to strike a stability between following specialists and enhancing private data.

It is very important keep in mind that all investments carry dangers, and no technique is foolproof. Traders ought to strategy mirror buying and selling with diligence, cautious consideration, and a willingness to constantly study and adapt to market dynamics.

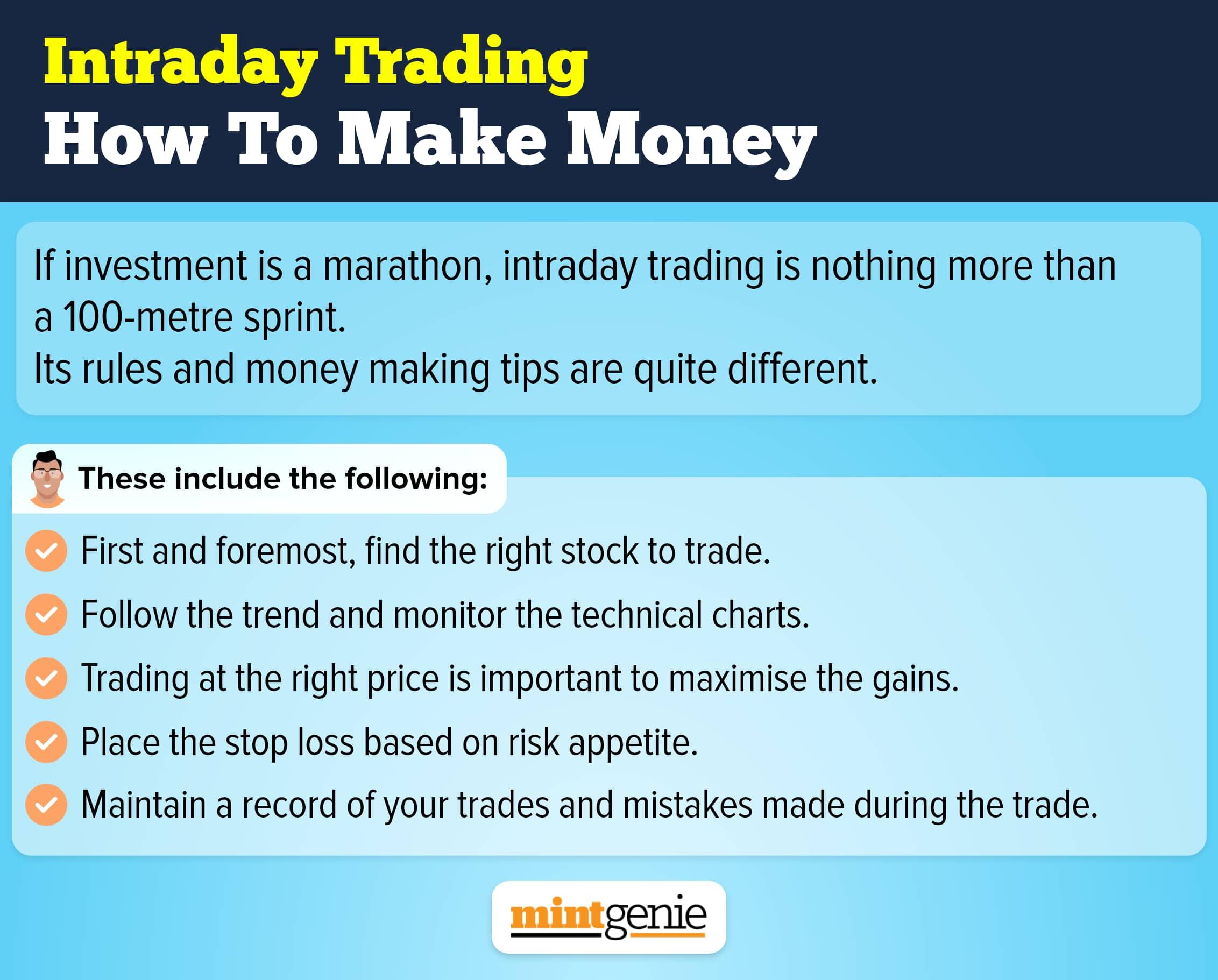

Intraday buying and selling: Find out how to generate profits

First Printed: 05 Aug 2023, 11:45 AM IST

Subjects to observe

Adblock check (Why?)