Inflation is an inevitable facet of any financial system, and its results can ripple by way of varied monetary devices, together with life insurance coverage insurance policies.

Whereas life insurance coverage is designed to offer monetary safety to your family members within the occasion of your demise, the impression of excessive inflation can considerably alter the protection and buying energy of the coverage.

On this article, we are going to discover how excessive inflation can have an effect on your life insurance coverage cowl and the steps you possibly can take to mitigate its impression.

What does inflation imply?

Inflation refers back to the regular enhance within the costs of products and companies over time. A excessive inflation fee erodes the buying energy of cash, making it much less useful sooner or later. For all times insurance coverage insurance policies with fastened sums assured, the true worth of the coverage payout diminishes with rising inflation.

In different phrases, the loss of life profit that appeared sufficient on the time of buy could not suffice to fulfill the monetary wants of your beneficiaries sooner or later.

How does it have an effect on the life insurance coverage protection?

Diminished payout worth

Life insurance coverage insurance policies with fastened sums assured can face the chance of dropping worth resulting from excessive inflation. If the loss of life profit stays unchanged, it might not be enough to cowl the longer term monetary wants of your beneficiaries, reminiscent of schooling bills, excellent money owed, or residing prices.

Rising premiums

Inflation may have an effect on insurance coverage premiums. As the price of residing will increase, insurance coverage firms could regulate their premiums to account for the upper bills and potential future claims. This can lead to larger premium funds, making it more difficult for policyholders to keep up their protection.

Diminished coverage adequacy

The rising value of residing can result in a change within the monetary objectives and wishes of your loved ones over time. A life insurance coverage coverage that appeared enough years in the past could not align with the present monetary necessities of your beneficiaries.

Find out how to mitigate the impact of excessive inflation on life insurance coverage?

Evaluation and regulate protection frequently

It’s important to evaluate your life insurance coverage protection periodically and assess whether or not it aligns along with your present monetary state of affairs and objectives. If wanted, take into account rising the sum assured to make sure sufficient protection for your loved ones’s future wants.

Think about inflation-adjusted insurance policies

To counter the impression of inflation, take into account buying inflation-adjusted or listed life insurance coverage insurance policies. These insurance policies supply a loss of life profit that grows over time according to the inflation fee, sustaining the buying energy of the payout.

Diversify investments

Inflation impacts not solely your life insurance coverage but in addition different monetary property. Diversifying your funding portfolio will help hedge towards inflation dangers and supply a possible supply of funds for your loved ones’s monetary wants.

Go for time period riders or add-ons

Many life insurance coverage insurance policies supply time period riders or add-ons that may be hooked up to the bottom coverage. These riders present further protection for a specified time period, guaranteeing that your insurance coverage protection stays sufficient regardless of the consequences of inflation.

Make investments properly

Aside out of your life insurance coverage coverage, investing in property that are inclined to carry out effectively throughout inflationary durations, reminiscent of equities, actual property, or commodities, will help safeguard your total monetary well-being.

By taking proactive measures, you possibly can be sure that your life insurance coverage stays an efficient monetary device to offer safety and assist to your loved ones, even within the face of excessive inflation.

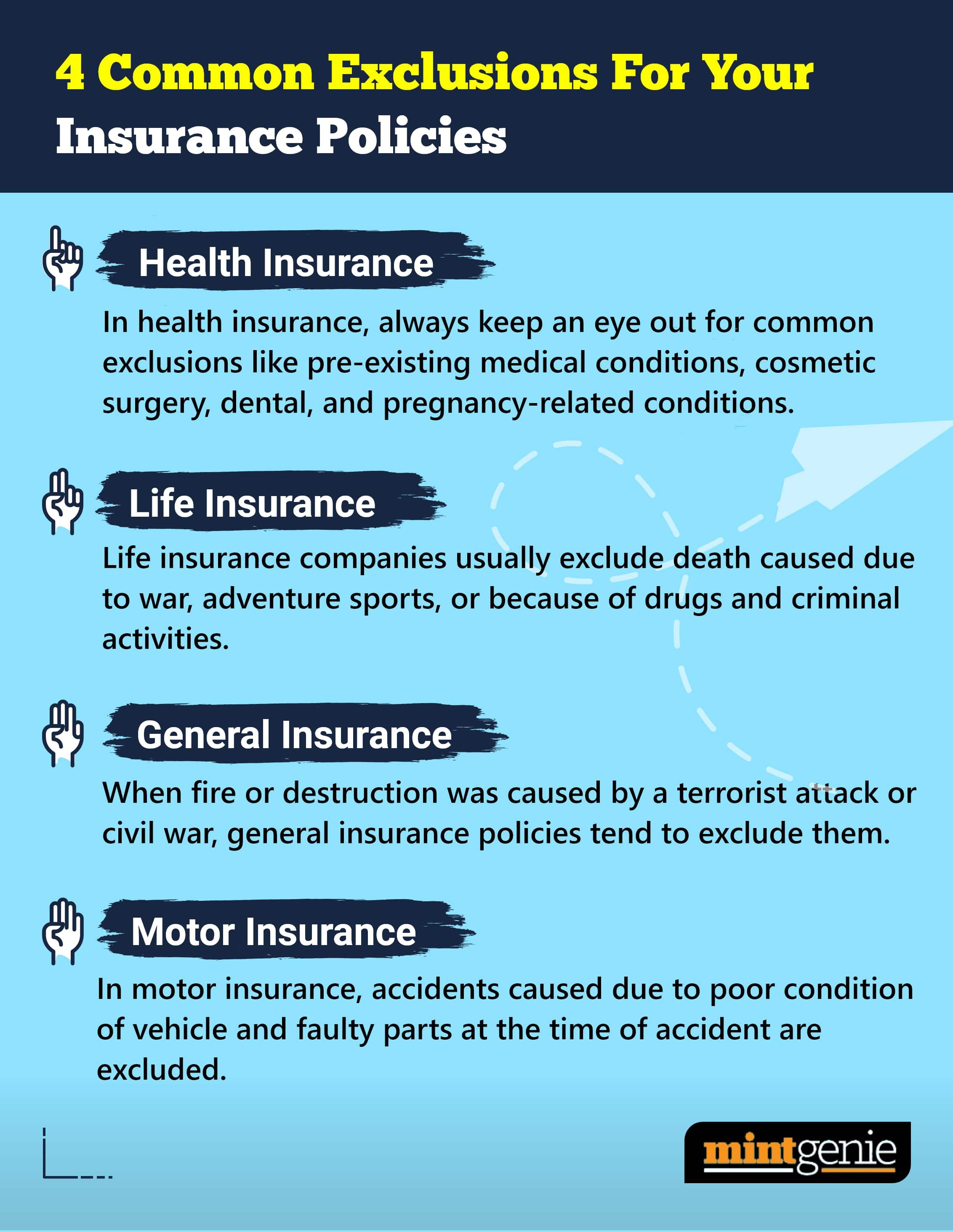

Right here we describe the frequent exclusions for well being, life, motor and common insurance coverage insurance policies.

First Printed: 26 Jul 2023, 09:49 AM IST

Matters to observe

Adblock take a look at (Why?)