Might 24, 2023

Throughout my preliminary years as an fairness analysis analyst working for a brokerage home, the depth of labor was on the peak in the course of the outcome season.

An analyst monitoring one sector, had no less than 20-30 firms below protection.

That meant roughly 100 days on a mean in a 12 months have been utilized to learn, analyse, write and take a name on the businesses below protection.

My level is… in case you are investing 100 days of your life in to one thing, the result needs to be essential.

Maintain on to that thought. I consider there’s an over reliance on quarterly outcomes on this planet of investing.

Over the weekend, the banking house was actually breaking the ceiling when it got here to reporting quarterly income.

The checklist of banks which reported tremendous robust numbers included giants like Kotak Mahindra Financial institution, IDFC First Financial institution, and RBL Financial institution.

Even PSU banks like Central Financial institution and IDBI Financial institution which have been plagued with mounting NPAs and losses reported floor breaking numbers.

Be it public sector banks or personal banks, each lender is reporting a superlative efficiency.

— Commercial —

Funding in securities market are topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing

Final 2 Days to Seize This

Our Common Small Cap Analysis Service At 50% Off and An Extra Yr of Entry

Declare Right here

Particulars of our SEBI Analysis Analyst registration are talked about on our web site – www.equitymaster.com

Let me additionally draw your consideration to the non-banking house.

Pharma main Laurus Labs reported its numbers final week. It missed estimates on income, working revenue, and internet revenue.

On one facet we had Kotak Mahindra Financial institution which reported life time excessive ROAs (Return on Asset) and one of many highest internet curiosity earnings and NIMs (internet curiosity margins).

I’ve barely seen banks report such robust efficiency.

On the opposite facet, an organization like Laurus Labs, which was a darling of traders only a 12 months in the past, continues to disappoint.

One other firm which reported very robust numbers was IDFC First financial institution, whose income doubled whereas asset high quality was at multi-quarter low.

The tempo at which IDFC First financial institution is rising is commendable.

So, we now have three firms…

- Kotak Mahindra Financial institution – Superlative quarterly outcomes, highest ever working parameters.

- IDFC First Financial institution – Very robust outcomes, revenue doubled.

- Laurus Labs – Poor efficiency on all parameters.

With such outcomes, may you guess the inventory value response the following day when market opened?

— Commercial —

Funding in securities market are topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing

Need Low Danger Shares with Excessive Progress Potential?

Entry Our Premium Analysis on Secure Shares at 50% Off

Full Particulars Right here

Particulars of our SEBI Analysis Analyst registration are talked about on our web site – www.equitymaster.com

Nicely, would you could have guessed this…

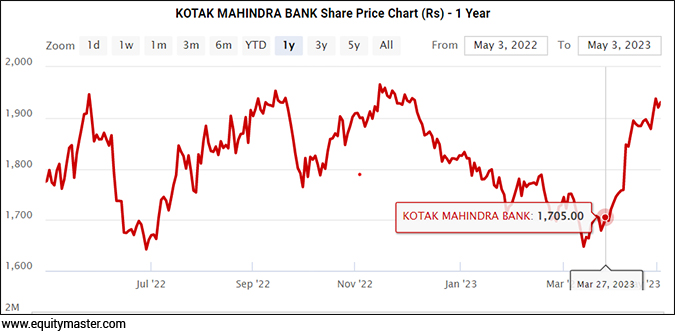

Kotak Mahindra Financial institution was down 1.5%.

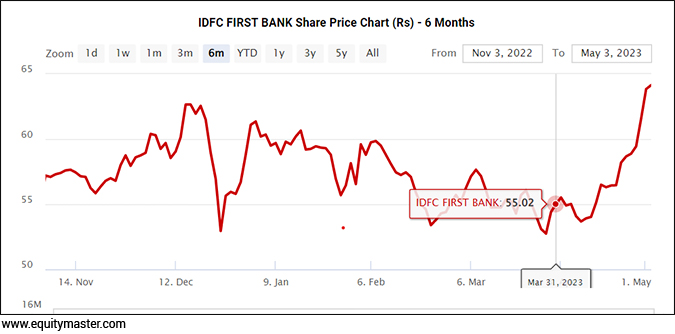

IDFC First Financial institution was up 4%.

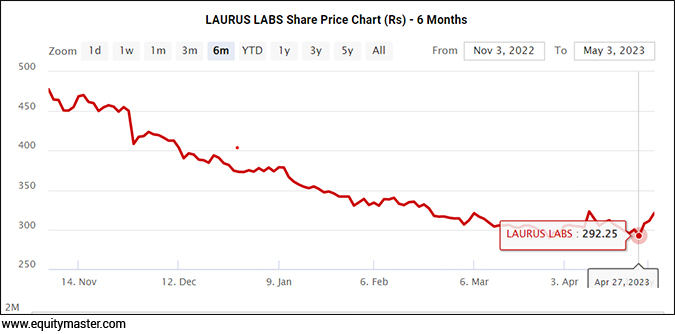

Laurus Labs was up 6%.

Allow us to take a look at the inventory motion of those shares over the previous 1 month to gauge how a lot of the outcomes was already within the value.

Kotak Mahindra Financial institution was Up 9% Final Month

Laurus Labs was in a Declining Development

IDFC First Financial institution was Up 5% Final Month

It has rather a lot to do with public notion, the place an organization like Laurus Labs was down by 60% over the previous 18 months. The road’s expectations have been muted.

Whereas Kotak was a basic instance of ‘promote on information’, in Laurus Labs was many of the negatives have been already priced in.

IDFC First Financial institution’s inventory motion was extra in tune with its outcomes.

One more reason which is grossly ignored is the main points.

The Satan is within the Particulars

On evaluation of Kotak Banks outcomes, opposite to public notion, the key a part of progress shock got here from unsecured retail loans, bank card progress, together with robust help from microfinance.

These classes are the riskiest within the enterprise and subsequently yield the best returns on capital for the financial institution.

The company mortgage ebook and the deposit progress which is the bread and butter for many banks, together with Kotak, was largely in keeping with expectations.

The rationale why Kotak registered all time excessive numbers was as a result of dangerous a part of the enterprise rising quicker.

For Kotak, danger is just not an issue proper now however it’s some extent to be contemplated upon.

However, should you take a look at Laurus Labs, the administration on the convention name was sounding cautiously optimistic.

It is the inventory value which turns first adopted by enchancment in fundamentals which can be mirrored a few quarters later.

I began out with spending 100 days in a 12 months, monitoring outcomes of firms below protection, nonetheless the brief time period final result in my view is zero.

The one rationale behind monitoring outcomes is to catch developments and act upon it.

If you’re searching for brief time period response on shares, belief me it is futile. Even the administration would not know the place the inventory value may go.

A great outcome can have so many issues priced in whereas a nasty outcome may need a silver lining.

Hold that in thoughts when a inventory you personal declares its quarterly outcomes.

Heat regards,

Aditya Vora

Analysis Analyst, Hidden Treasure

Adblock check (Why?)