Zerodha Mutual Fund, one in all India’s latest fund homes, has launched its inaugural new fund provides (NFOs). These new funding alternatives, named the Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund and the Zerodha Nifty LargeMidcap 250 Index Fund, intention to offer traders with numerous choices for his or her monetary portfolios.

Stay TV

Loading…

The NFO subscription interval for each funds commenced on Friday, October 20, 2023, and can proceed till November 3, 2023.

Zerodha ELSS Tax Saver Nifty LargeMidcap 250 Index Fund

The first goal of this scheme is to spend money on shares that represent the Nifty LargeMidcap 250 Index in the identical proportion because the index, aiming to realize returns equal to the Whole Return Index of the Nifty LargeMidcap 250 Index. Moreover, it provides deductions beneath Part 80C of the Earnings-tax Act, 1961, the fund home mentioned.

Traders on this scheme are eligible for deductions beneath Part 80C of the Earnings Tax Act, 1961, topic to the statutory limits and circumstances.

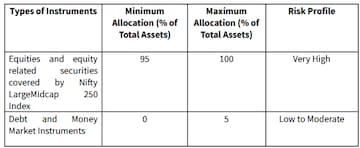

Below regular circumstances, the fund’s asset allocation will embrace equities and equity-related securities (95-100% of complete property) and debt and cash market devices (0-5% of complete property).

(Supply: Zerodha Mutual Fund)

This scheme adopts a passive funding technique, aiming to carefully mirror the Nifty LargeMidcap 250 Index by rebalancing the portfolio as wanted. It could additionally spend money on debt and cash market devices for liquidity.

Zerodha Nifty LargeMidcap 250 Index Fund

This fund goals to duplicate the Nifty LargeMidcap 250 Index and obtain returns equal to its Whole Return Index, topic to monitoring error. This scheme permits subscription and redemption at NAV-based costs on all enterprise days, with redemption proceeds dispatched inside three working days.

The benchmark for this fund is the Nifty LargeMidcap 250 Index TR.

(Supply: Zerodha Mutual Fund)

That is additionally a passively managed index fund that strives to duplicate the Nifty LargeMidcap 250 Index whereas minimizing monitoring error via common rebalancing.

Funding issues

Each funds provide traders an opportunity to take part within the efficiency of the Nifty LargeMidcap 250 Index with totally different tax-saving advantages within the case of the ELSS fund. Nonetheless, it is essential for traders to fastidiously assess their funding objectives, danger tolerance, and time horizon earlier than deciding to spend money on these NFOs.

Consultants say that NFO might make sense solely when the fund provides one thing distinctive that’s not accessible out there. Moreover, traders can have a look at the target and the motive behind the brand new fund provide. Additionally, returns of different funds in that class must be checked. As with all funding, it is advisable to seek the advice of with a monetary advisor to make knowledgeable selections that align with one’s monetary aims, consultants opine.

First Revealed: Oct 20, 2023 3:07 PM IST

Adblock take a look at (Why?)